SpendPilot

A modern financial management platform that puts users in control of their spending and expenses.

A modern financial management platform that puts users in control of their spending and expenses.

A modern financial management platform that puts users in control of their spending and expenses.

B2C

B2C

B2C

Account Aggregator Framework

Account Aggregator Framework

Account Aggregator Framework

AI

AI

AI

About SpendPilot

About SpendPilot

SpendPilot is a modern financial management platform that puts users in control of their spending and expenses.

The app analyzes spending patterns and provides personalized insights while keeping users’ data secure through bank-grade encryption. Using licensed account aggregator frameworks, SpendPilot safely connects to your bank accounts to consolidate all your financial information in one place.

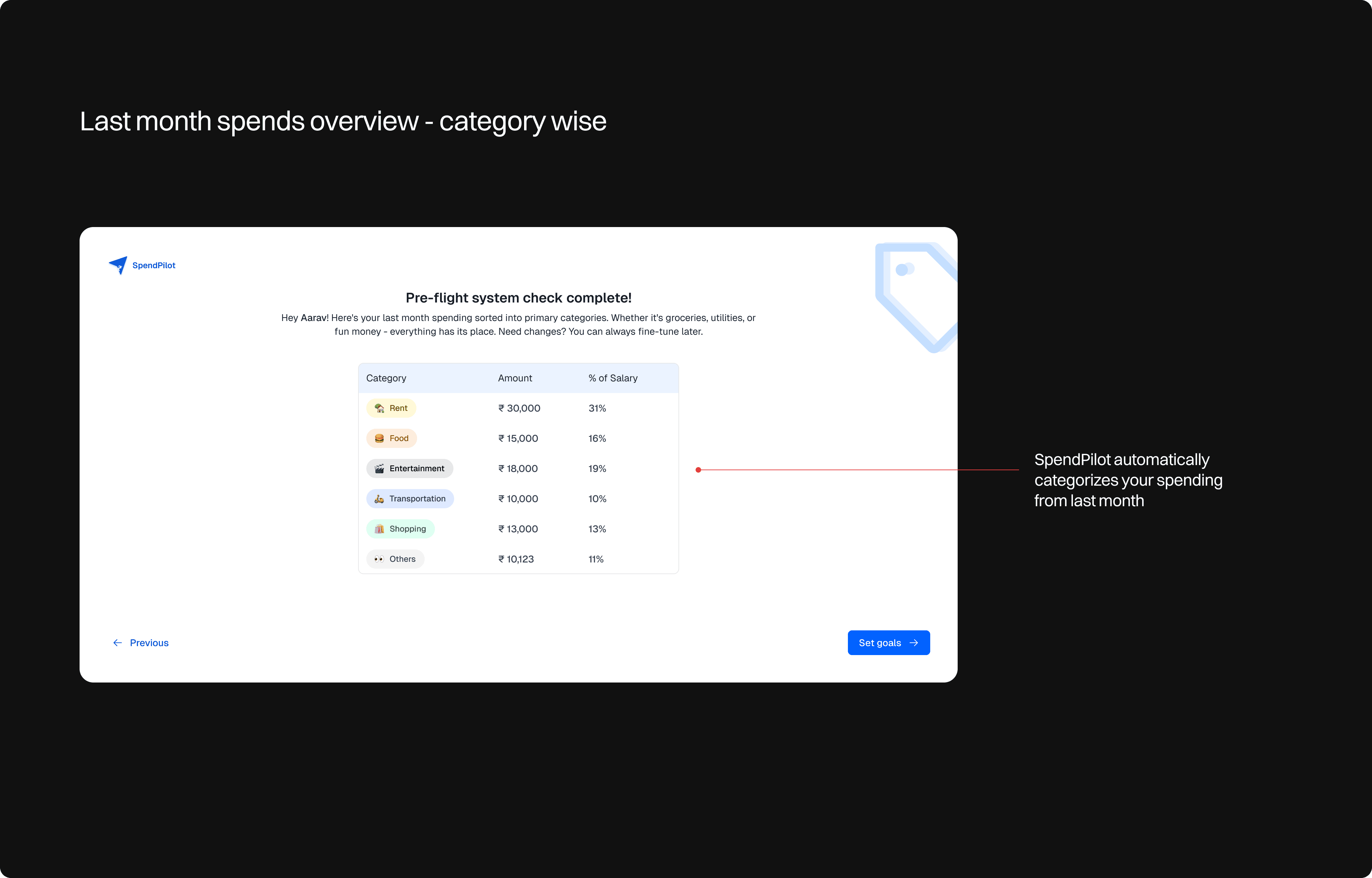

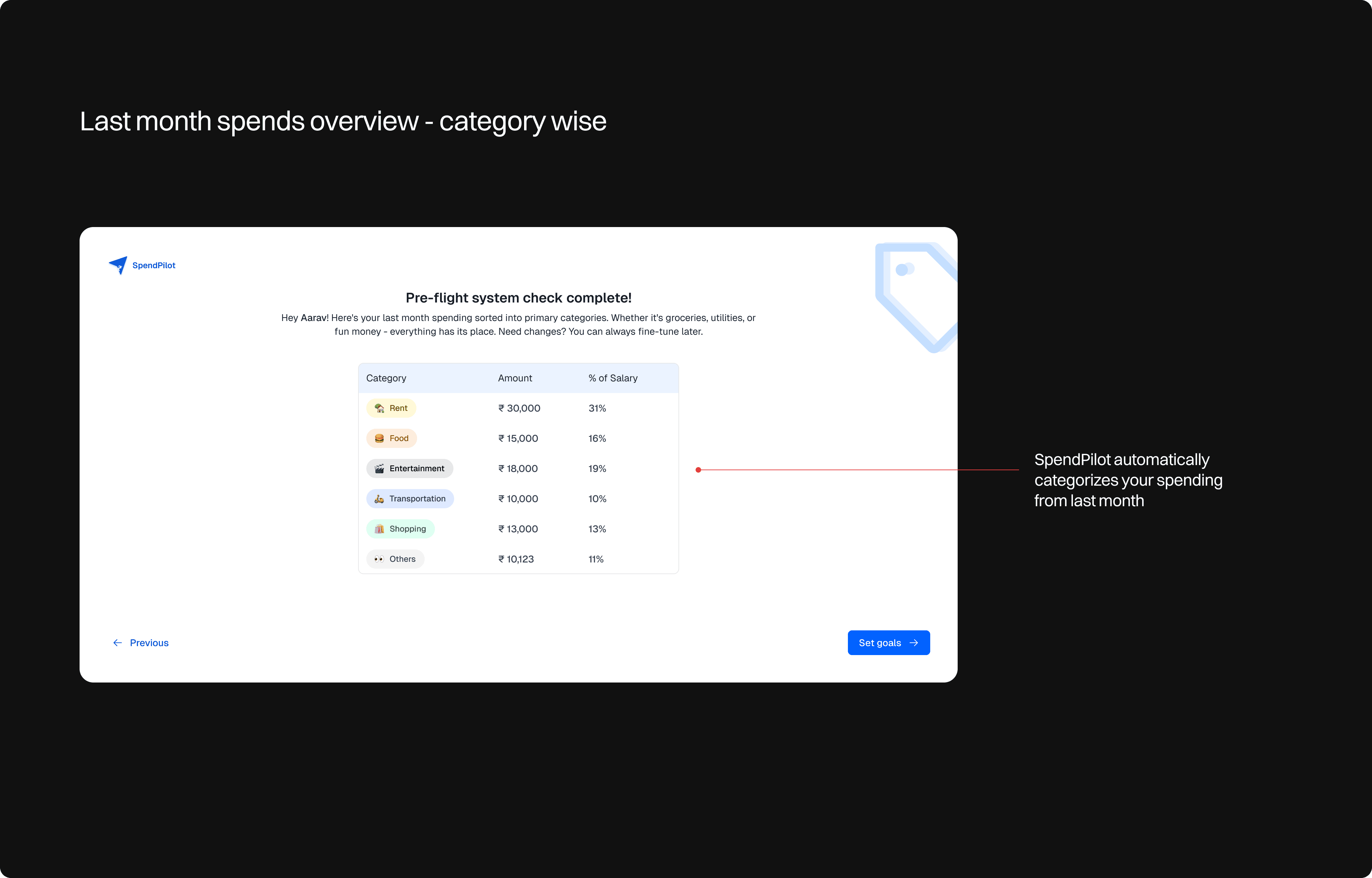

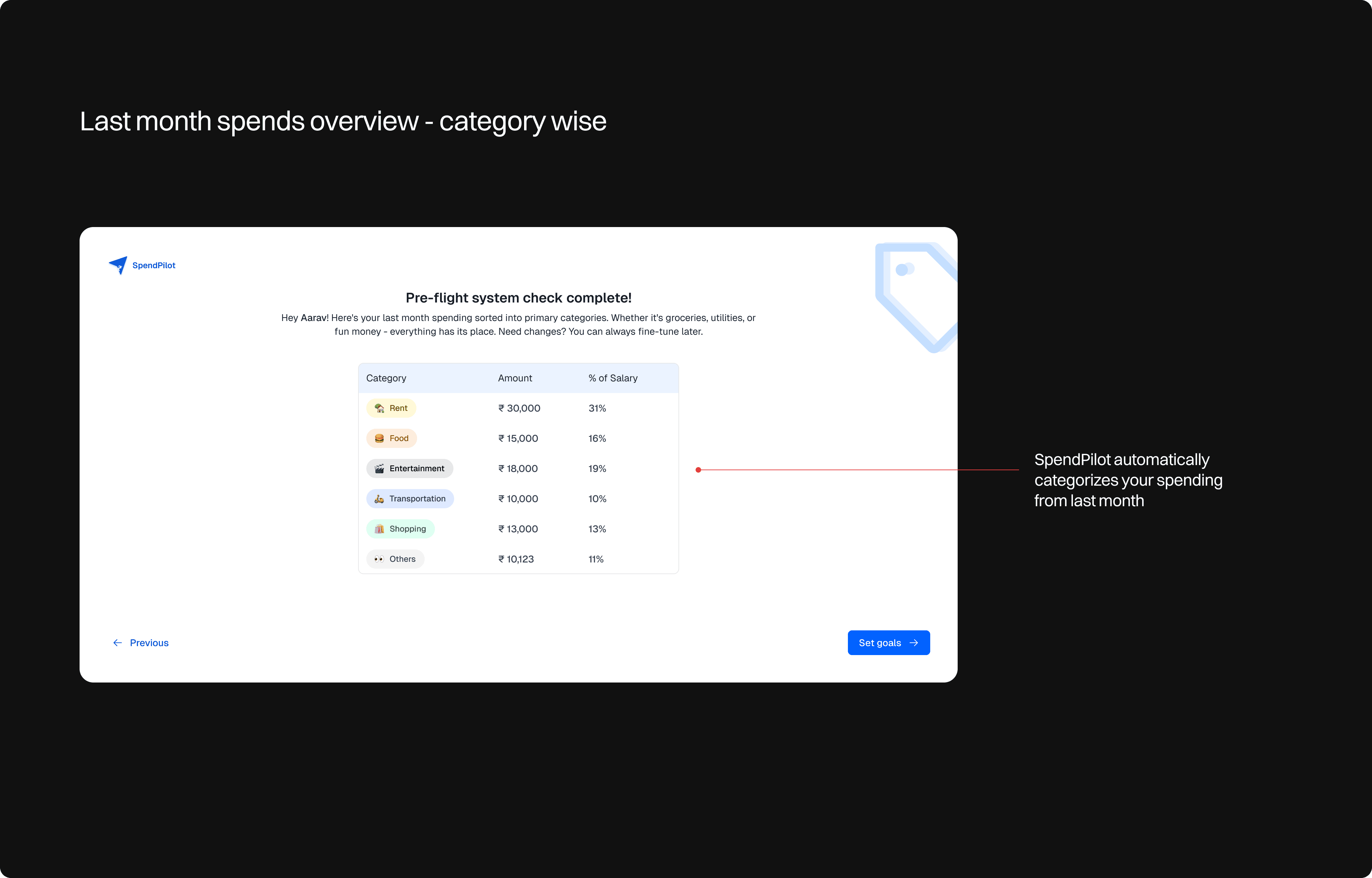

The platform automatically categorizes transactions and identifies spending trends to help you make better financial decisions.

SpendPilot is a modern financial management platform that puts users in control of their spending and expenses.

The app analyzes spending patterns and provides personalized insights while keeping users’ data secure through bank-grade encryption. Using licensed account aggregator frameworks, SpendPilot safely connects to your bank accounts to consolidate all your financial information in one place.

The platform automatically categorizes transactions and identifies spending trends to help you make better financial decisions.

Problem Statement

Problem Statement

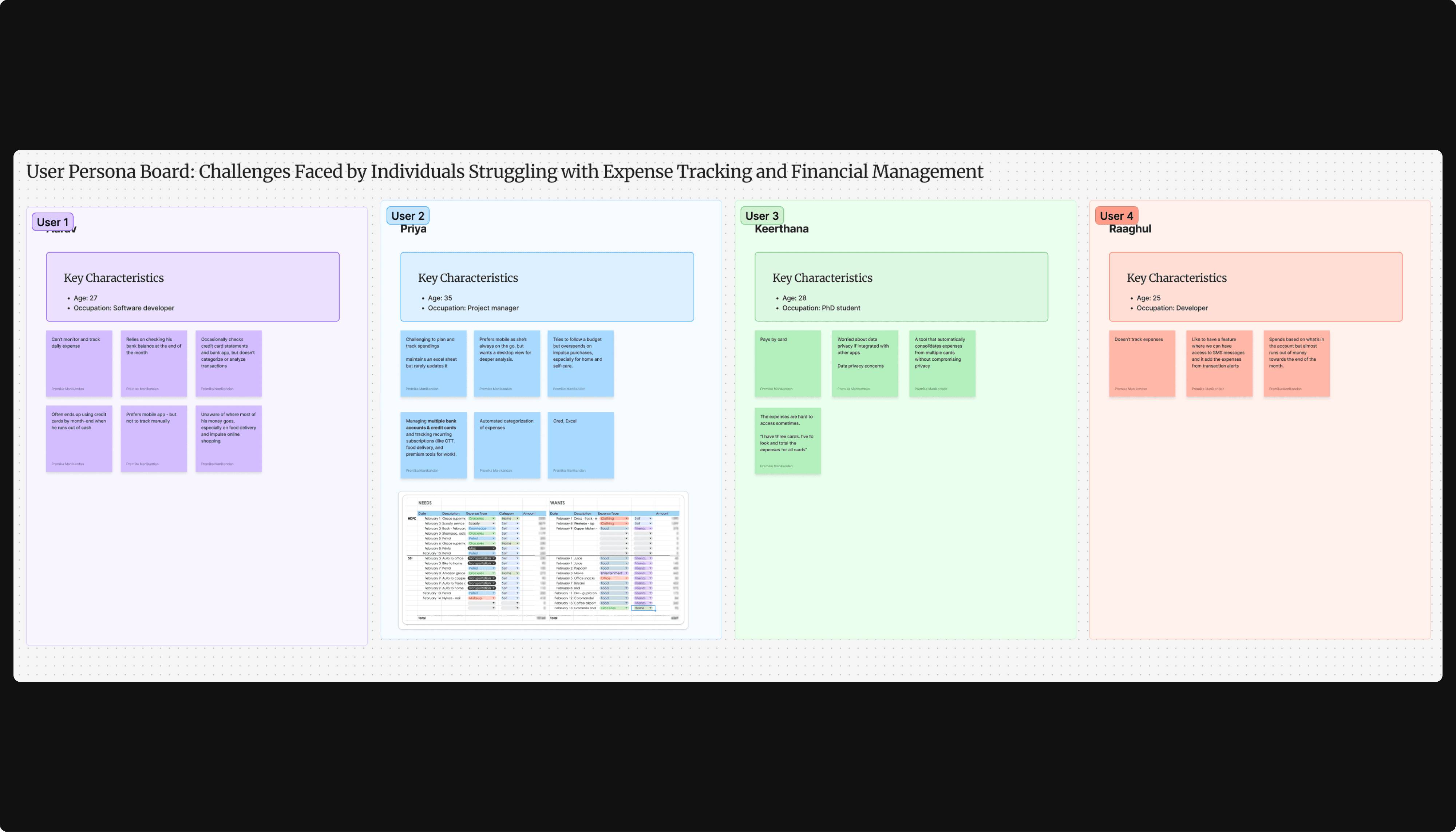

Aarav, a 27-year-old software developer, struggles to monitor his daily expenses. Priya, a 35-year-old project manager, finds it challenging to plan & track spending. Both need a way to effectively manage their personal finances.

Aarav, a 27-year-old software developer, struggles to monitor his daily expenses. Priya, a 35-year-old project manager, finds it challenging to plan & track spending. Both need a way to effectively manage their personal finances.

Goal

Goal

To help you track, manage and optimize your spends effortlessly with AI-driven insights.

To help you track, manage and optimize your spends effortlessly with AI-driven insights.

Metrics

Metrics

Metrics that can contribute to the success of the web app apart from the core user engagement metrics like DAU, MAU, user retention rate, churn rate etc.

Metrics that can contribute to the success of the web app apart from the core user engagement metrics like DAU, MAU, user retention rate, churn rate etc.

Budget Adherence Rate - % of users who stick to their set budget

Budget Adherence Rate - % of users who stick to their set budget

Savings Growth Rate - How much users increase their savings over time

Savings Growth Rate - How much users increase their savings over time

Assumptions

Assumptions

Account Aggregator Framework - core assumption

Account Aggregator Framework - core assumption

A regulated and secure financial data sharing system backed by RBI

- Provide real-time visibility across all user bank accounts and financial institutions

- Eliminate manual data entry and the need for uploading bank statements

- Ensure highest standards of data security through consent-based architecture

- Access standardized financial data format for accurate analysis

- Build user trust through a regulated framework rather than screen scraping

A regulated and secure financial data sharing system backed by RBI

- Provide real-time visibility across all user bank accounts and financial institutions

- Eliminate manual data entry and the need for uploading bank statements

- Ensure highest standards of data security through consent-based architecture

- Access standardized financial data format for accurate analysis

- Build user trust through a regulated framework rather than screen scraping

Target Audience

Target Audience

SpendPilot will initially focus on serving the Indian market and addressing the unique financial management needs of Indian users.

SpendPilot will initially focus on serving the Indian market and addressing the unique financial management needs of Indian users.

Features focused

Features focused

SpendPilot's core functionality centers on debit card expense tracking and management, with clear call-to-action for upcoming credit card features.

SpendPilot's core functionality centers on debit card expense tracking and management, with clear call-to-action for upcoming credit card features.

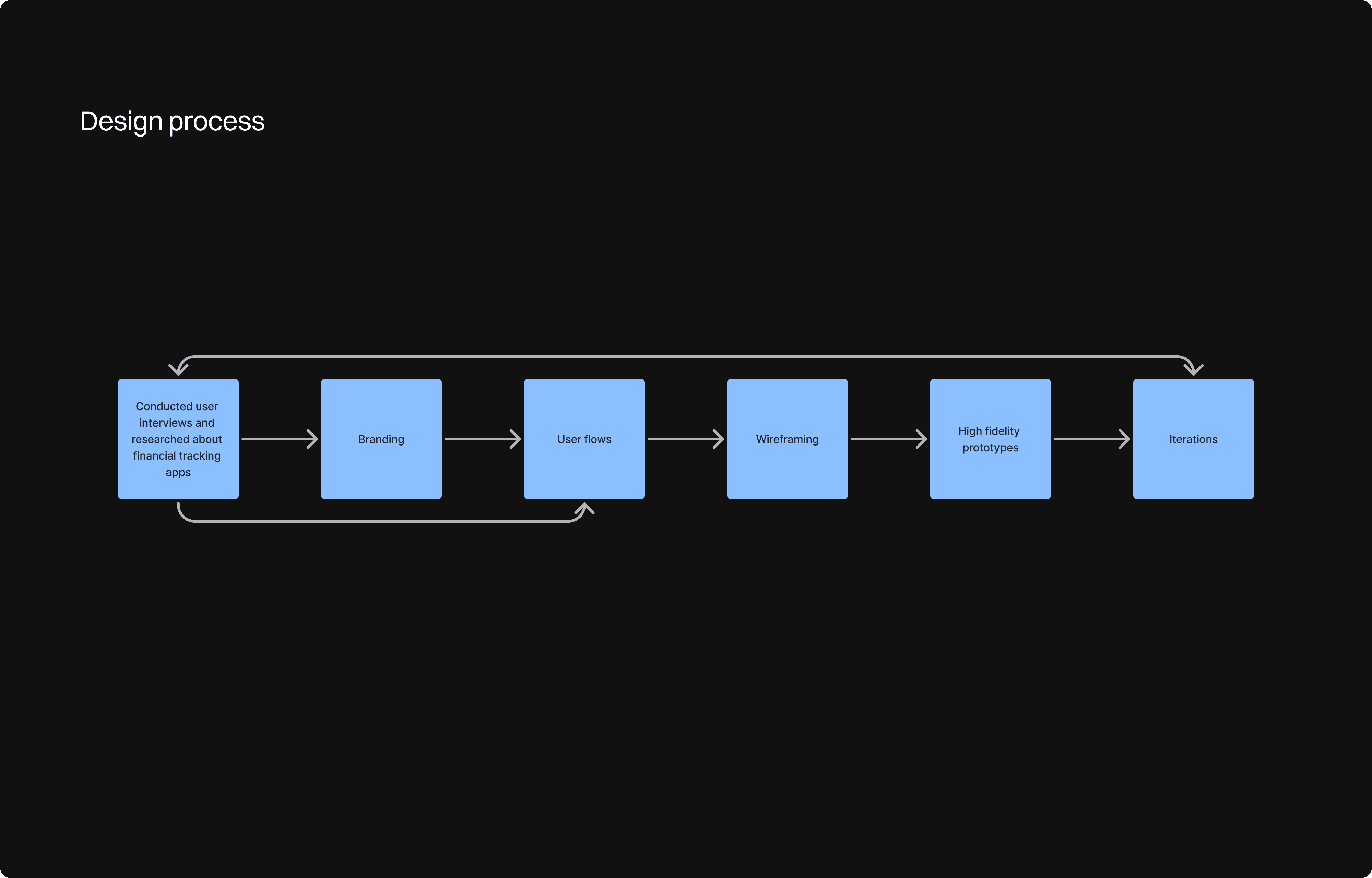

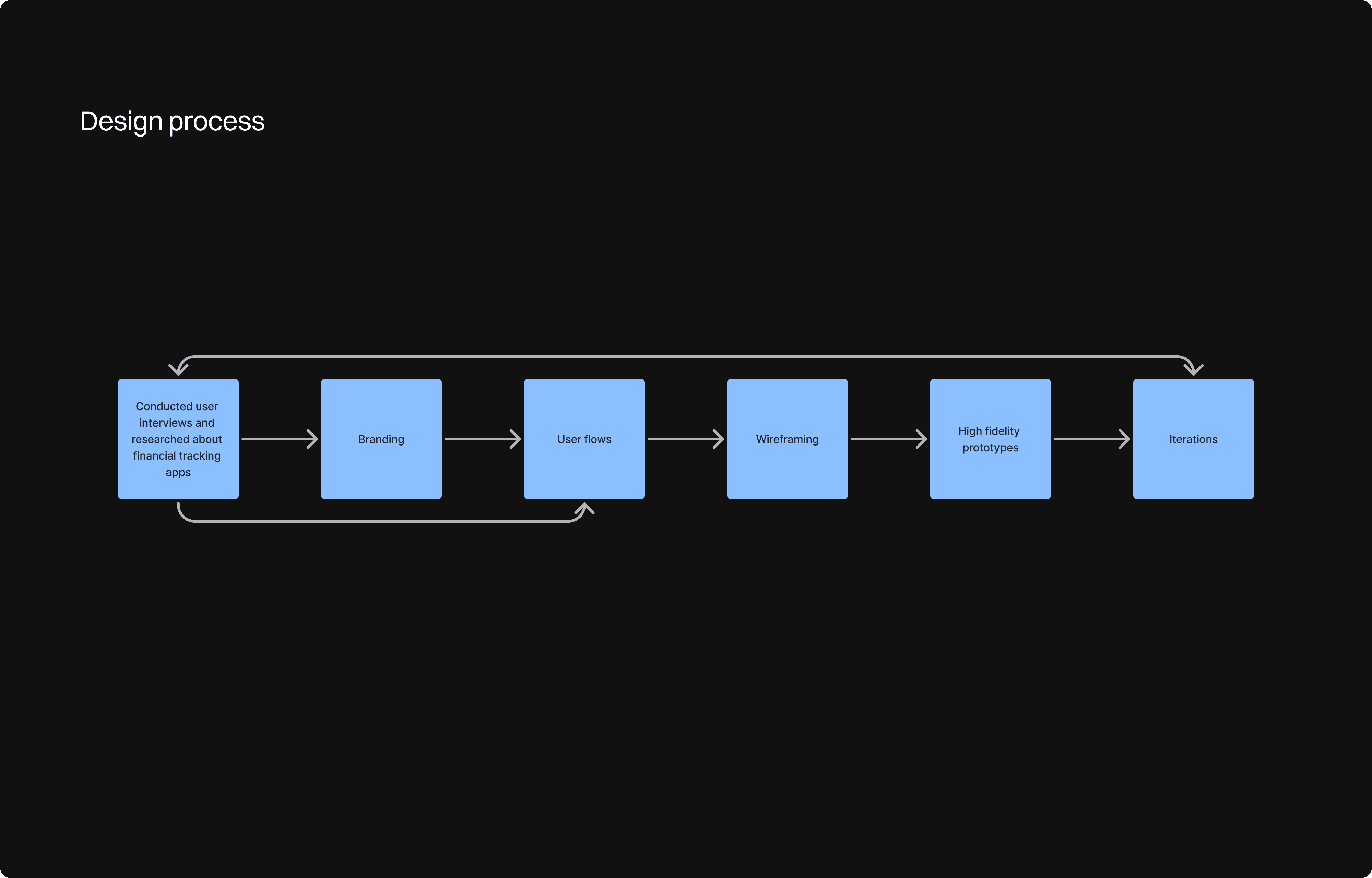

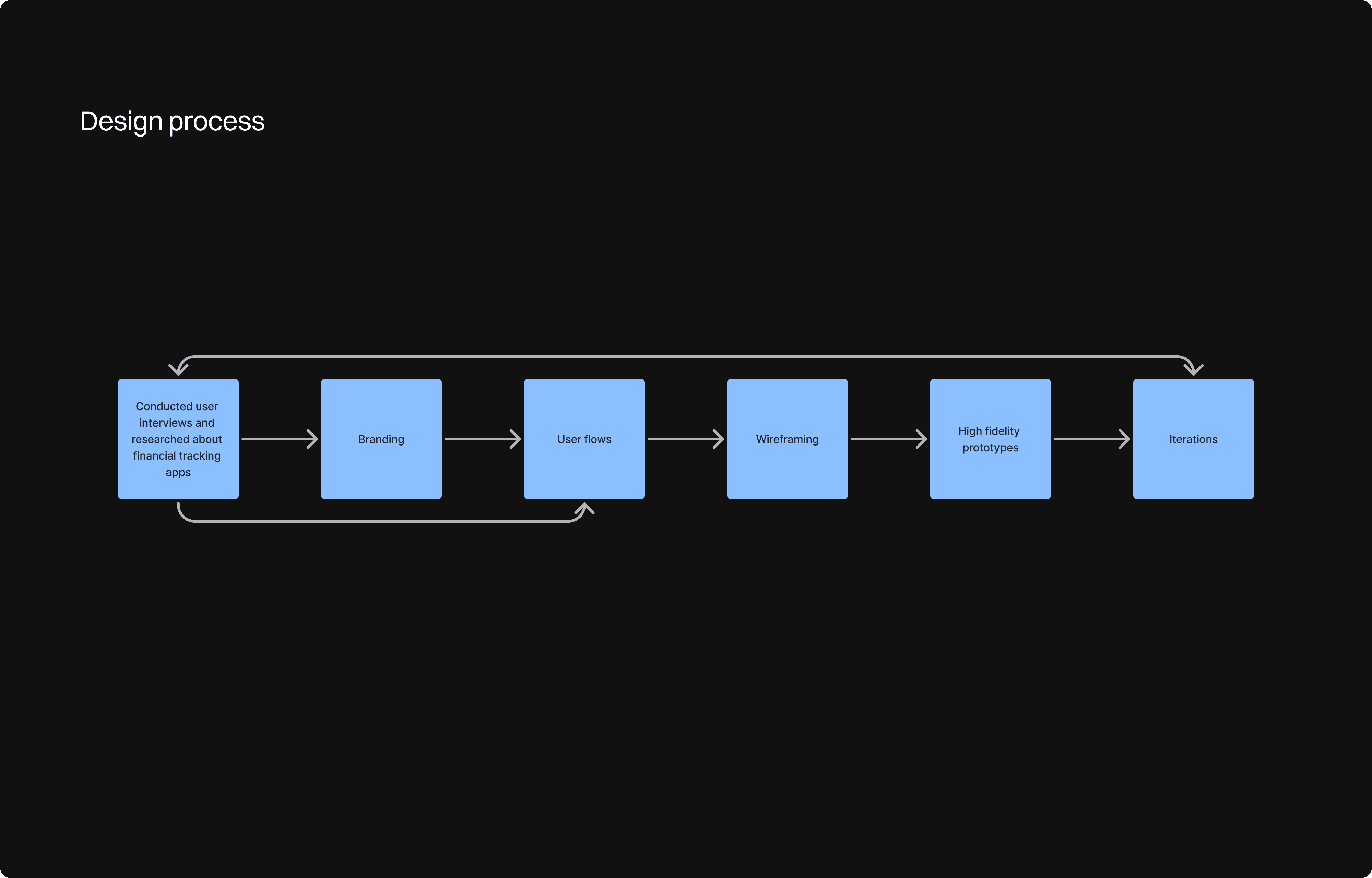

Design Process

Design Process

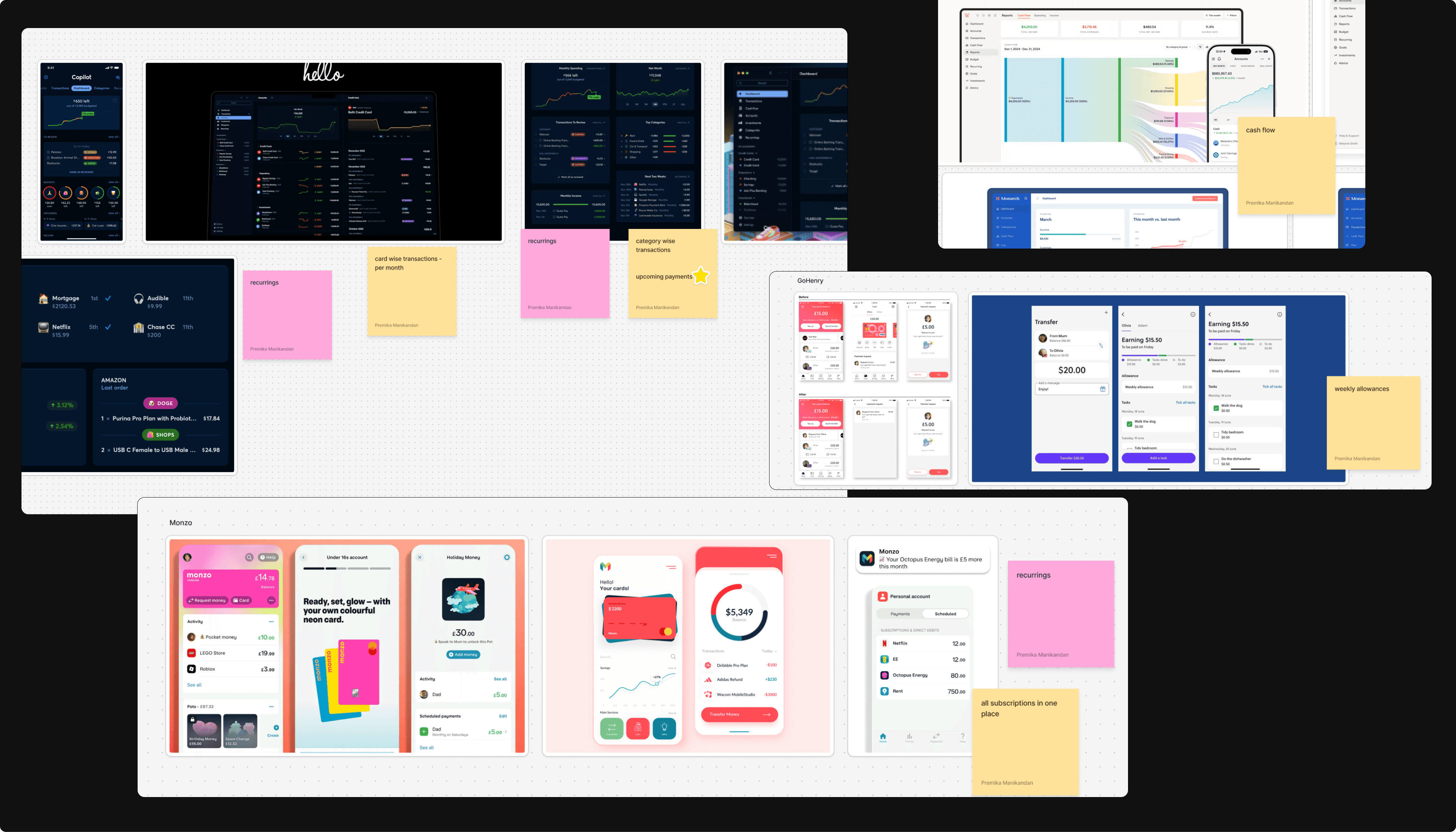

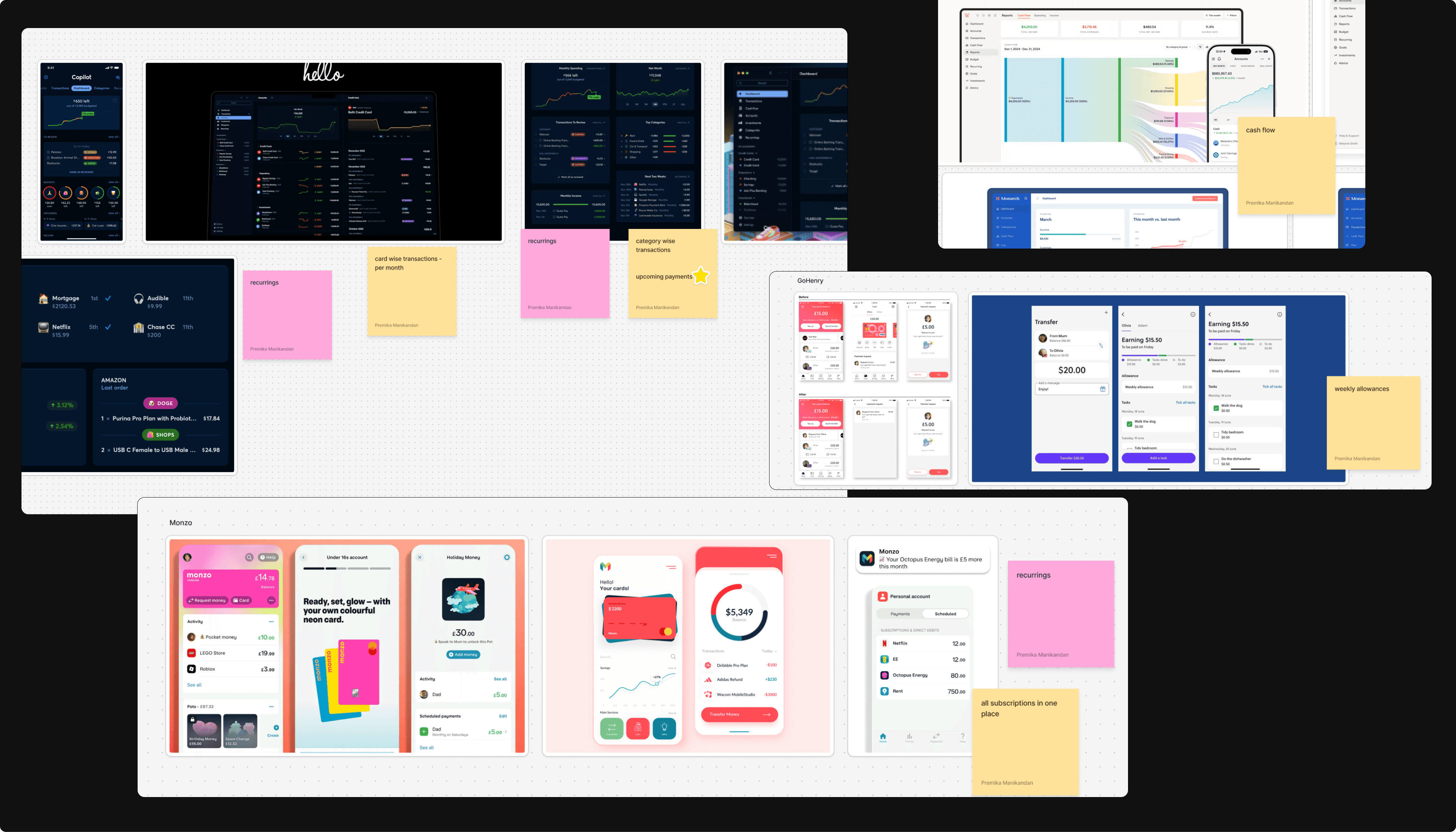

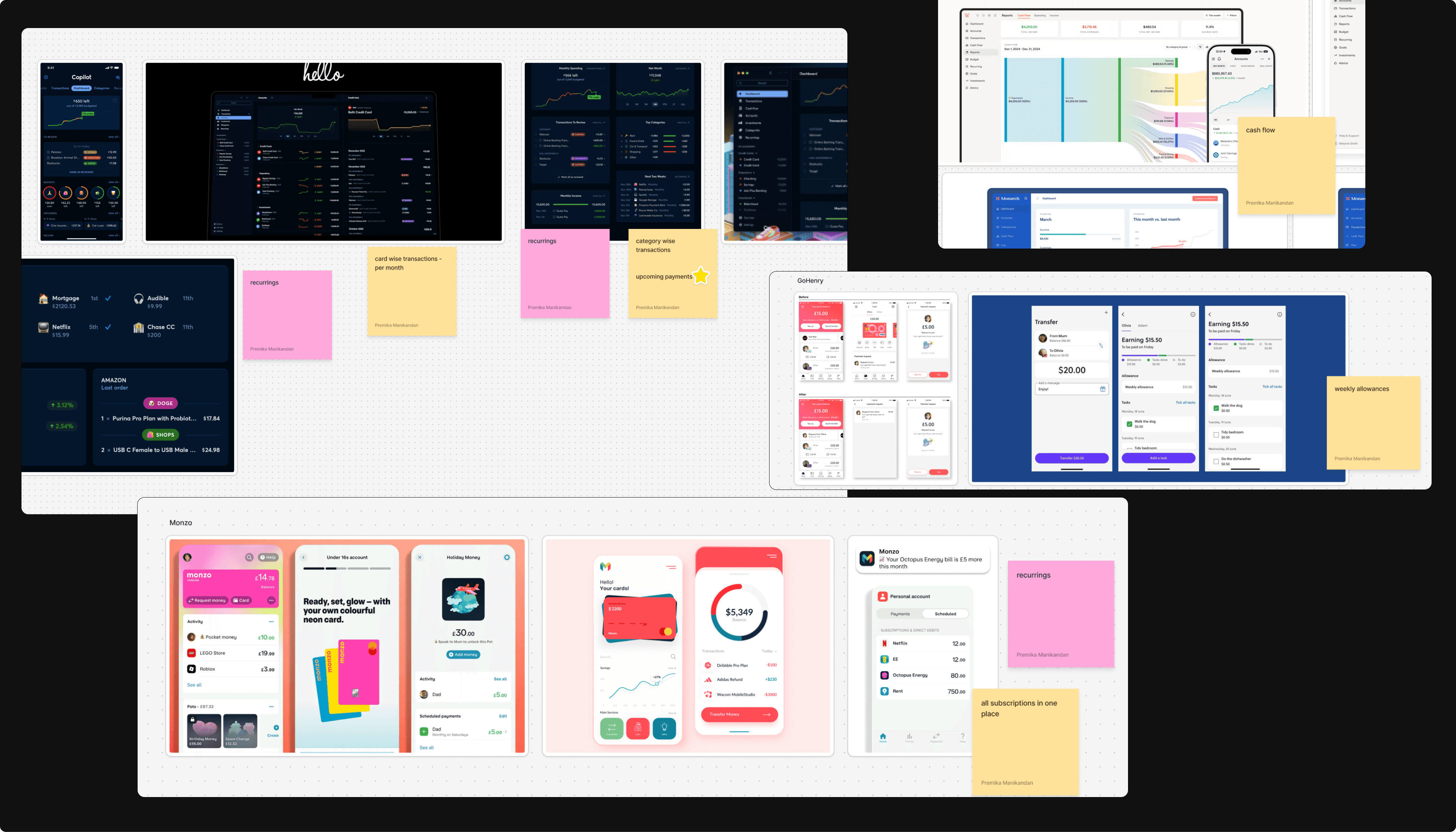

The design process was not linear. With user interviews and iterating along the way, there were a lot of learnings.

The design process was not linear. With user interviews and iterating along the way, there were a lot of learnings.

Research and User Interviews

Research and User Interviews

I explored various financial apps, analyzing their onboarding flows and budgeting processes.esign process was not linear. With user interviews and iterating along the way, there were a lot of learnings.

I explored various financial apps, analyzing their onboarding flows and budgeting processes.esign process was not linear. With user interviews and iterating along the way, there were a lot of learnings.

I conducted interviews with my friends to understand their perspectives on budgeting and financial planning apps. I jotted down notes on their experiences and expectations. I designed a user flow and also created wireframes to put down my thoughts on a paper.

I conducted interviews with my friends to understand their perspectives on budgeting and financial planning apps. I jotted down notes on their experiences and expectations. I designed a user flow and also created wireframes to put down my thoughts on a paper.

User flow

User flow

Branding - Logo Design & naming process

Branding - Logo Design & naming process

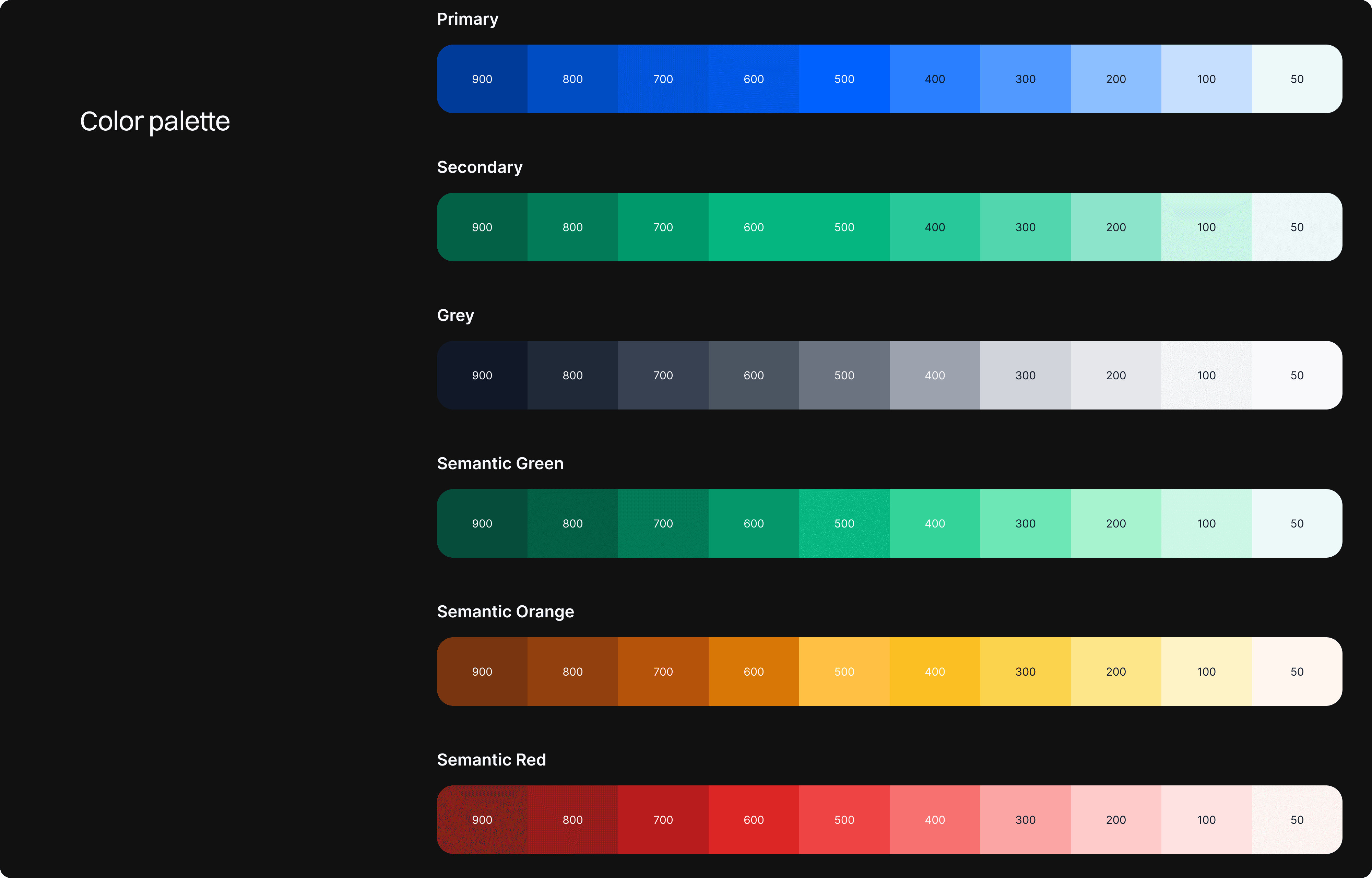

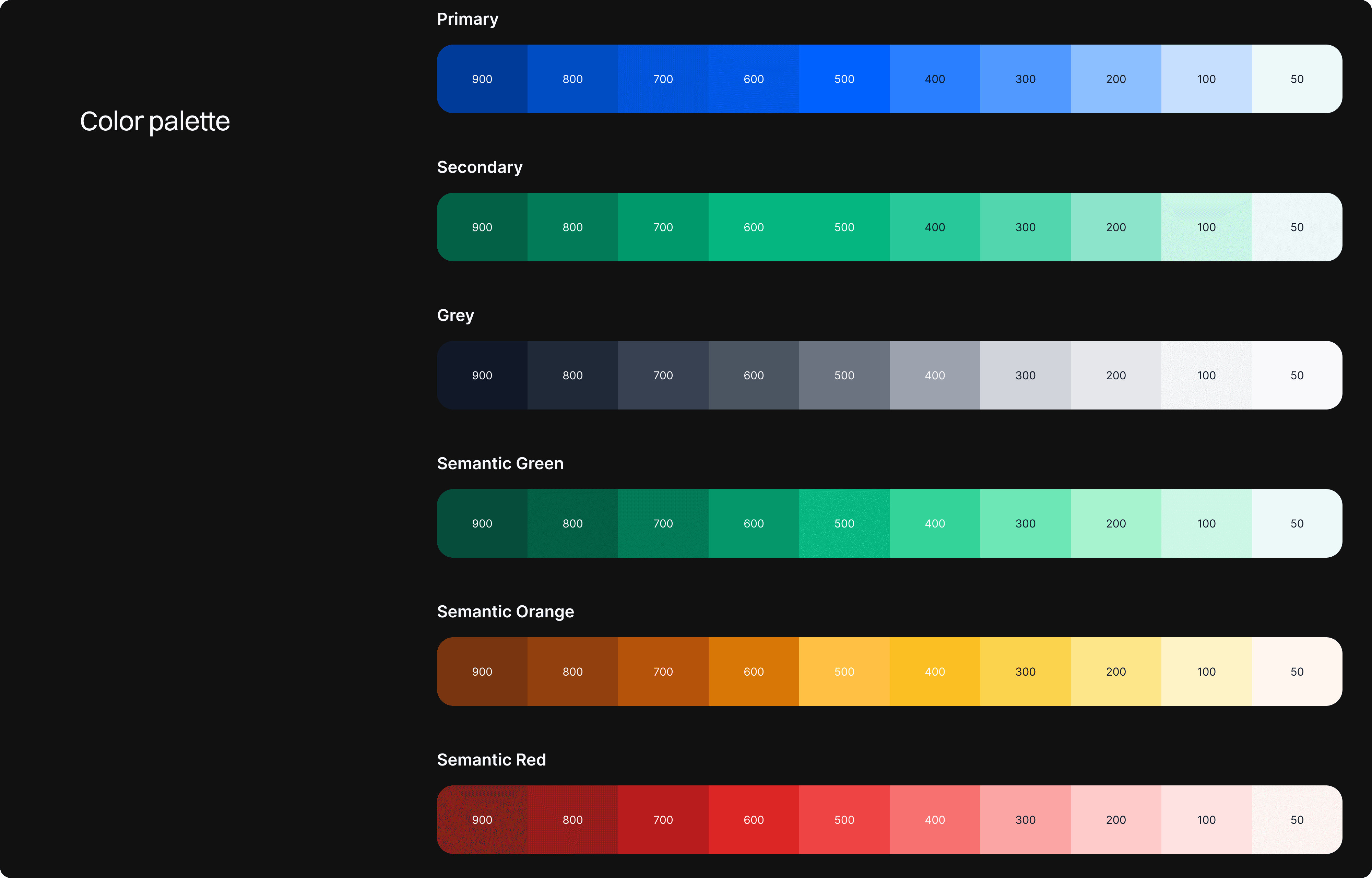

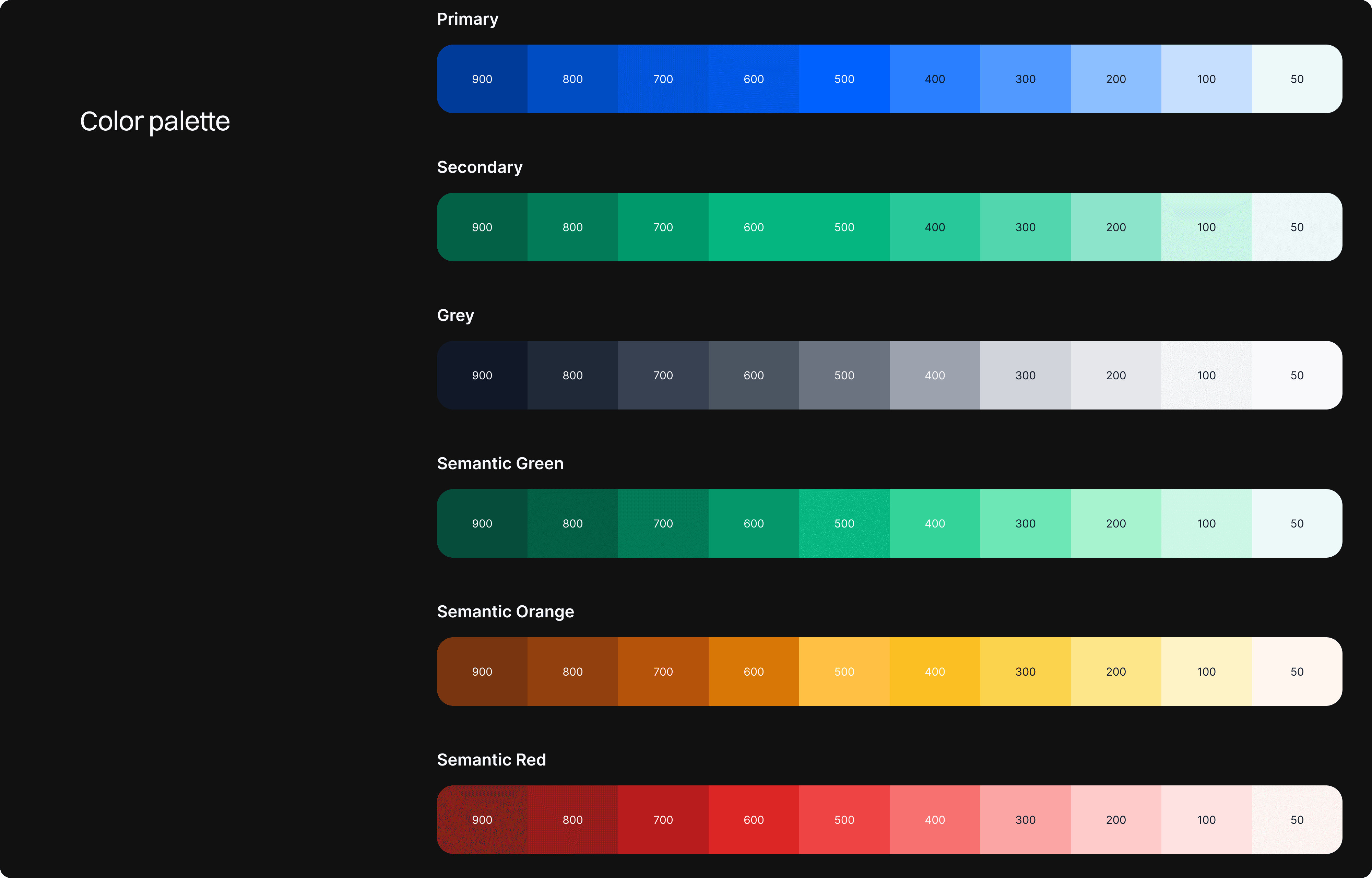

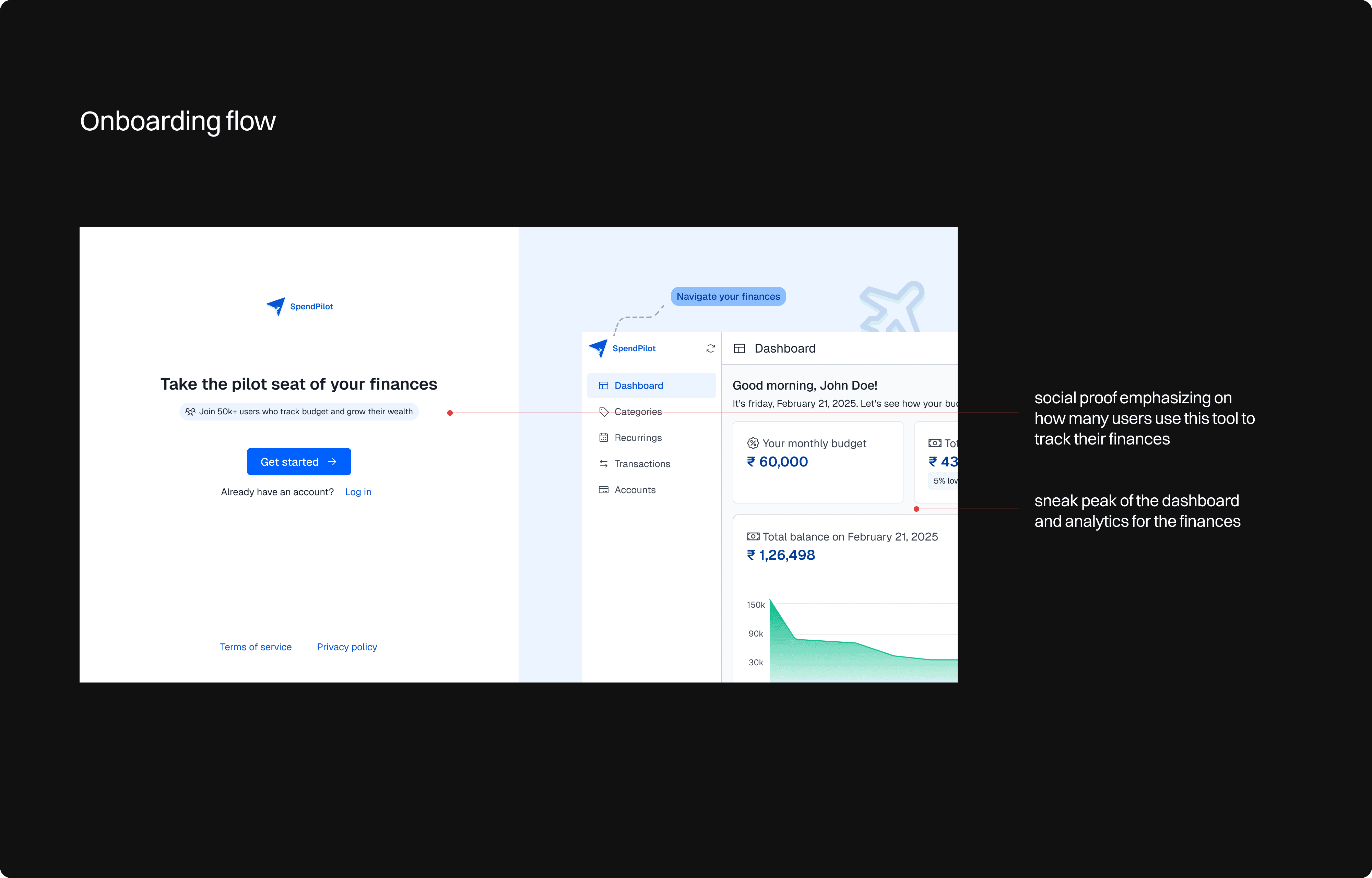

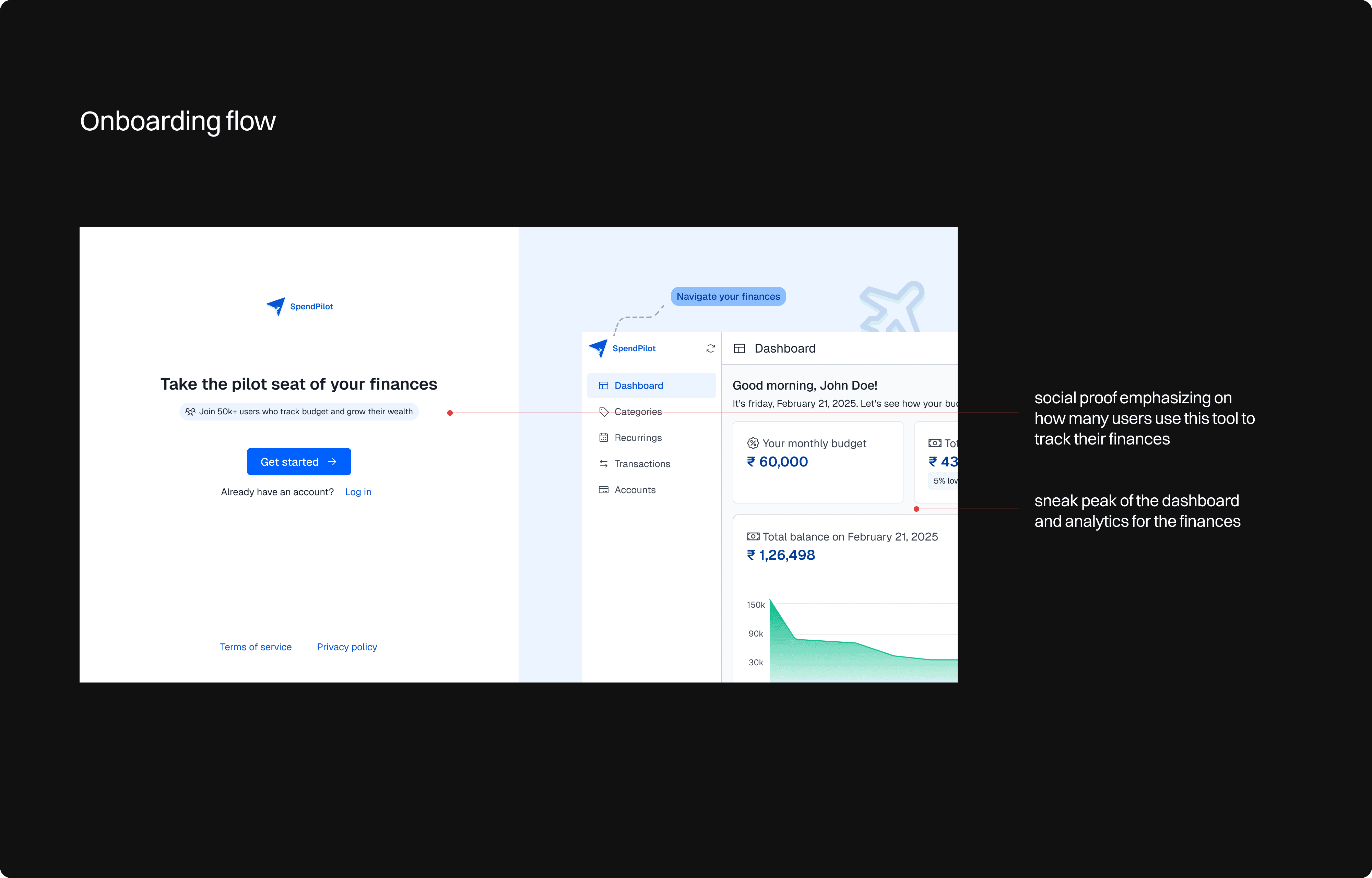

I started by brainstorming keywords related to spending, finance, analysis, and budget tracking. Wanting to merge AI with finance, I came up with SpendPilot—a financial copilot that helps navigate your finances. For the color palette, I chose blue, symbolizing the sky and flight, aligning with the "pilot" theme. Green represents financial growth and prosperity.

I started by brainstorming keywords related to spending, finance, analysis, and budget tracking. Wanting to merge AI with finance, I came up with SpendPilot—a financial copilot that helps navigate your finances. For the color palette, I chose blue, symbolizing the sky and flight, aligning with the "pilot" theme. Green represents financial growth and prosperity.

Color palette, typography and design system

Color palette, typography and design system

Primary and secondary colors chosen for the app

Primary and secondary colors chosen for the app

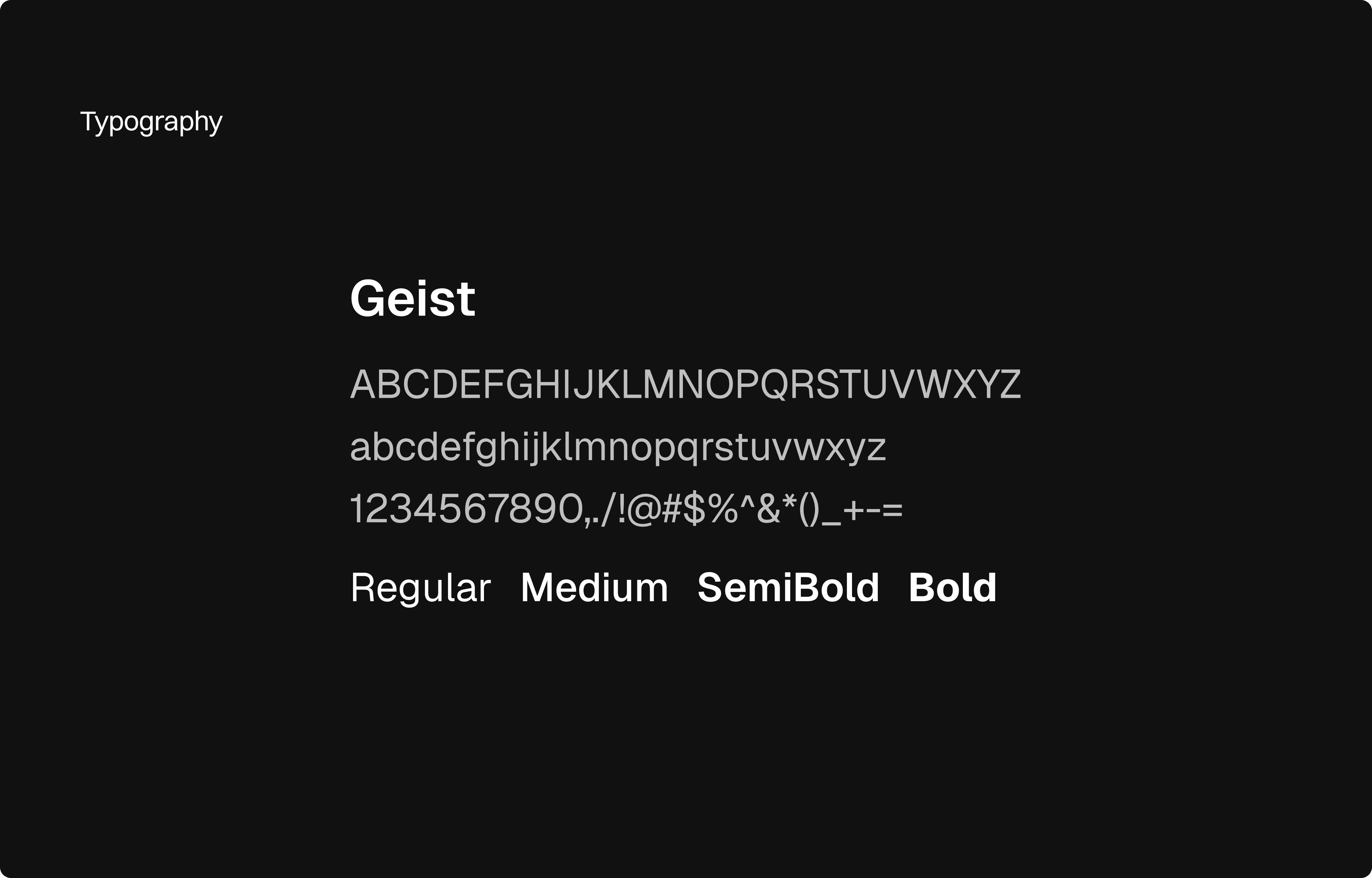

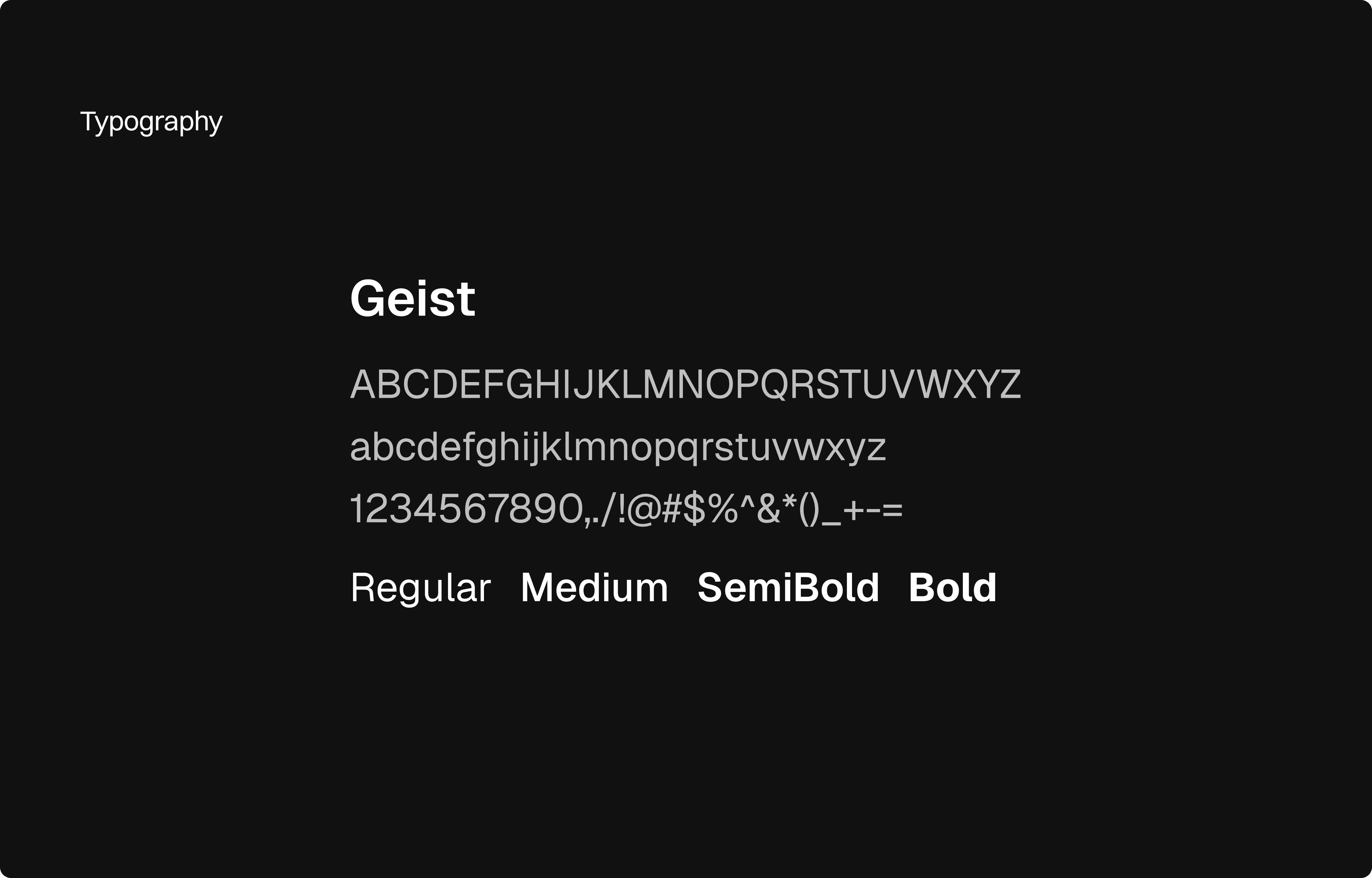

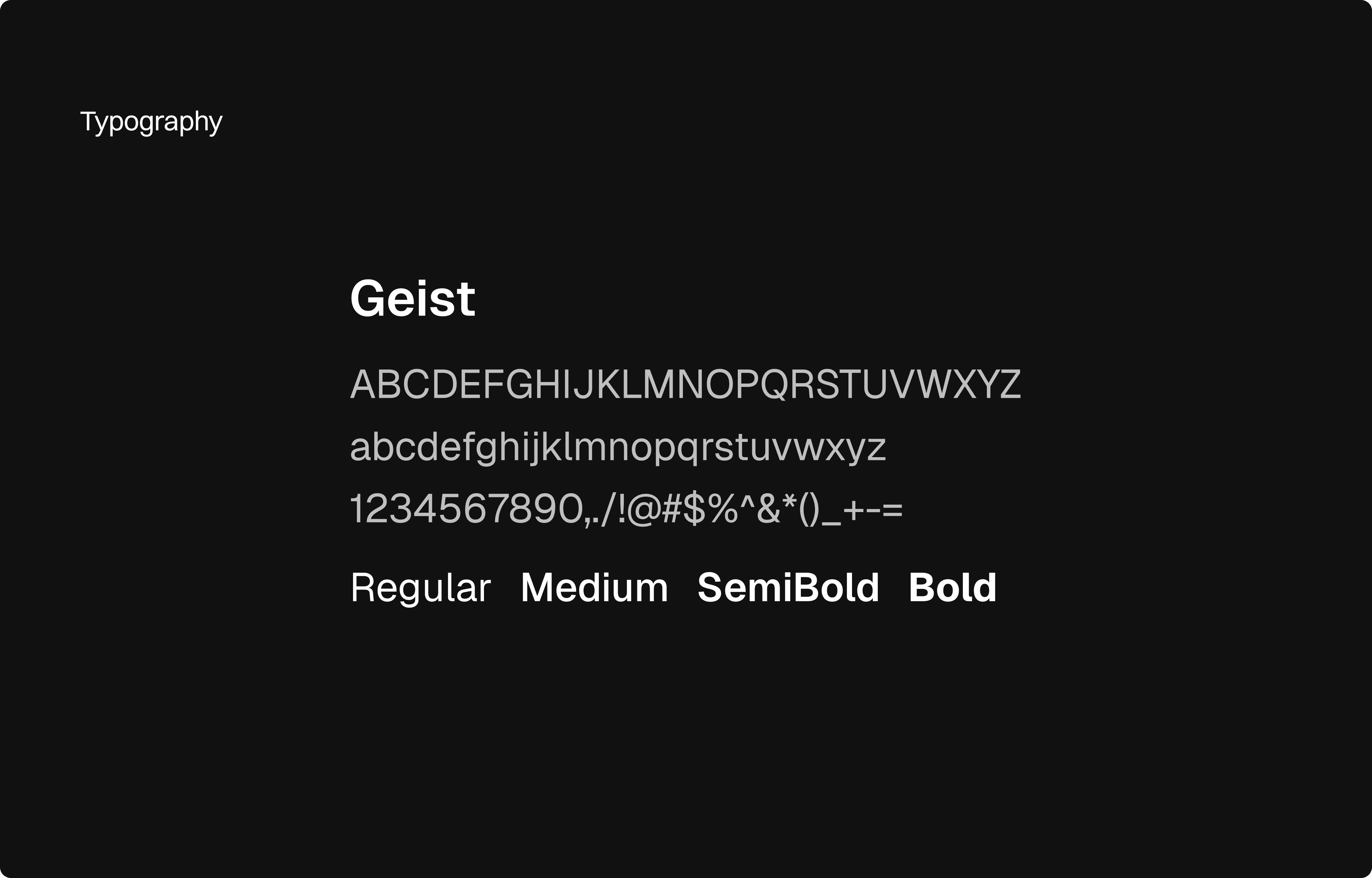

Typography

Typography

I used Geist, a sans serif font for the app

I used Geist, a sans serif font for the app

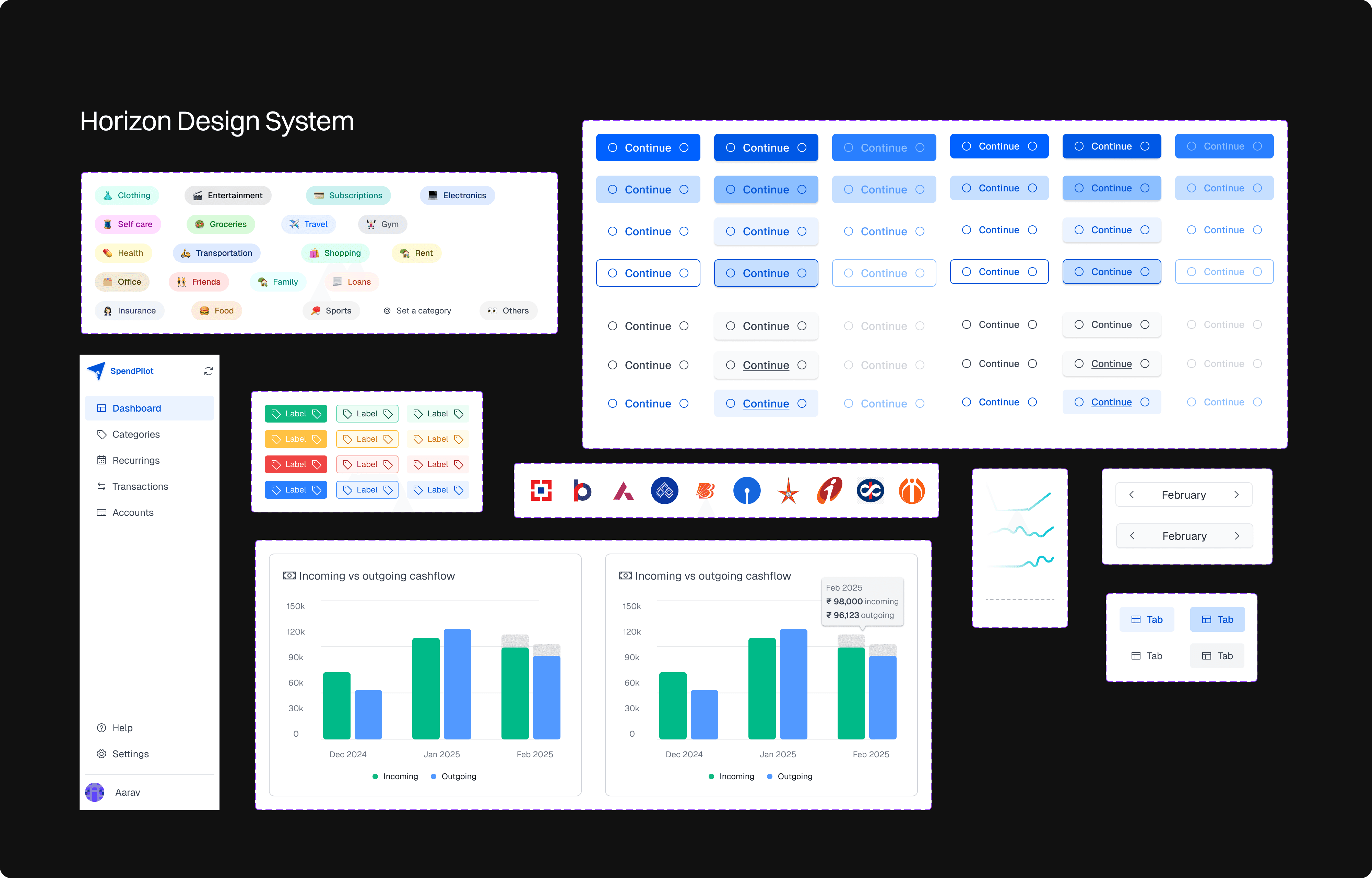

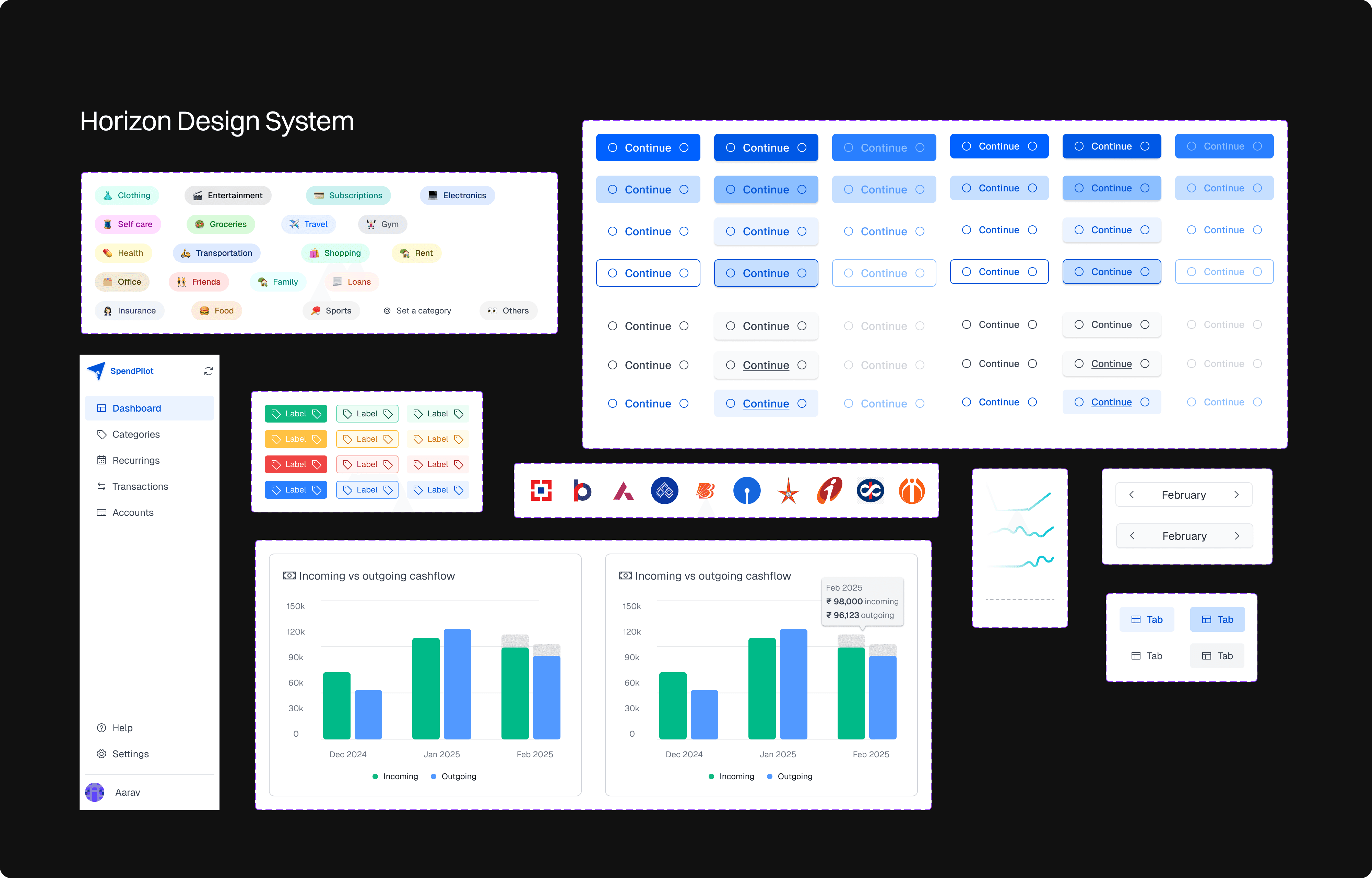

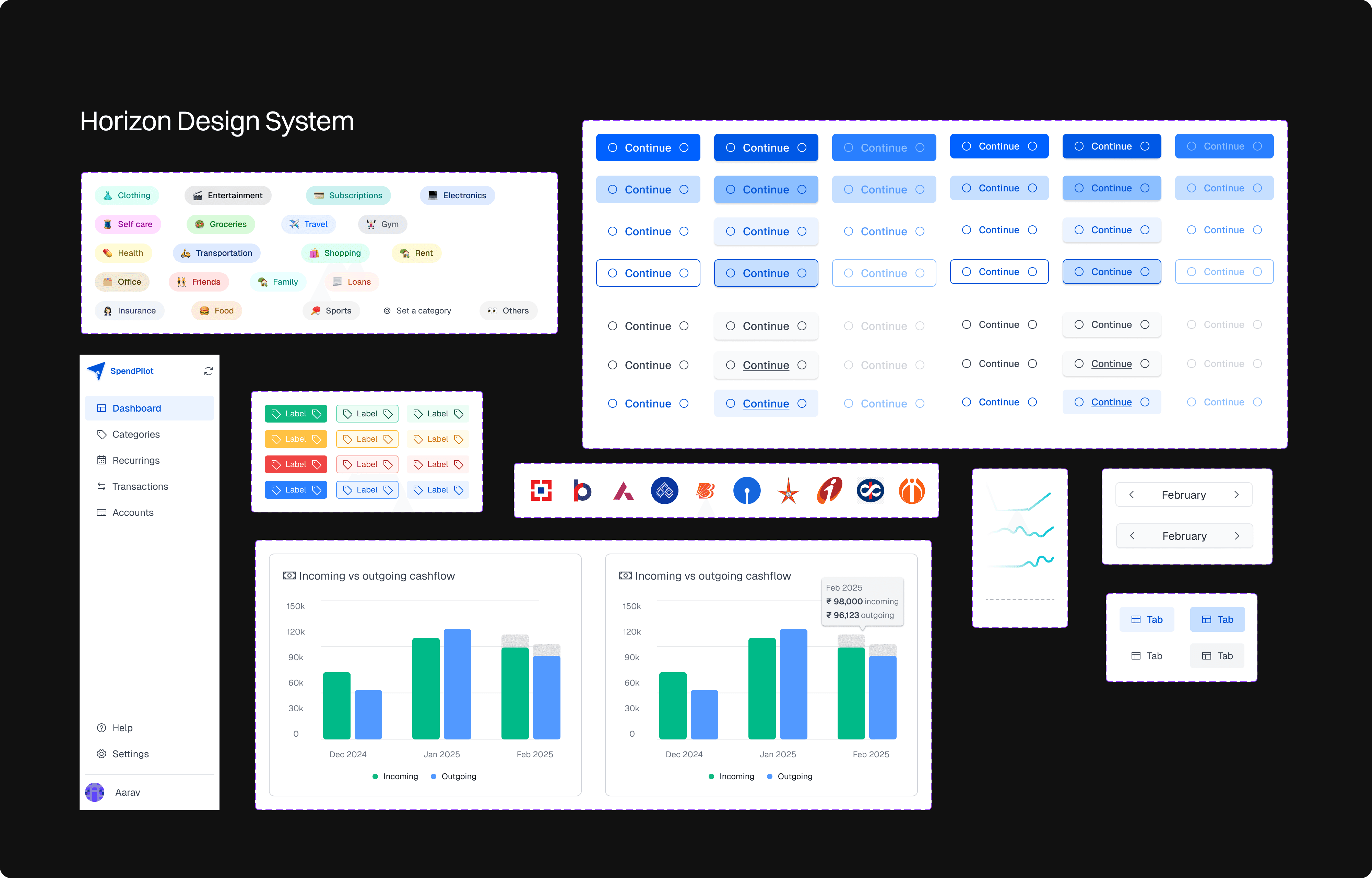

Horizon design system

Horizon design system

I've established the foundation for the design system - focusing on essential UI elements that will serve as the building blocks.

I've established the foundation for the design system - focusing on essential UI elements that will serve as the building blocks.

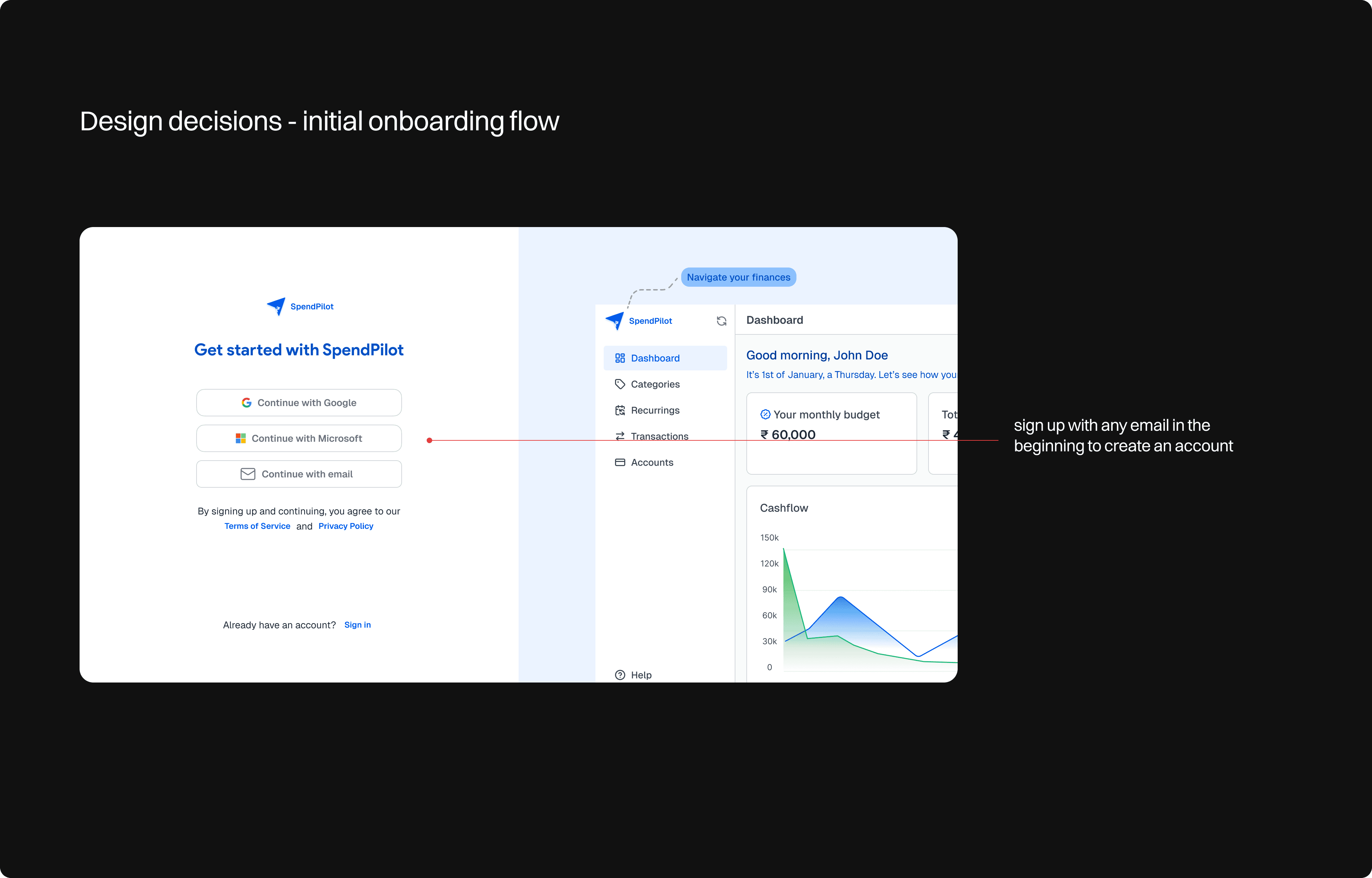

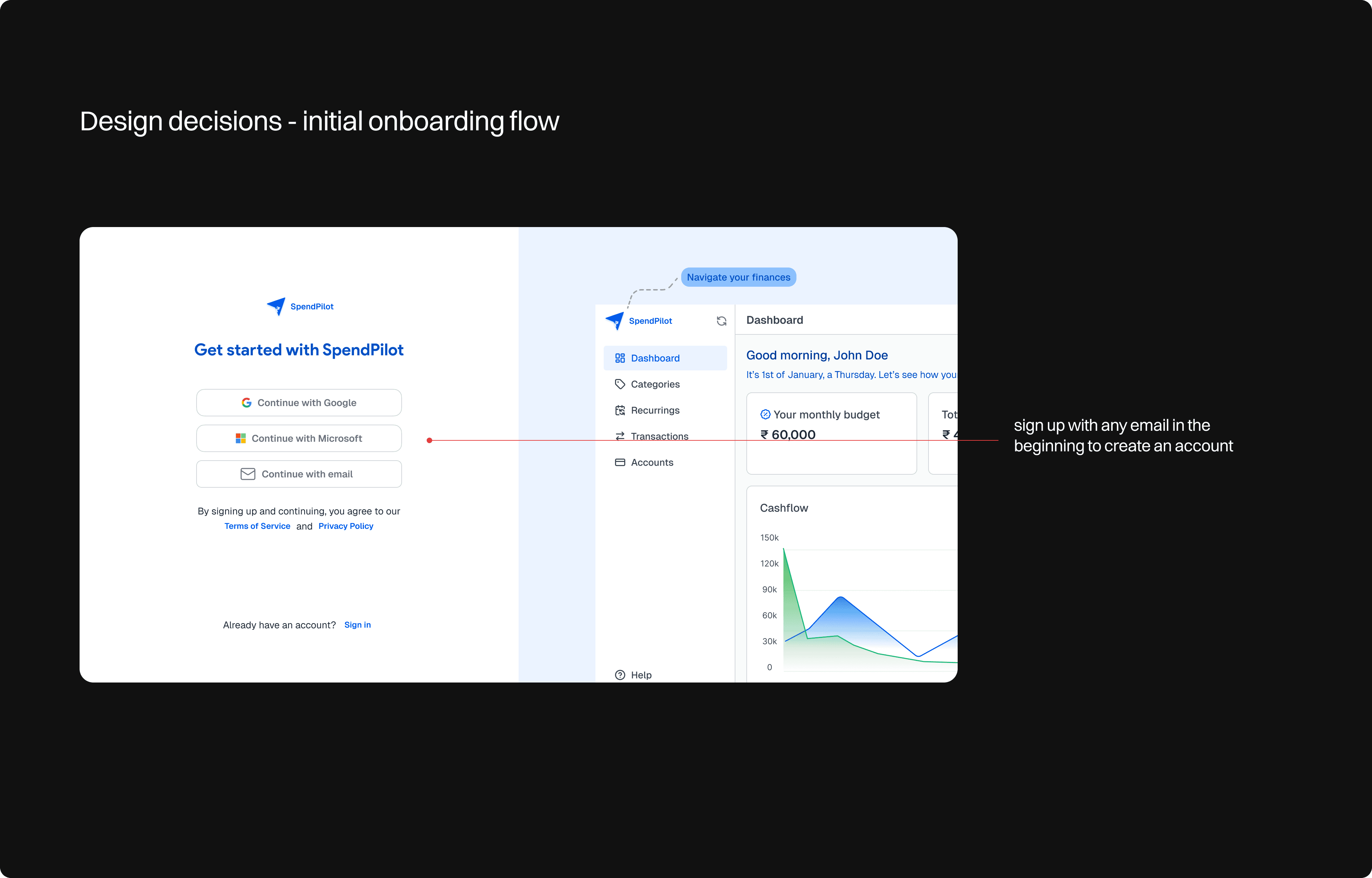

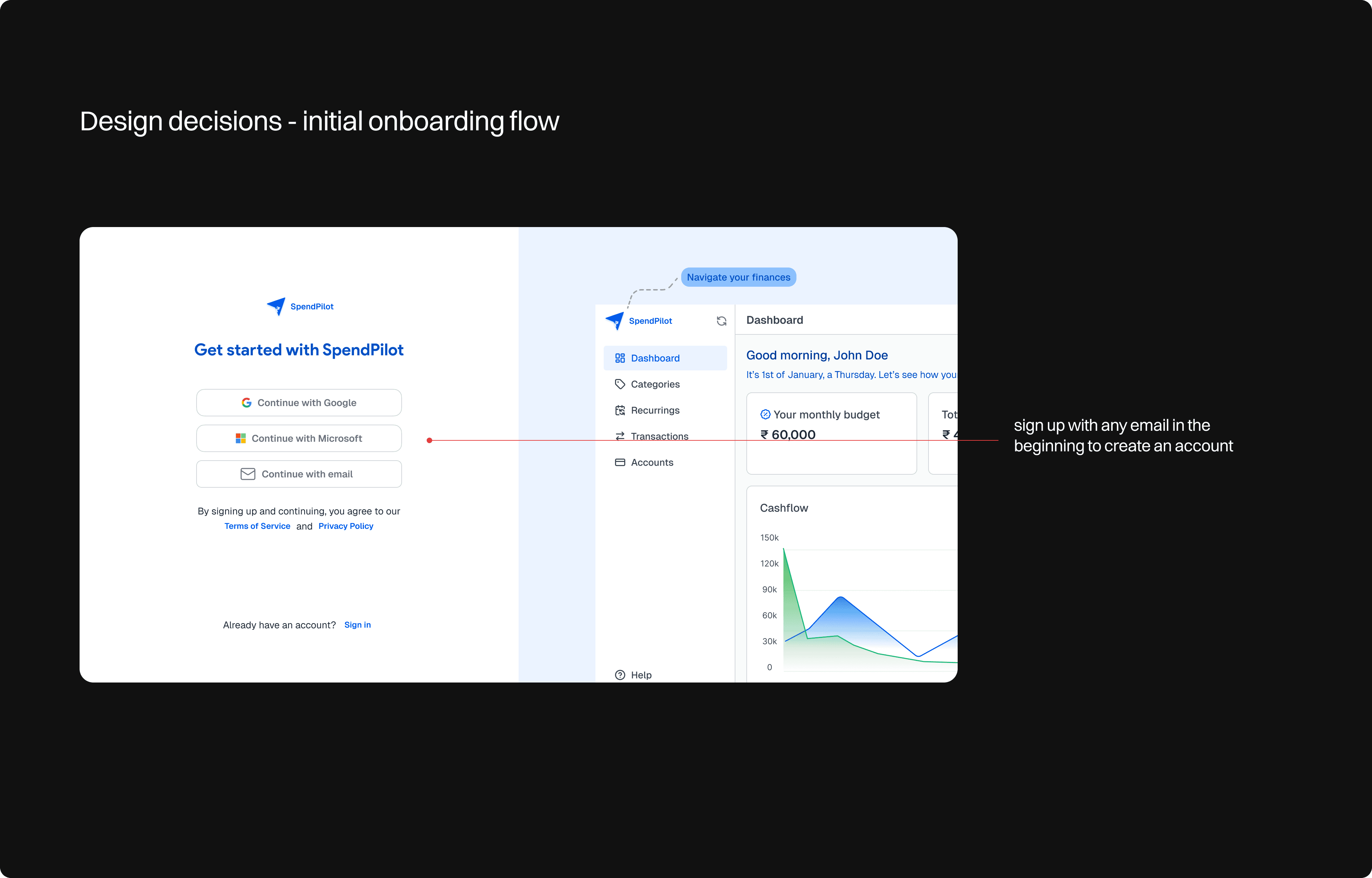

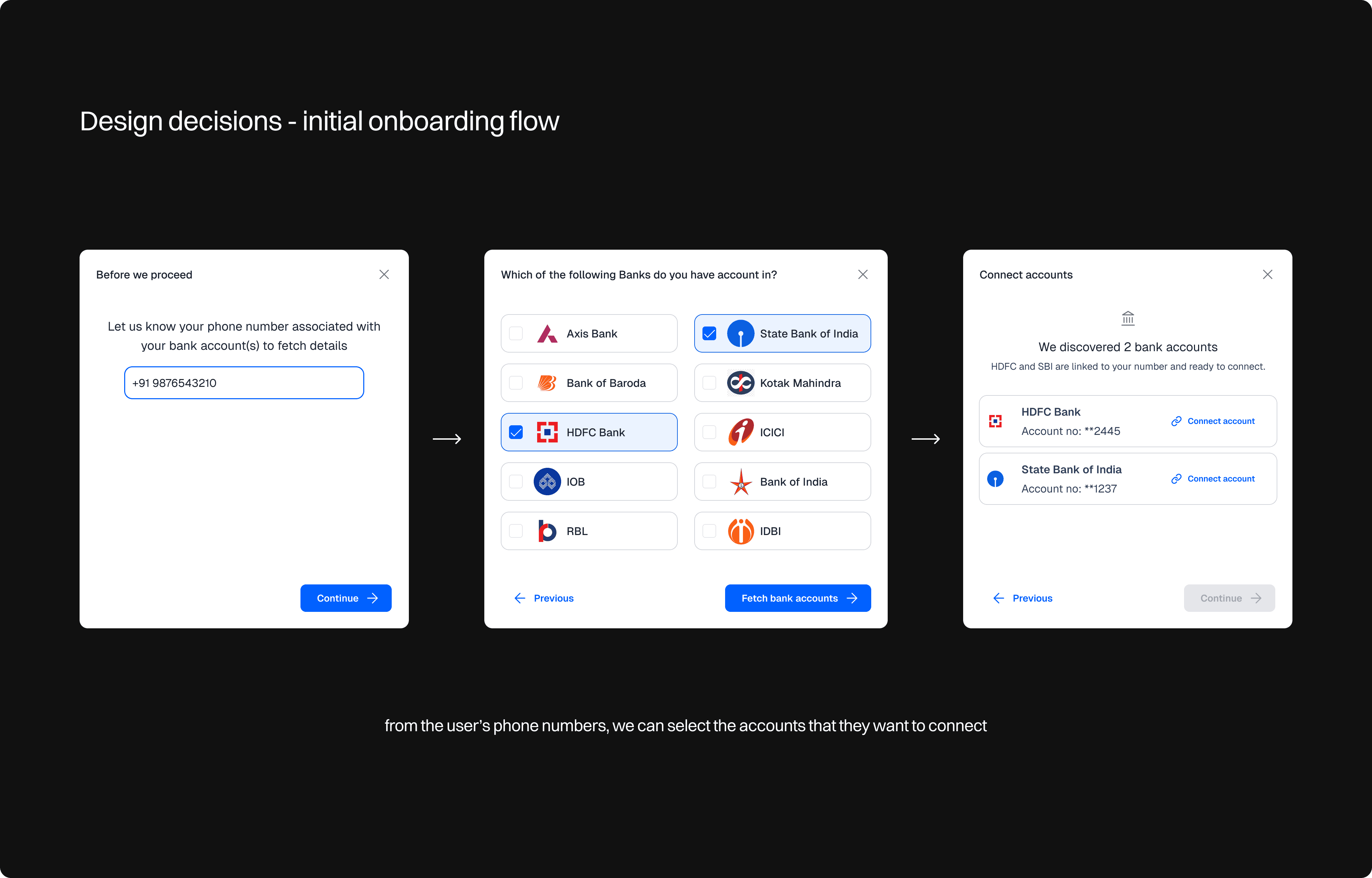

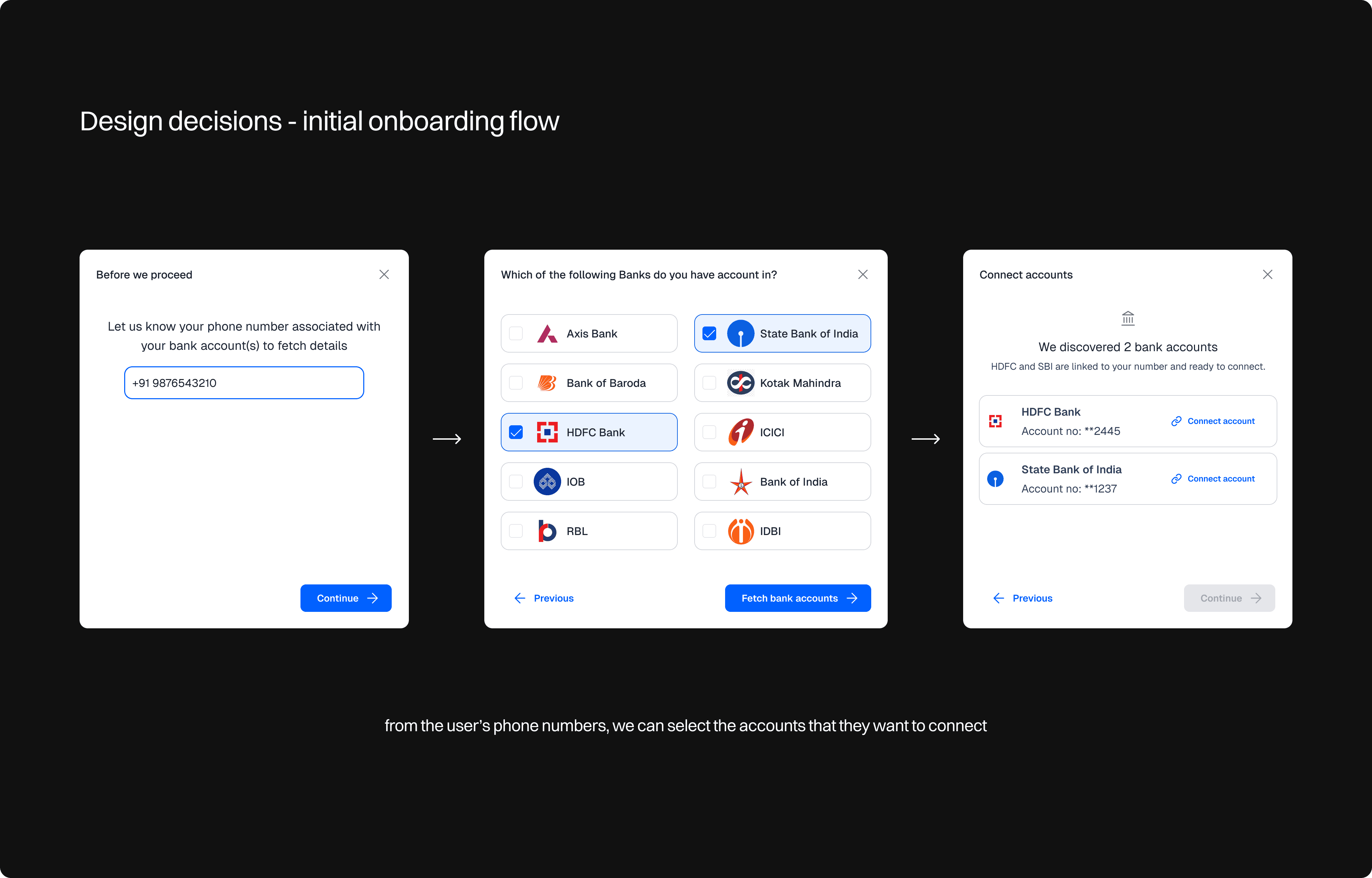

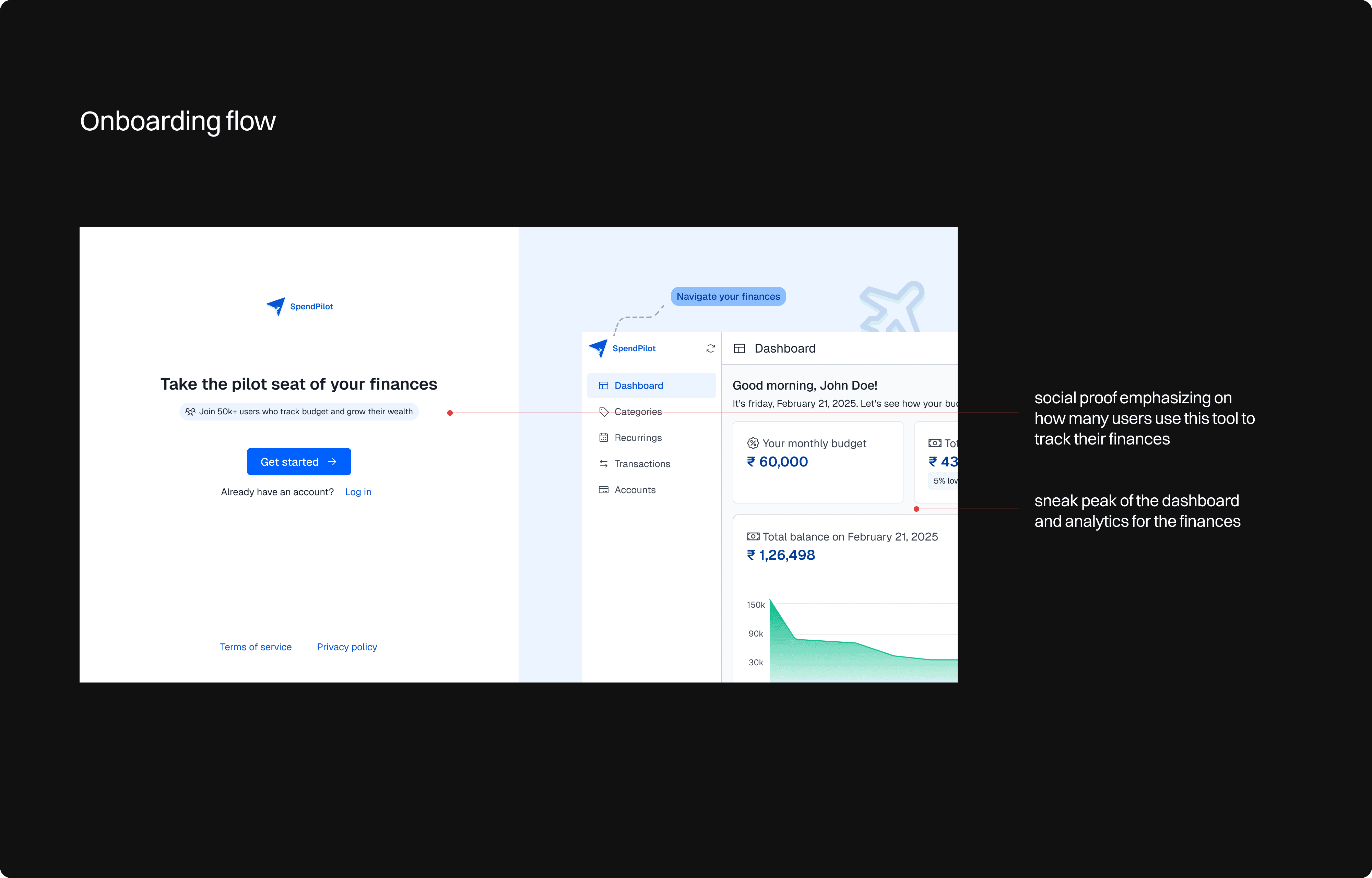

Iterations - Onboarding flow

Iterations - Onboarding flow

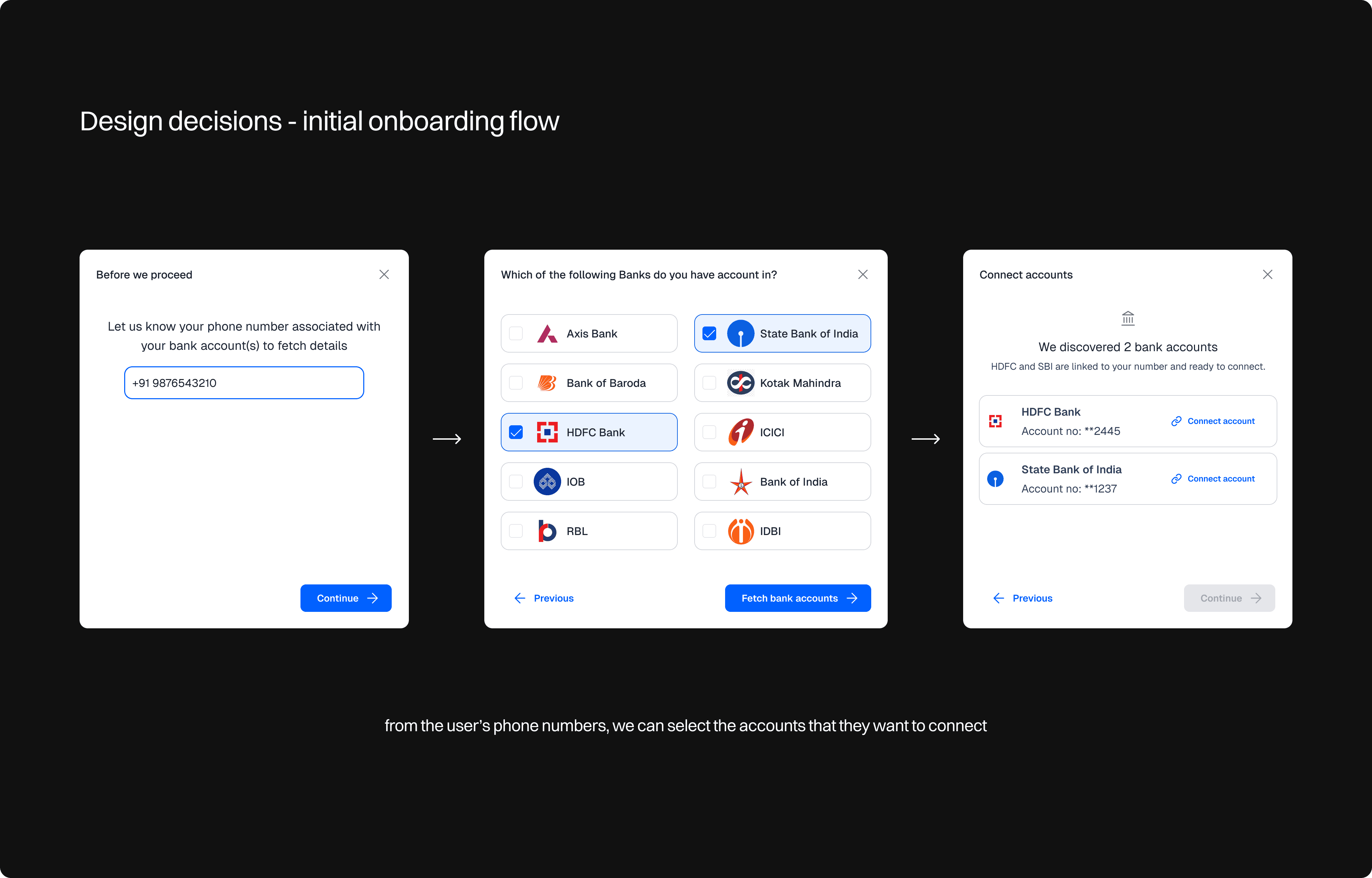

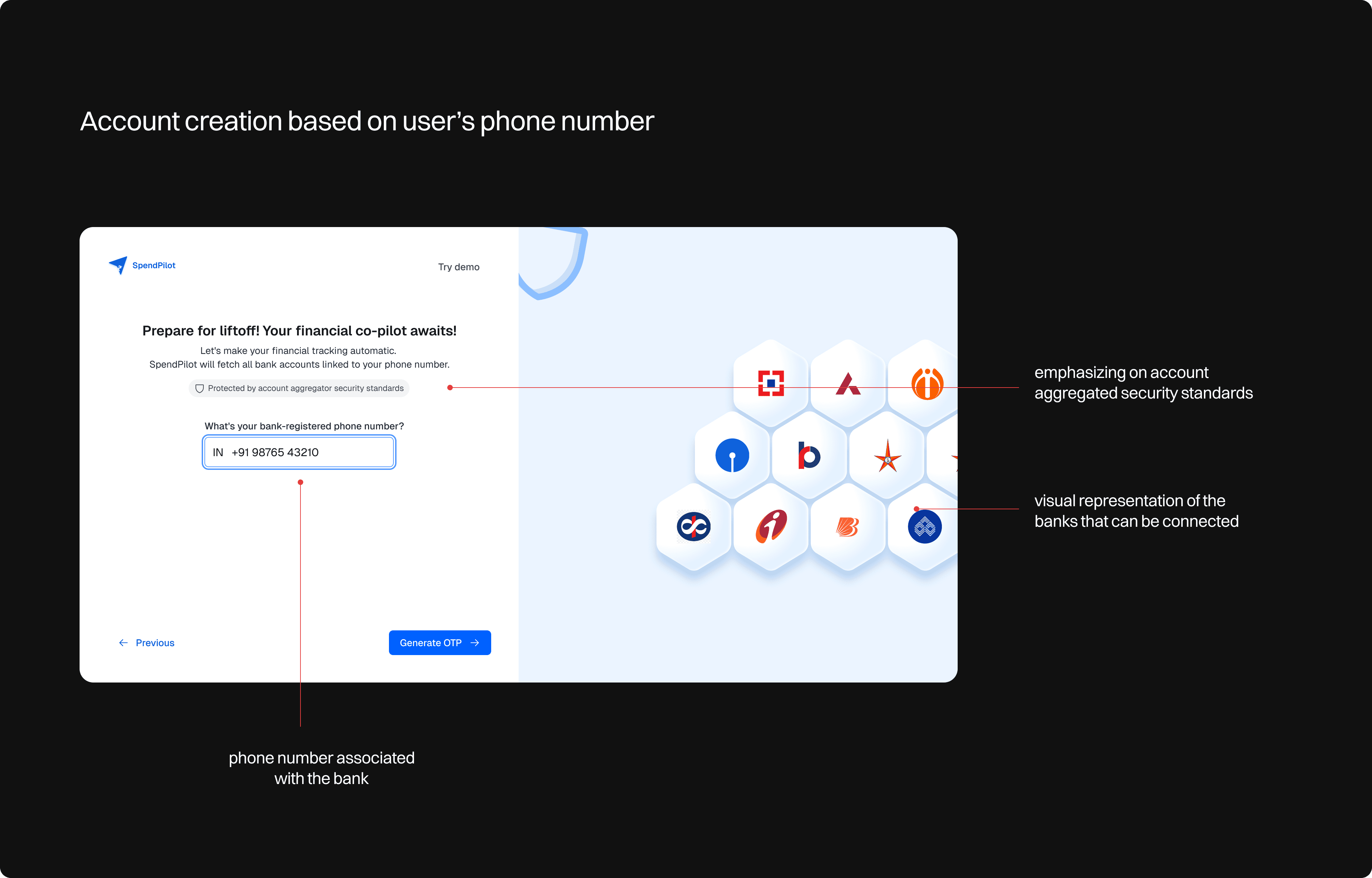

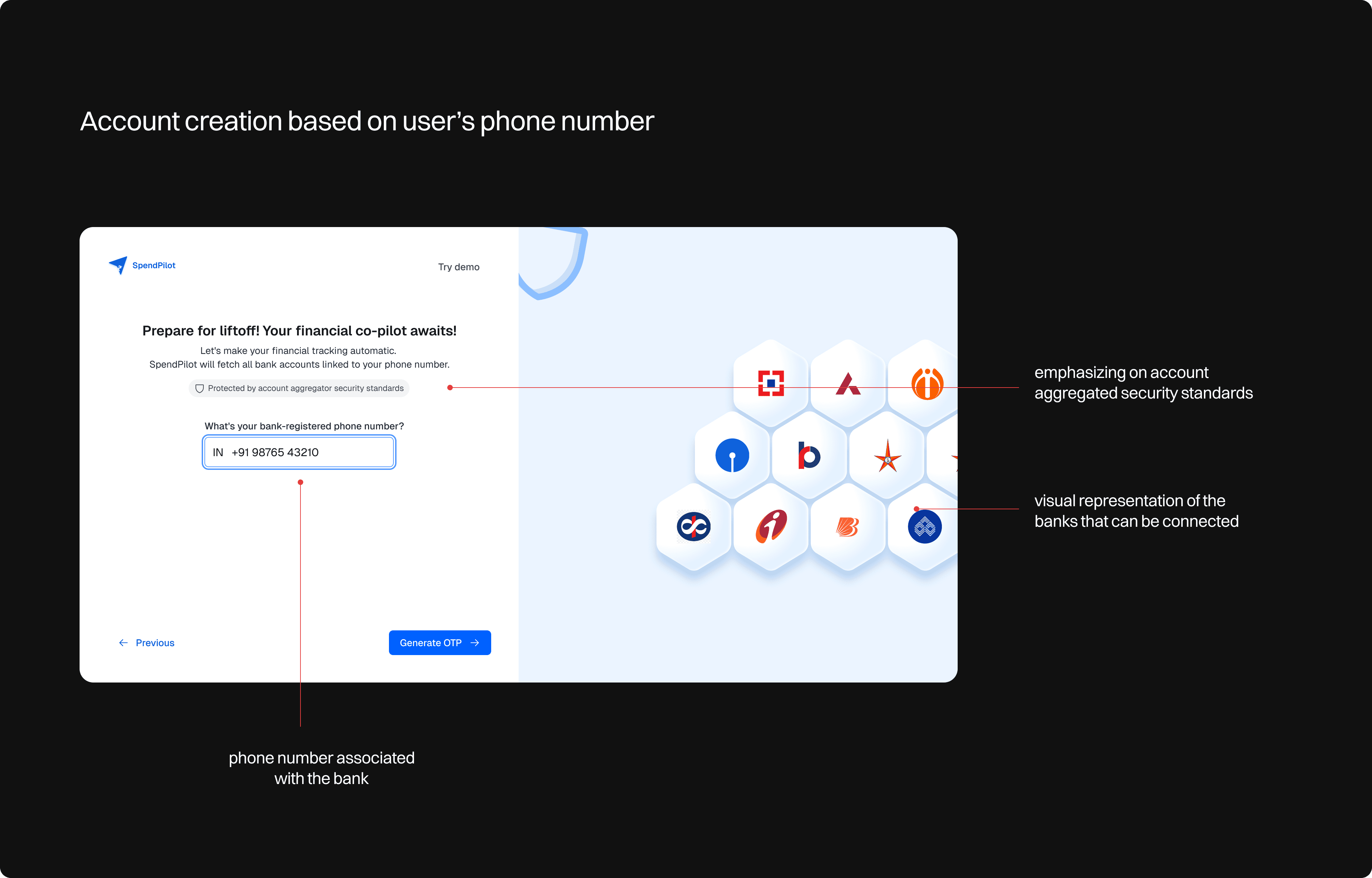

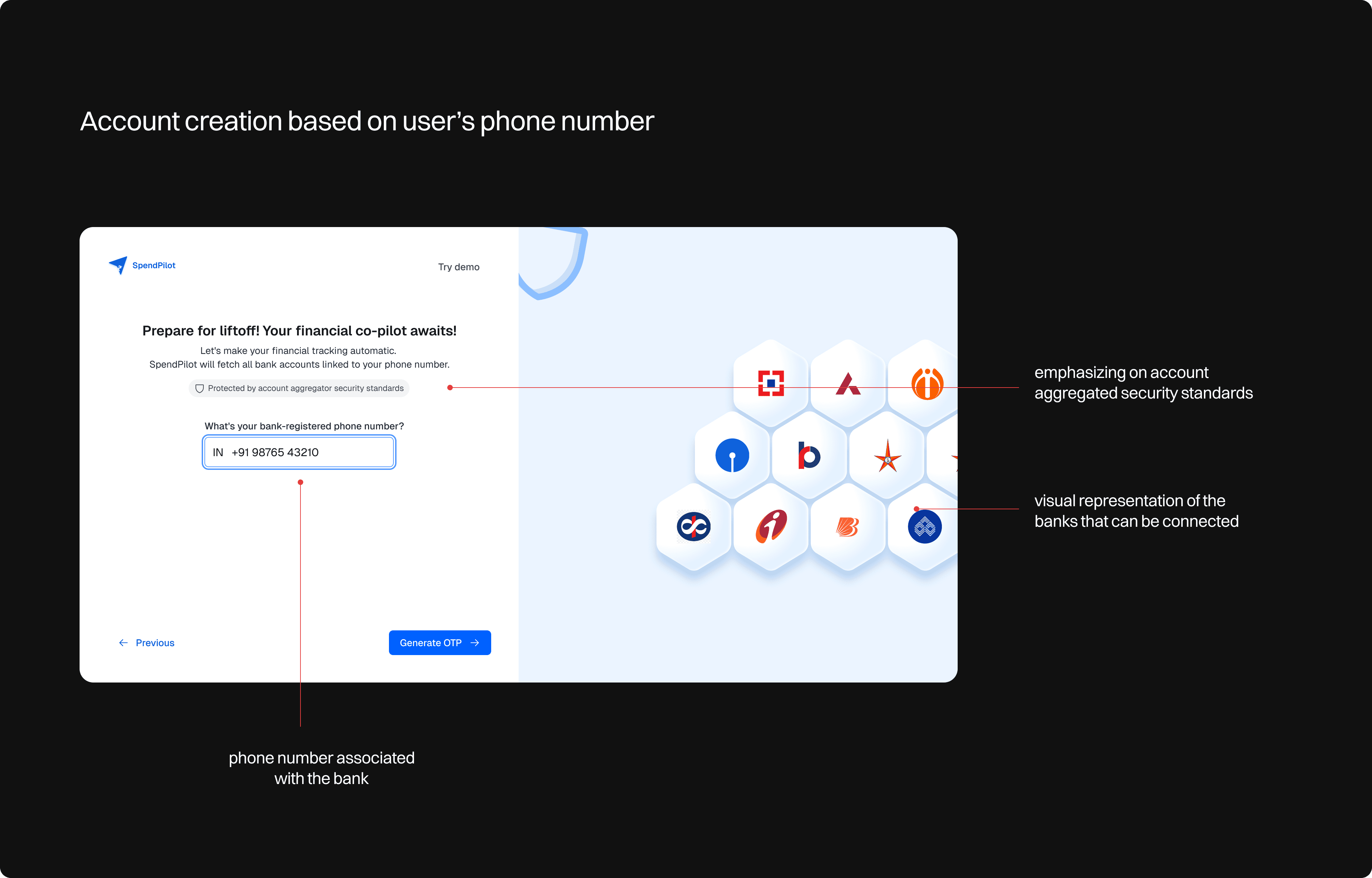

Mobile first authentication - Initially I designed for a email sign up but I eliminated this process and directly allow users for a mobile number-based authentication. This decision was driven by the AA framework's integration capabilities, which uses mobile numbers as the primary identifier. This change has made the onboarding process more straightforward and reduced the time to value for users.

Mobile first authentication - Initially I designed for a email sign up but I eliminated this process and directly allow users for a mobile number-based authentication. This decision was driven by the AA framework's integration capabilities, which uses mobile numbers as the primary identifier. This change has made the onboarding process more straightforward and reduced the time to value for users.

Final Visual Designs

Final Visual Designs

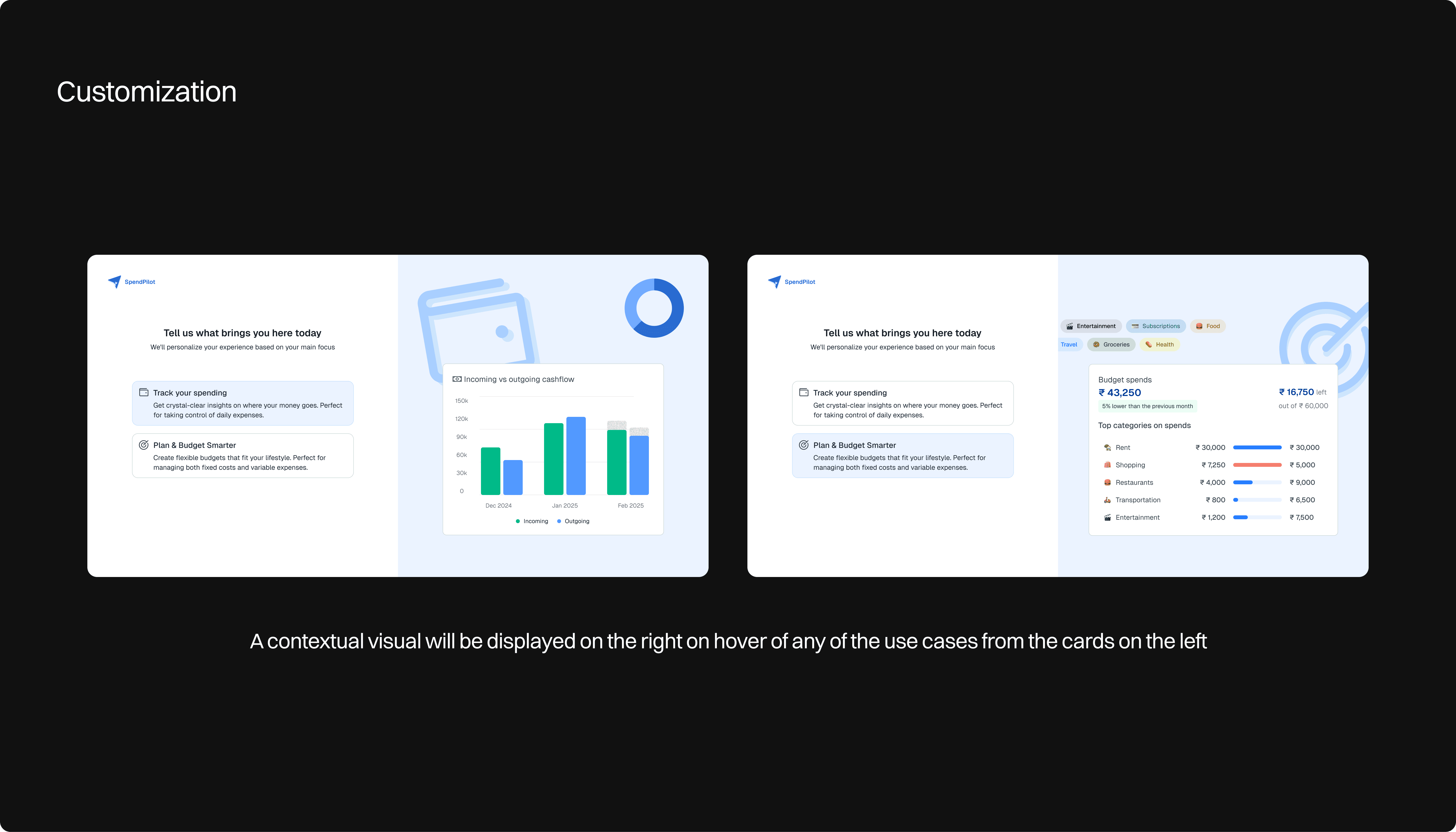

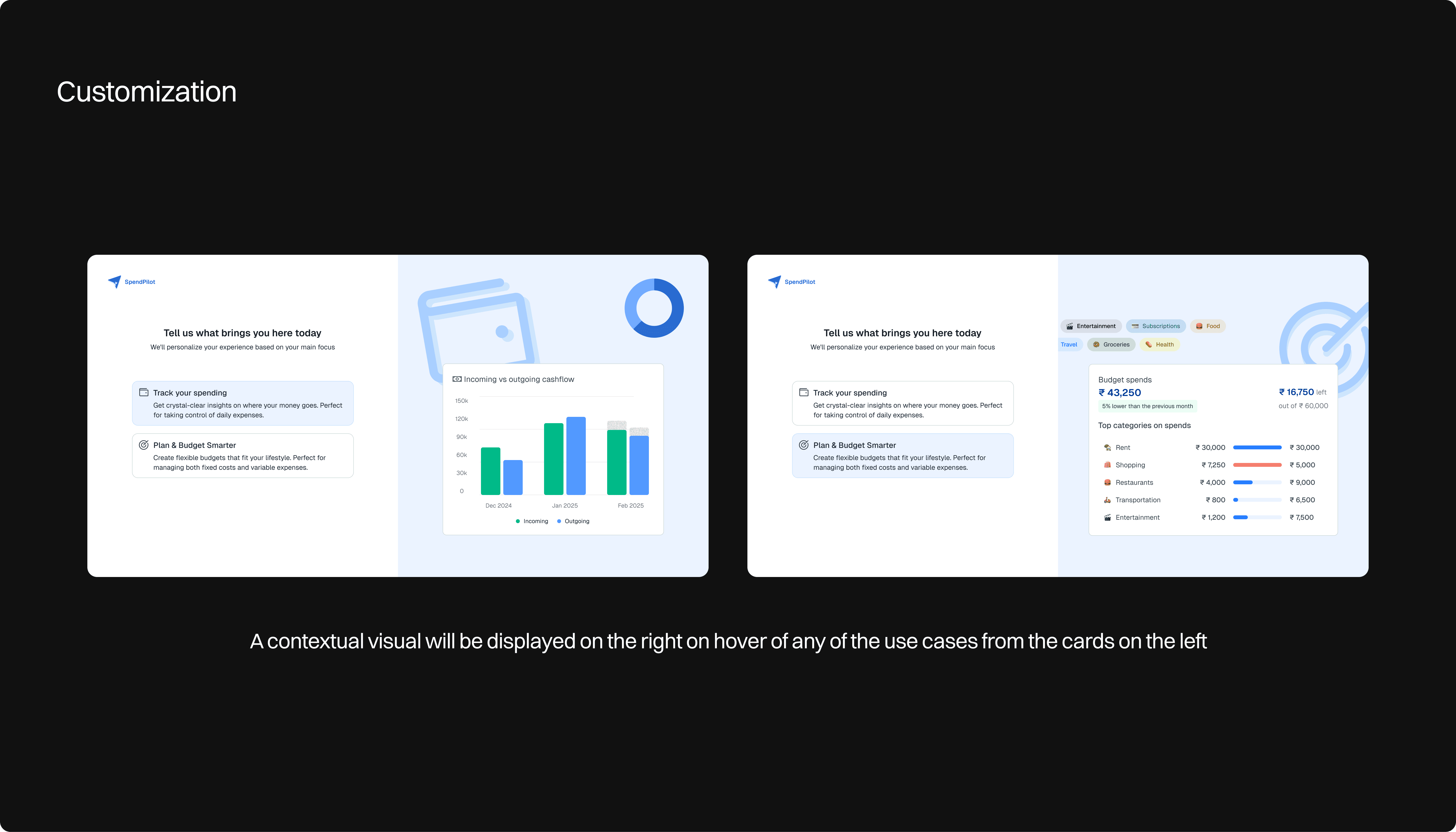

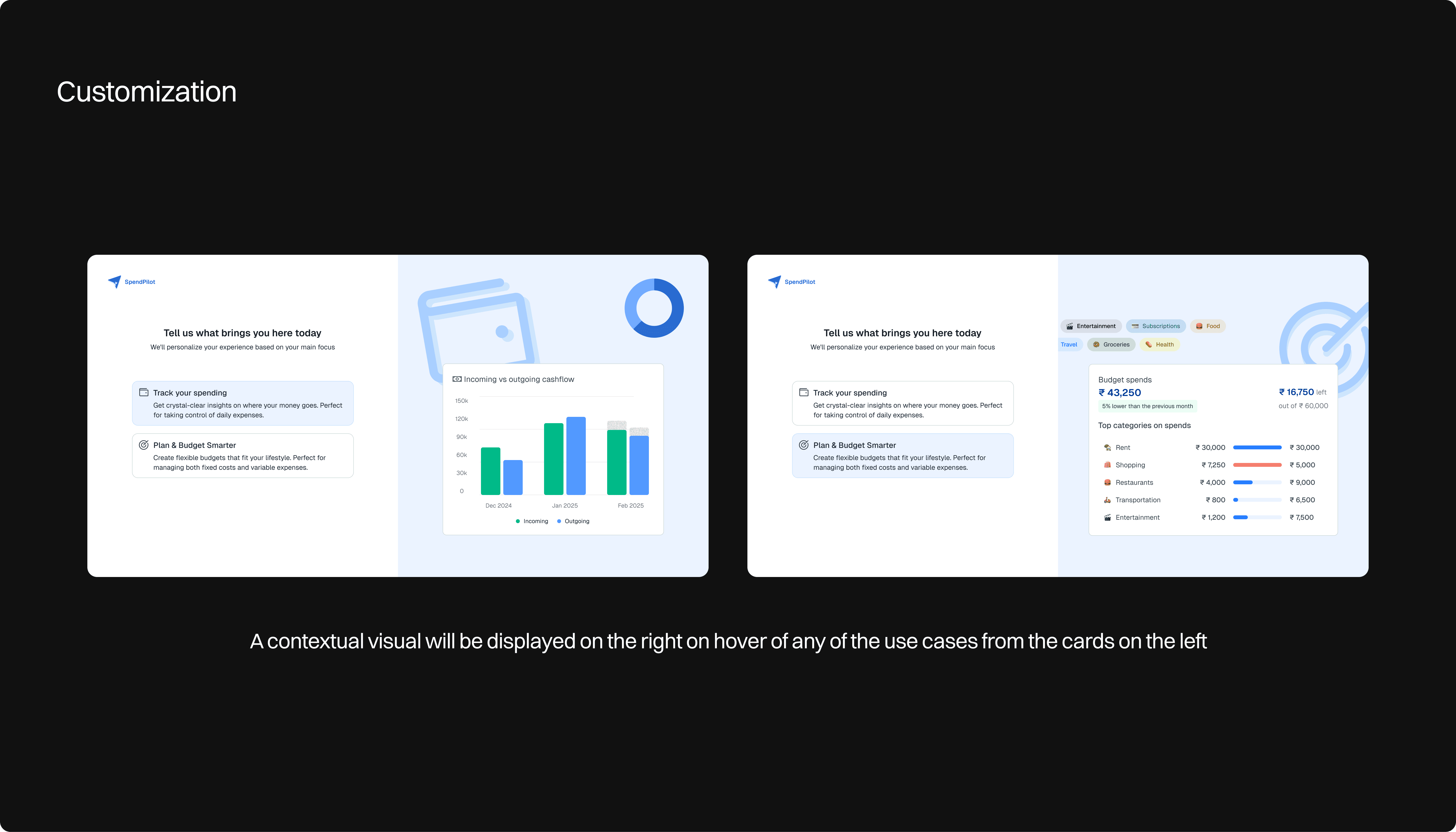

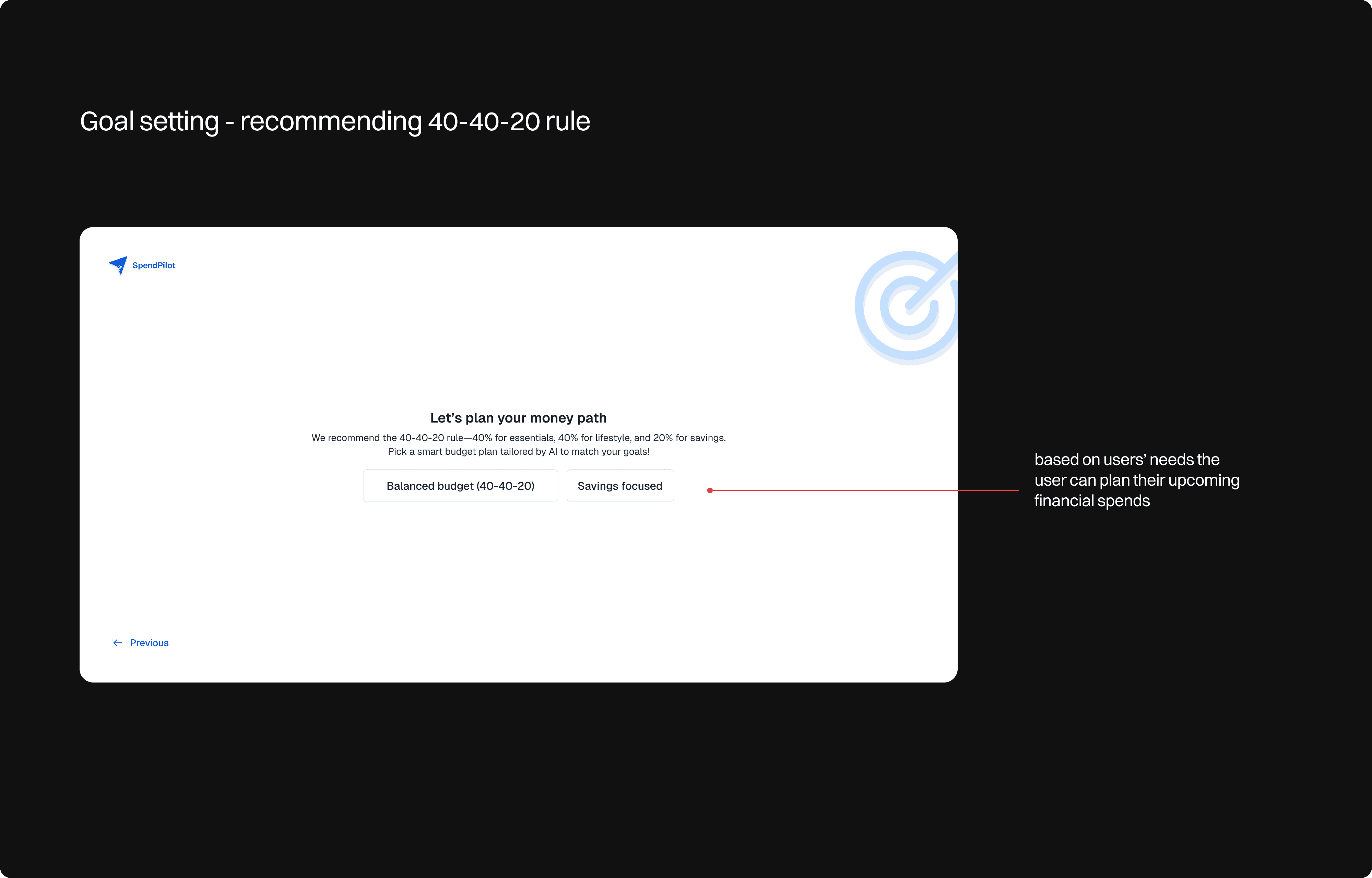

Personalization - I prompt users to enter their name and select their primary financial goals through an interactive card interface. Each card reveals a preview of relevant features on hover, giving users a glimpse of how the app will help them achieve their specific objectives. I designed this to set clear expectations and increase engagement from the start.

Personalization - I prompt users to enter their name and select their primary financial goals through an interactive card interface. Each card reveals a preview of relevant features on hover, giving users a glimpse of how the app will help them achieve their specific objectives. I designed this to set clear expectations and increase engagement from the start.

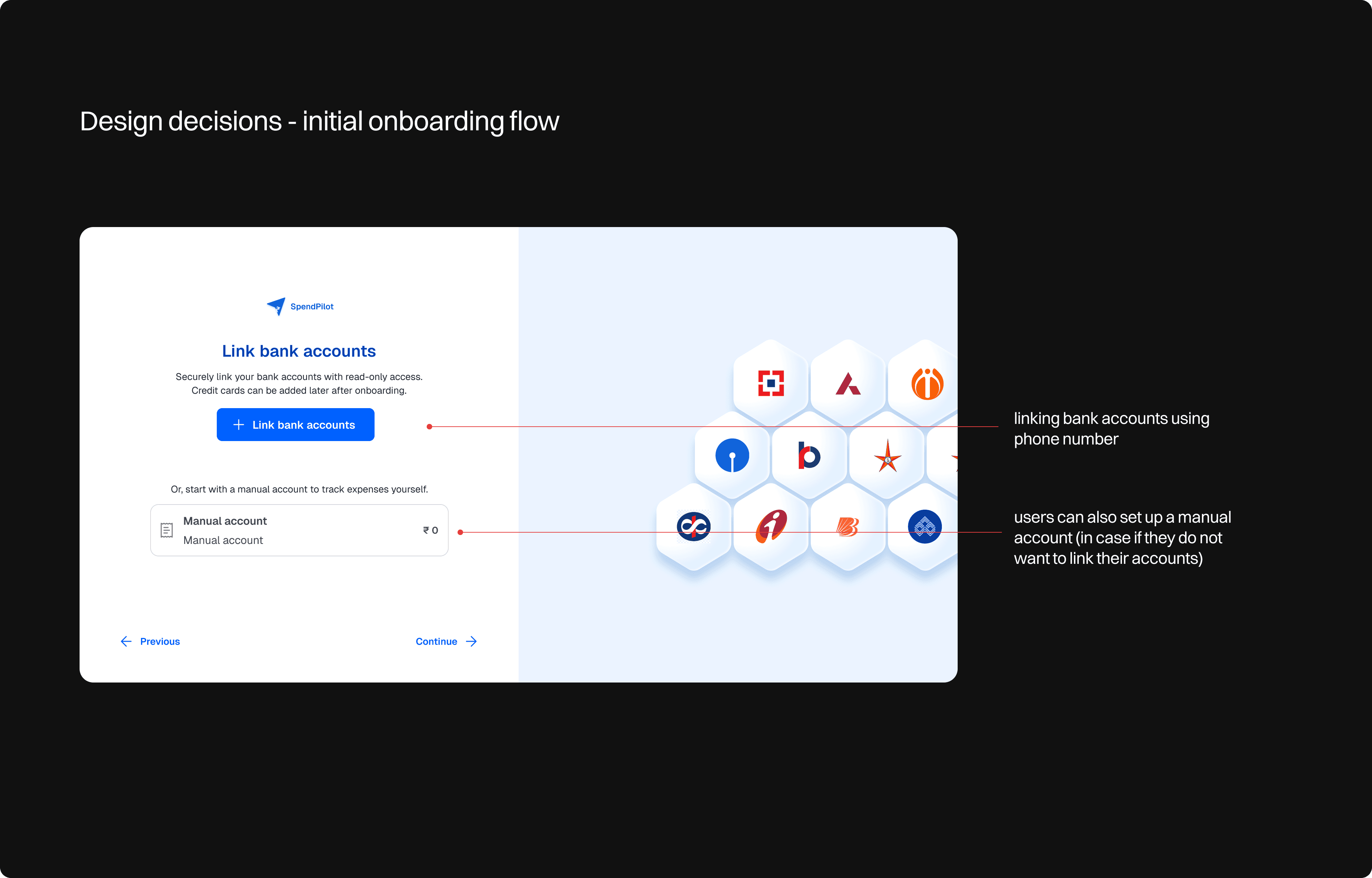

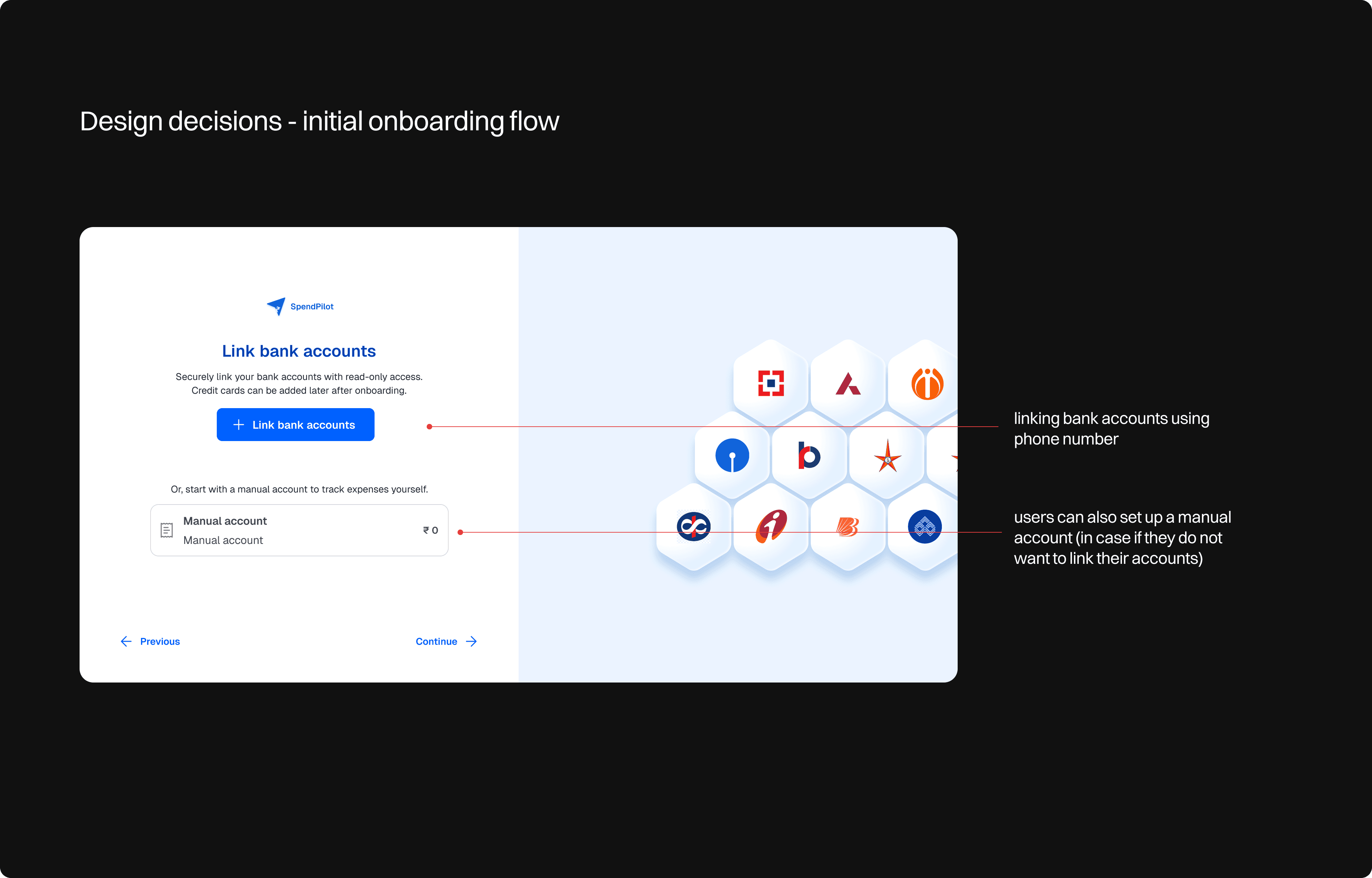

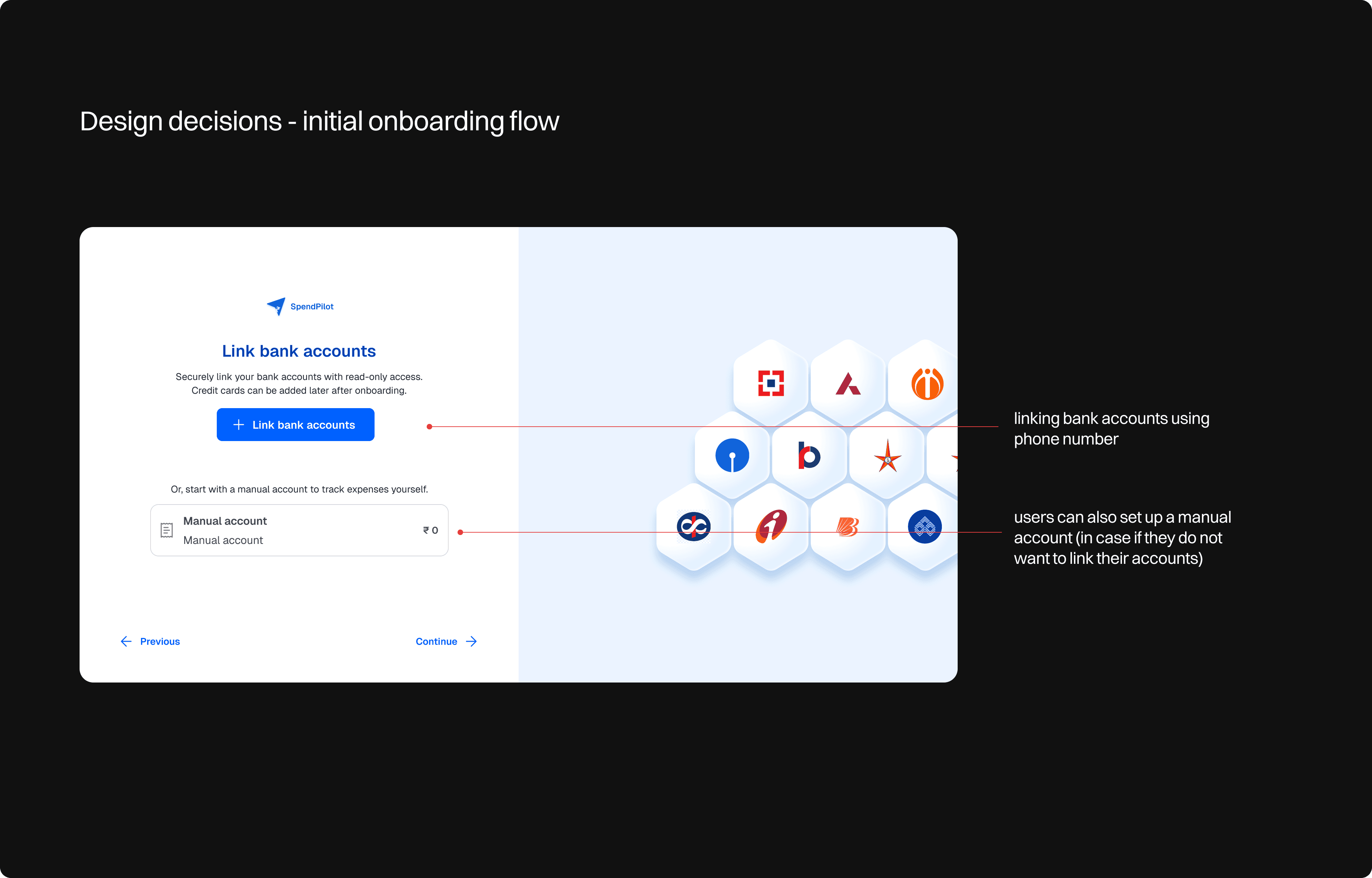

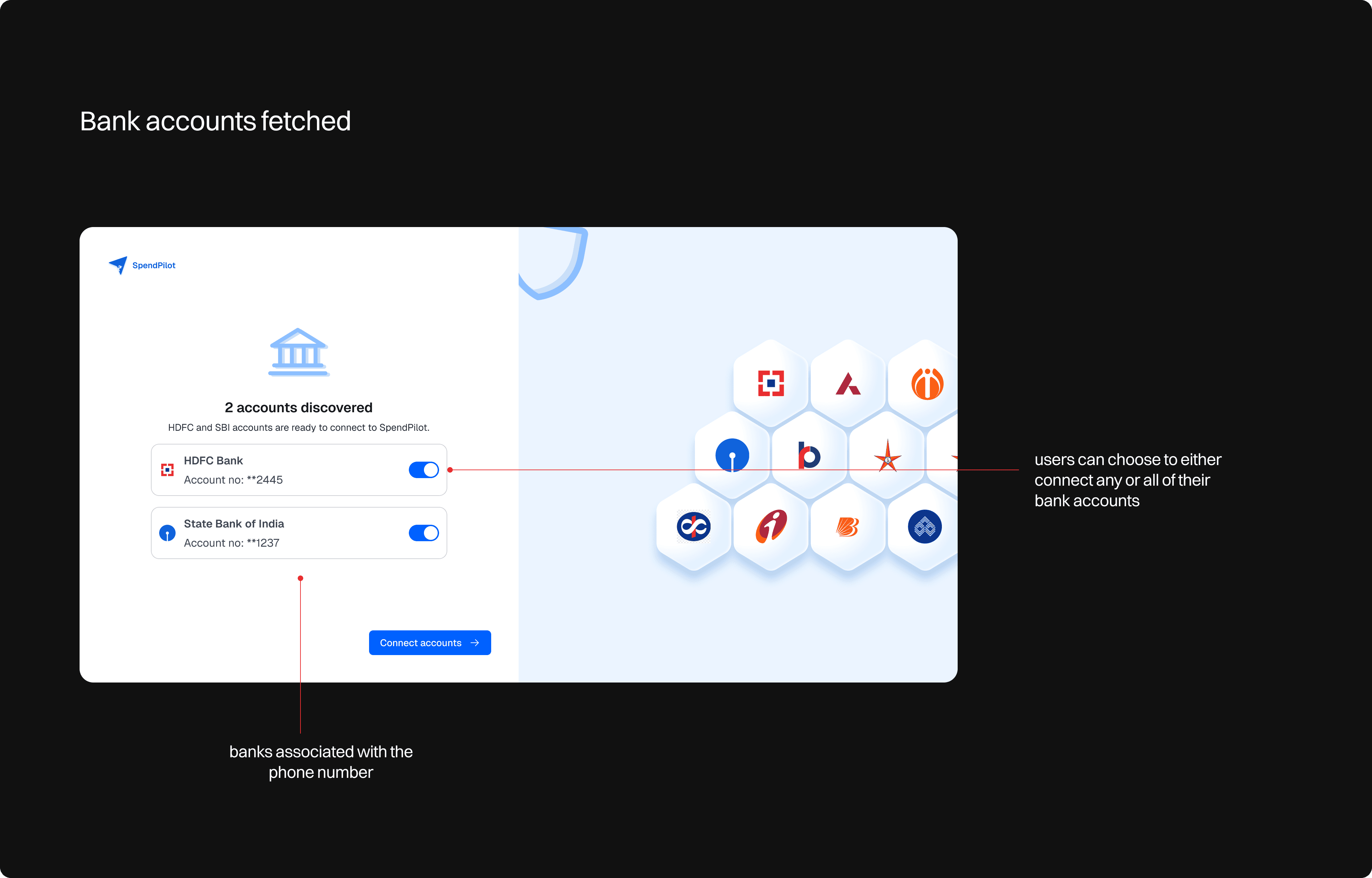

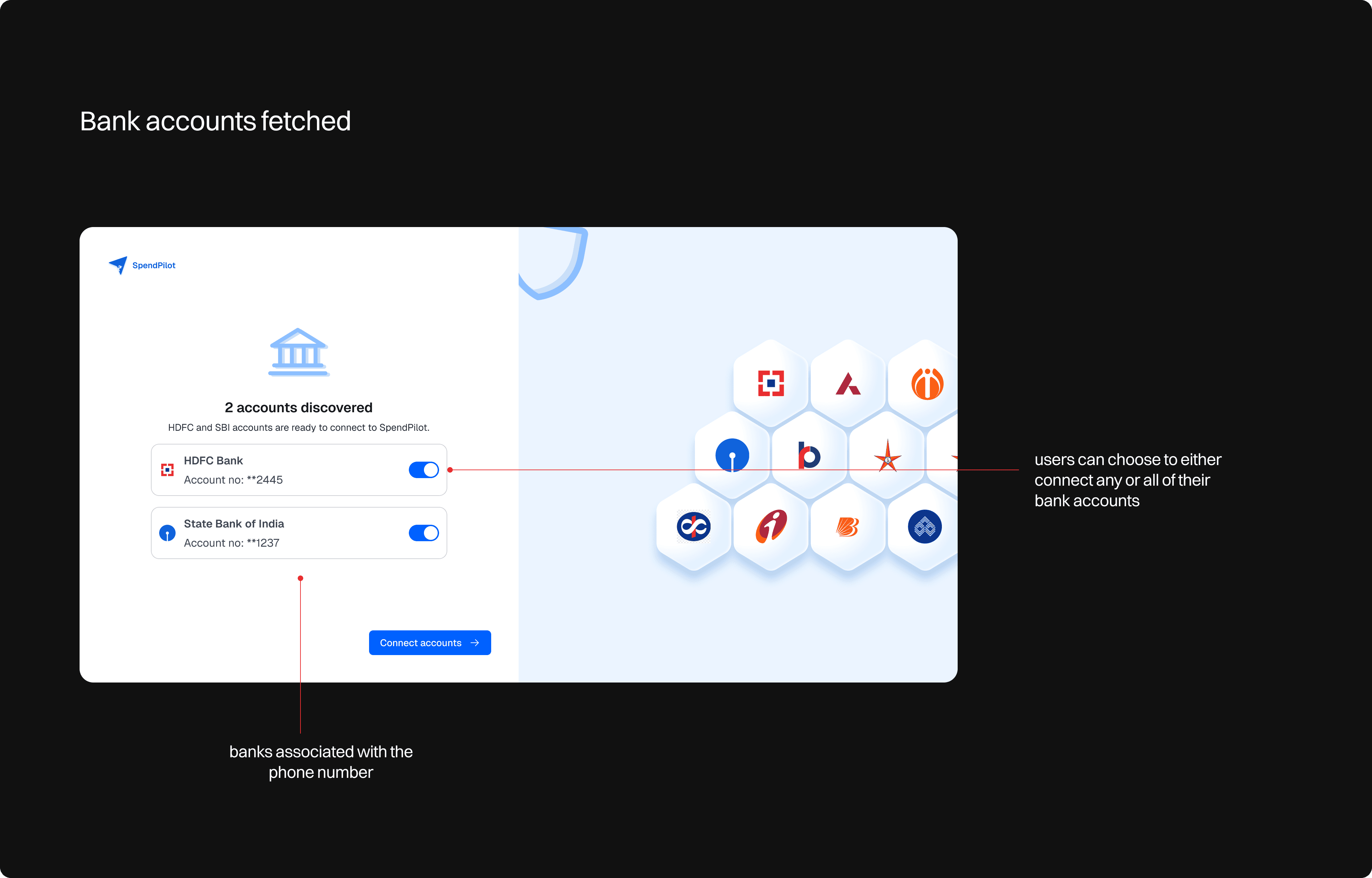

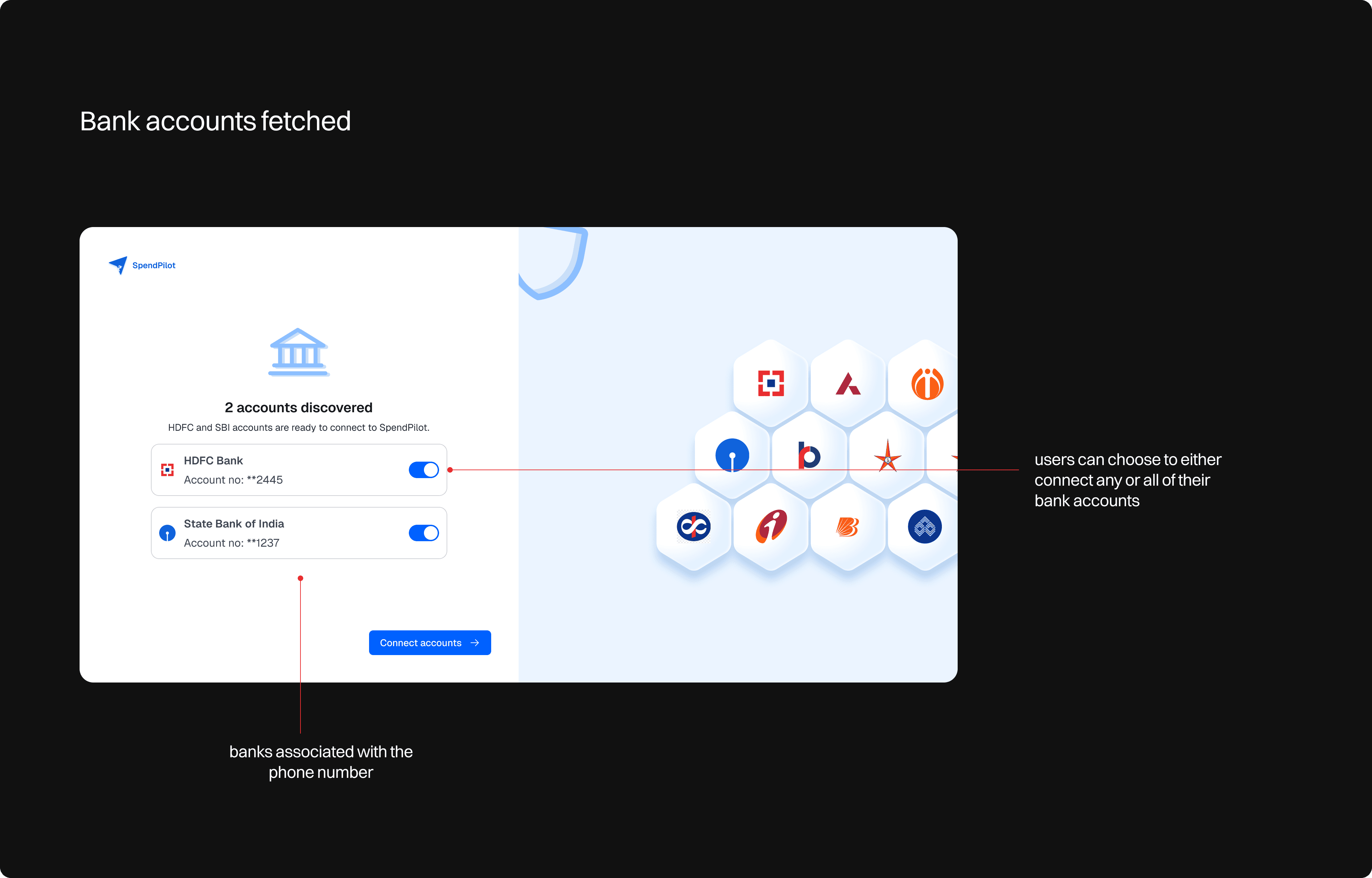

Seamless bank integration - I leveraged the AA framework's intelligent system to automatically identify all bank accounts associated with the user's mobile number. This eliminates the tedious process of manually selecting and linking accounts. Users simply verify their identity through OTP authentication. I've focused the initial phase on debit card synchronization to ensure a focused and reliable experience.

Seamless bank integration - I leveraged the AA framework's intelligent system to automatically identify all bank accounts associated with the user's mobile number. This eliminates the tedious process of manually selecting and linking accounts. Users simply verify their identity through OTP authentication. I've focused the initial phase on debit card synchronization to ensure a focused and reliable experience.

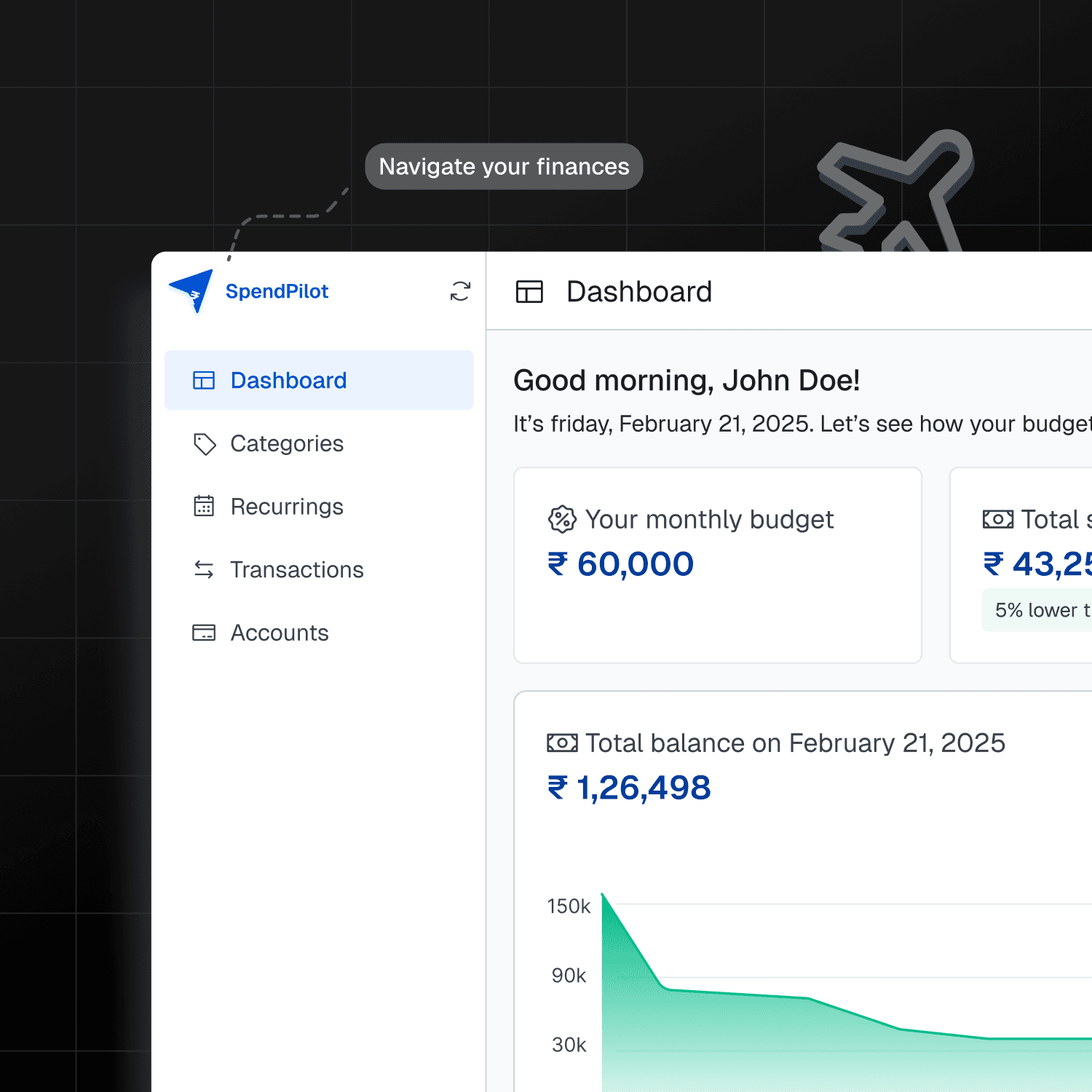

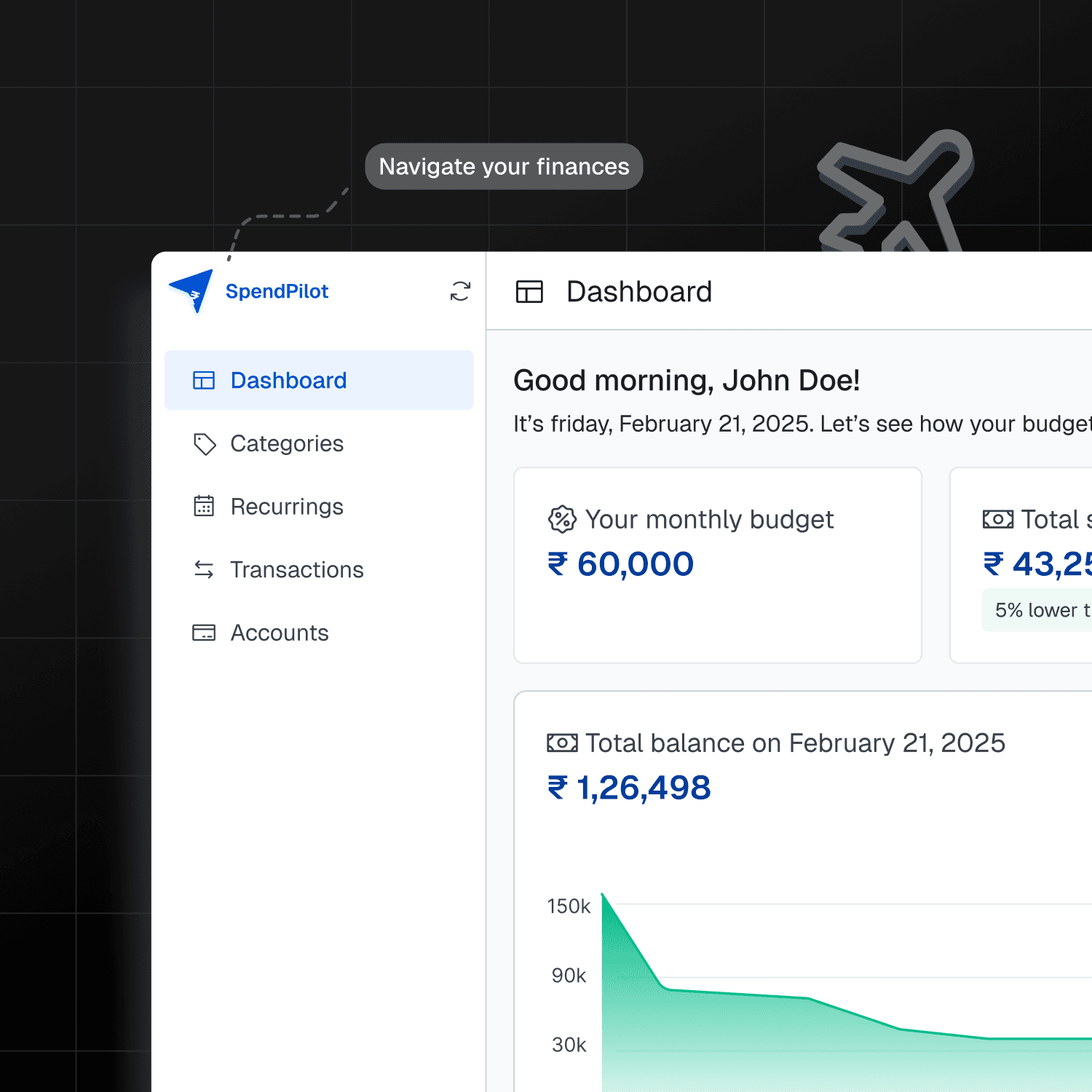

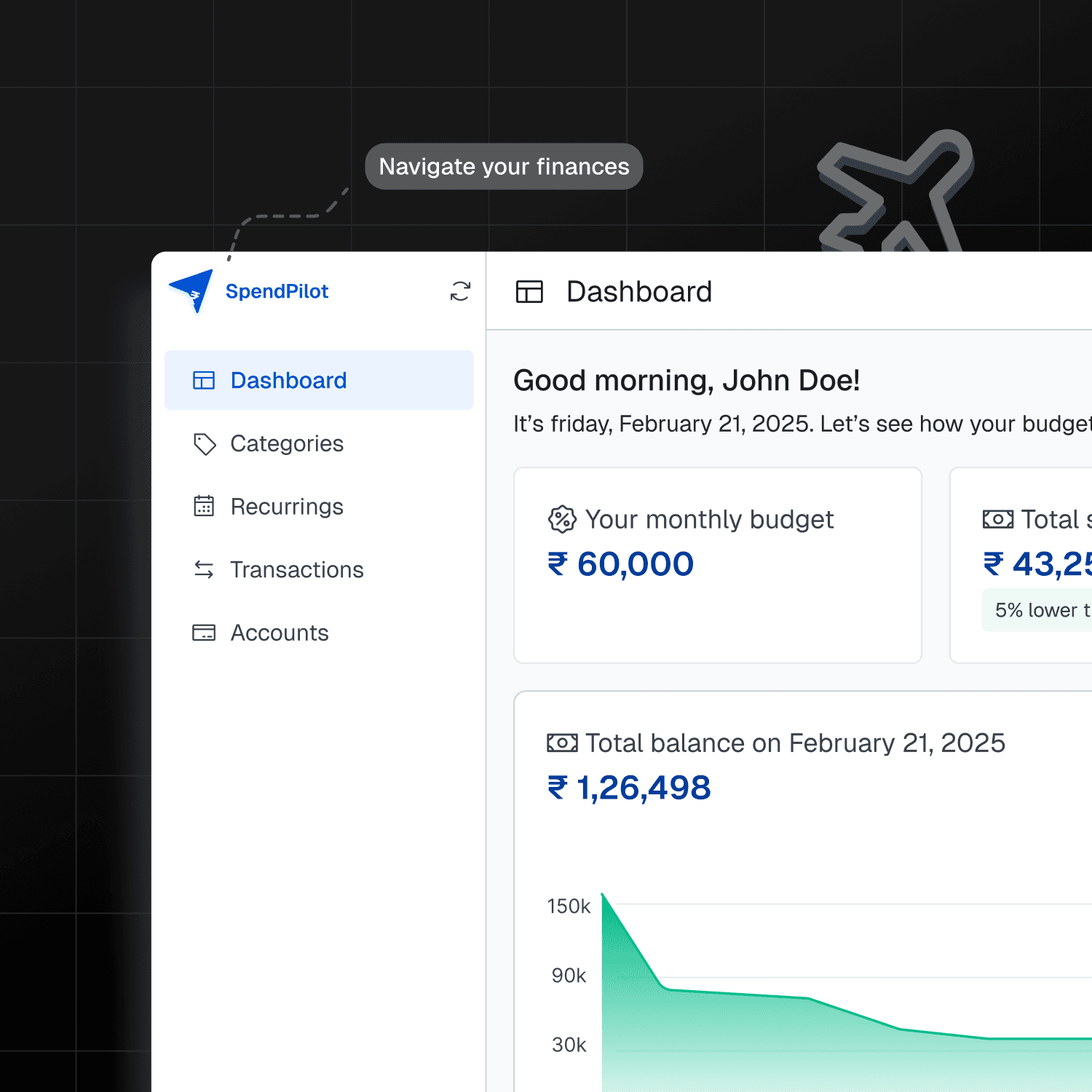

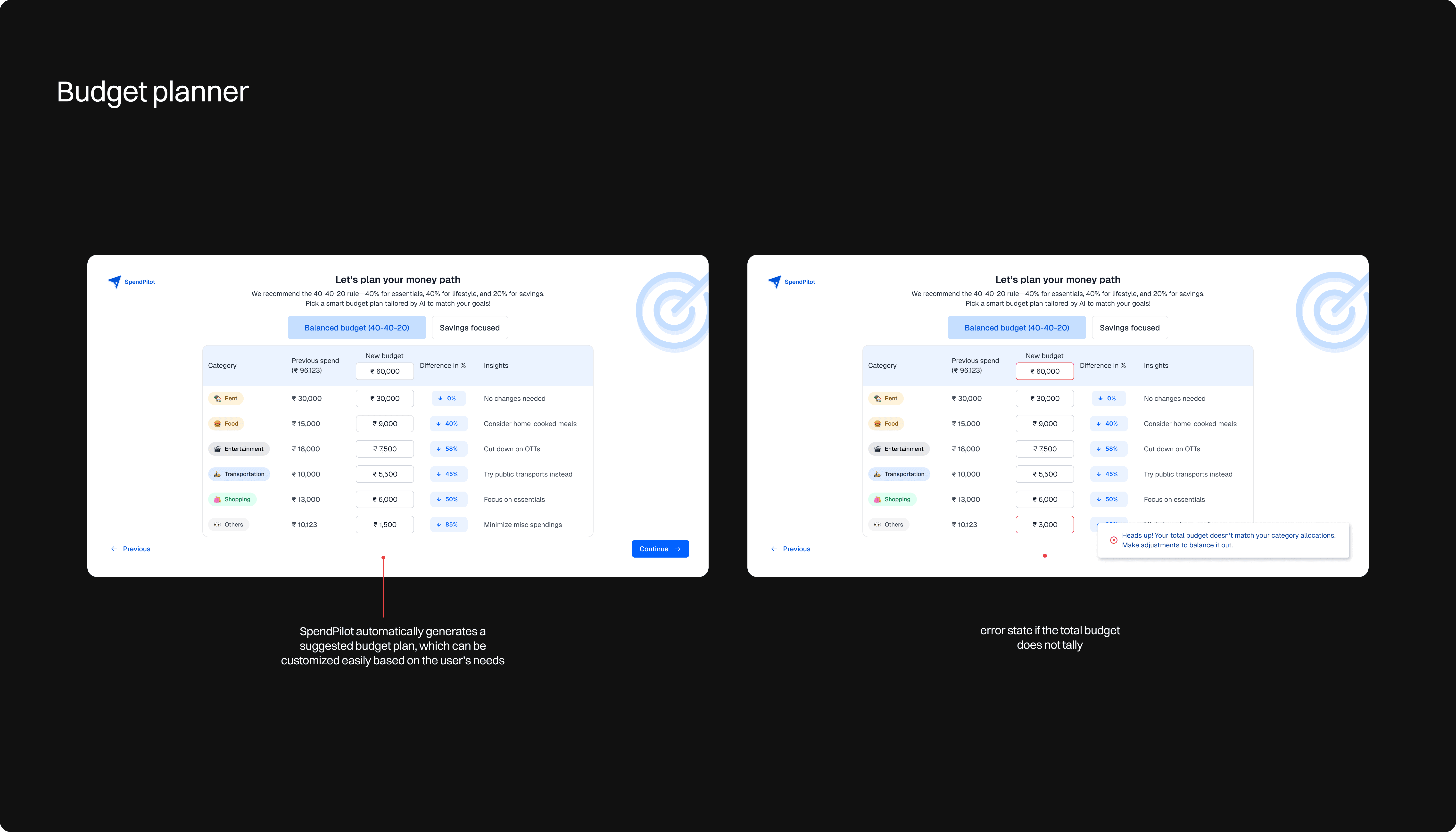

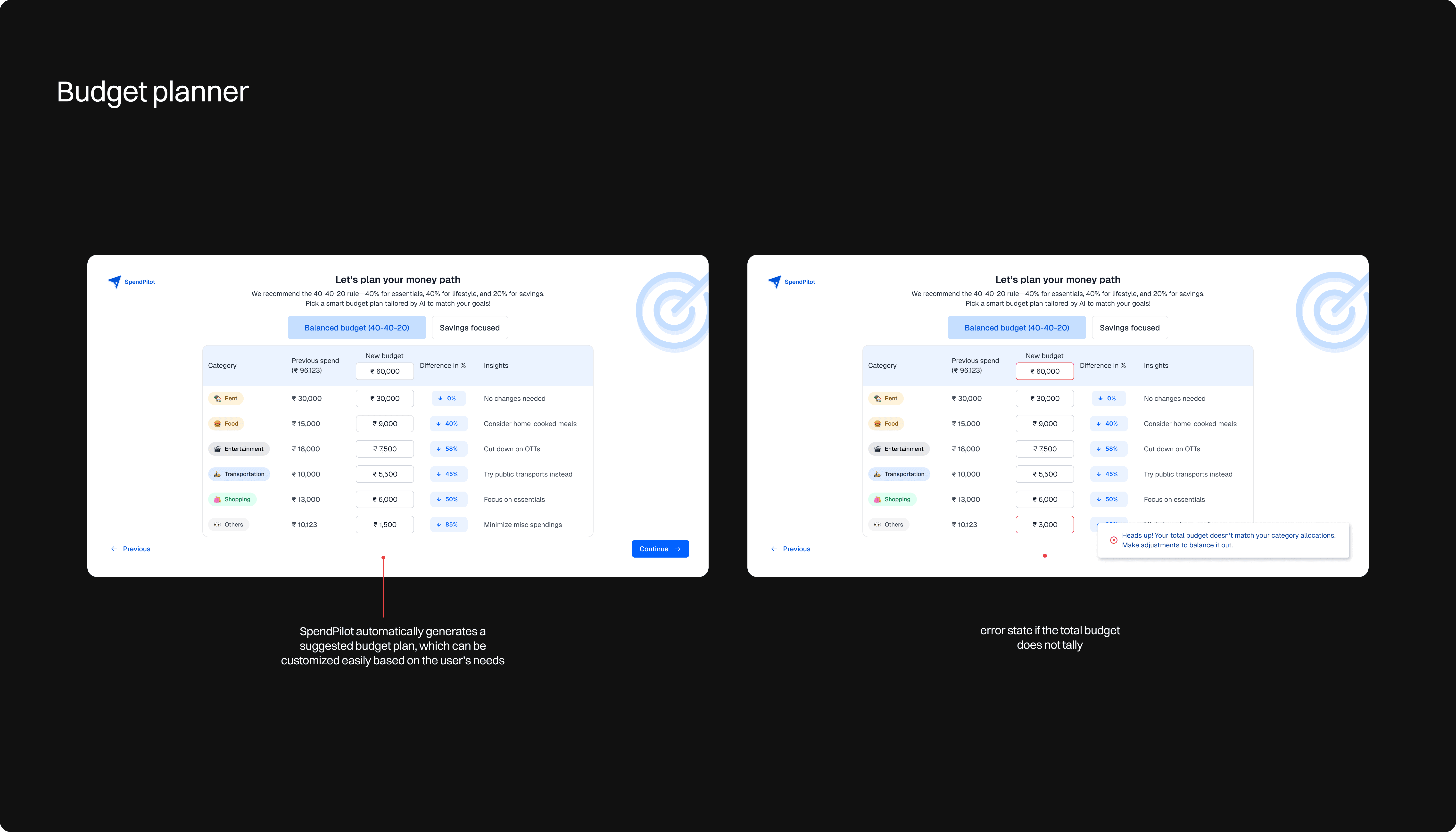

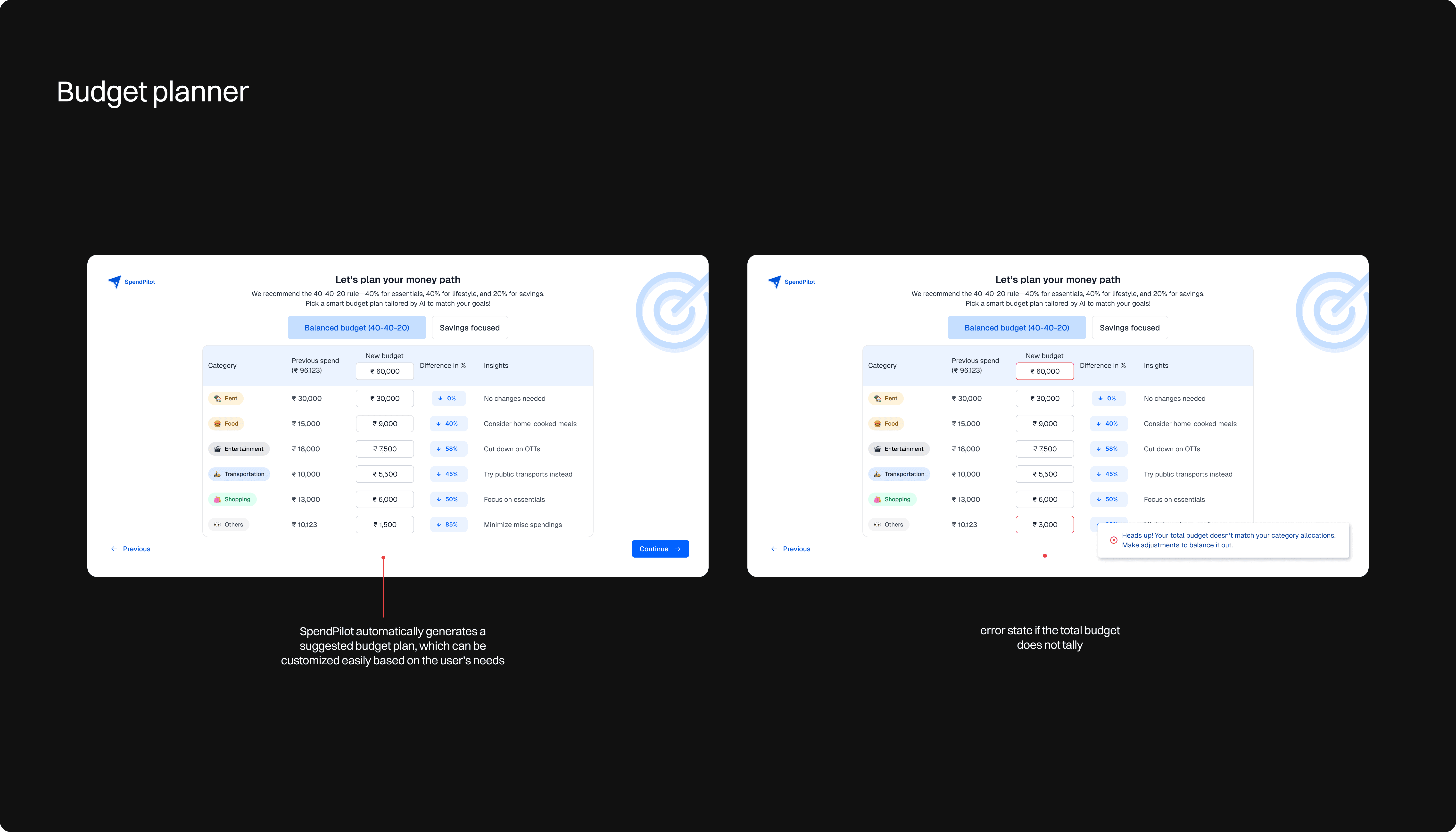

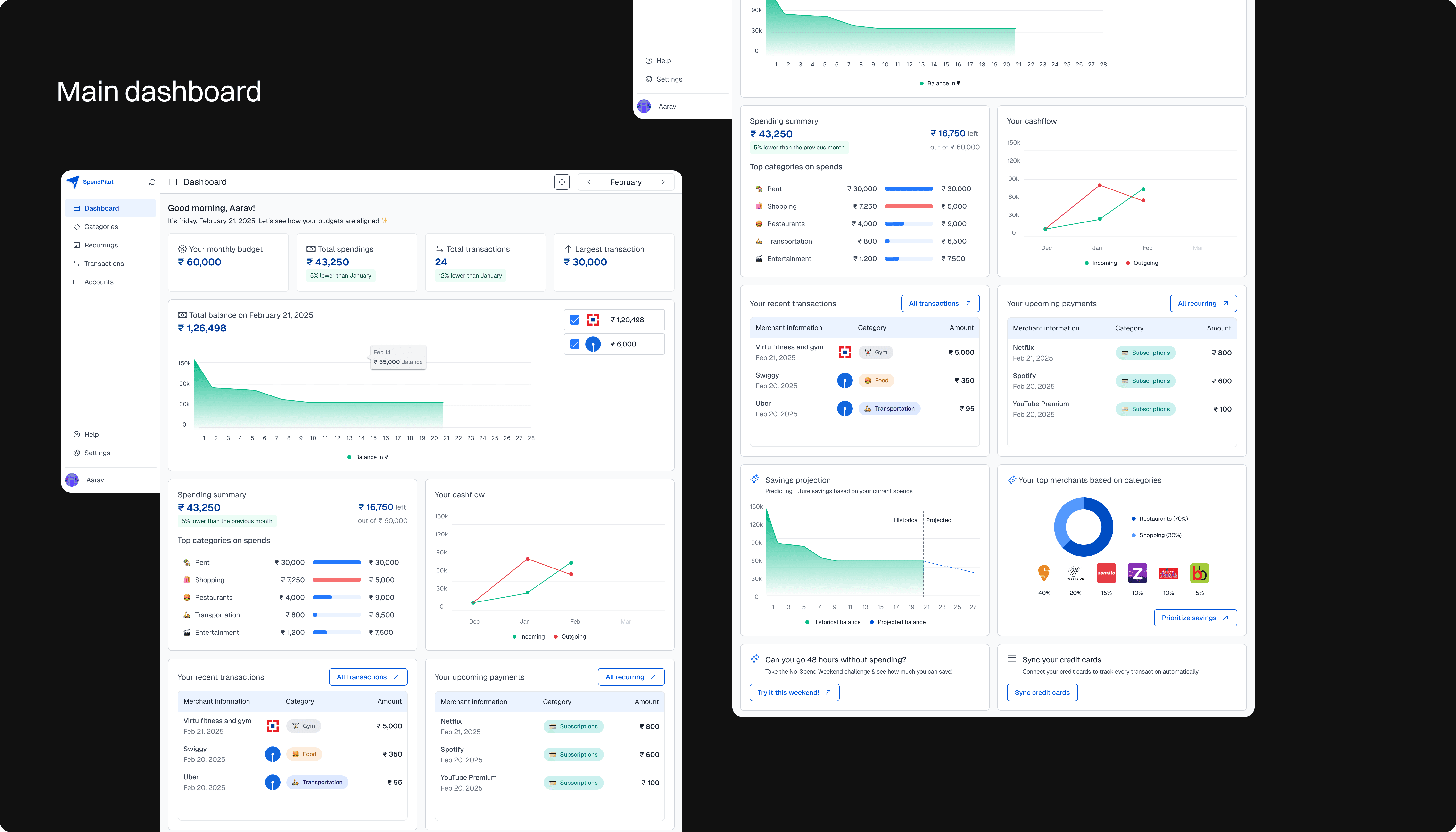

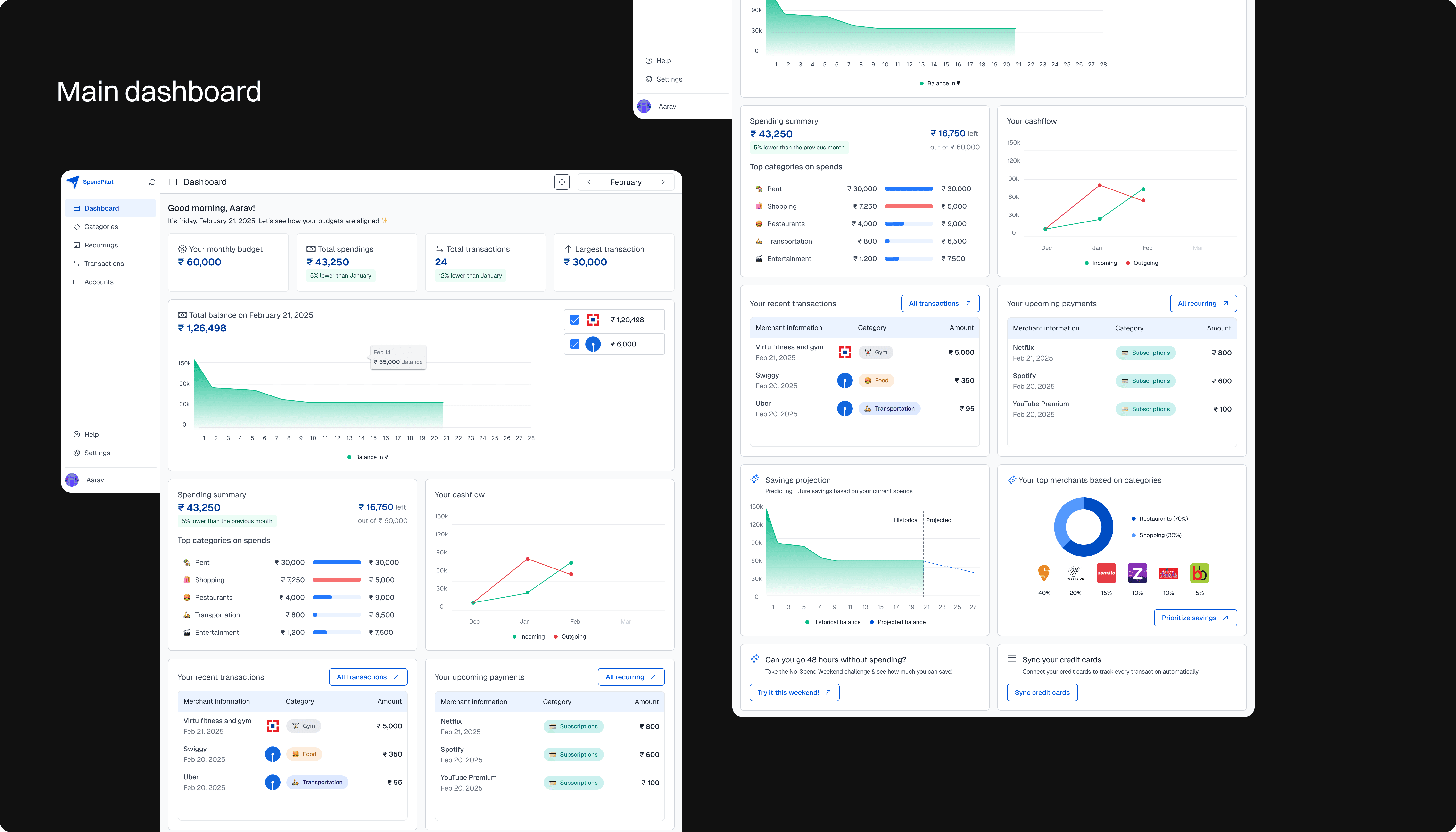

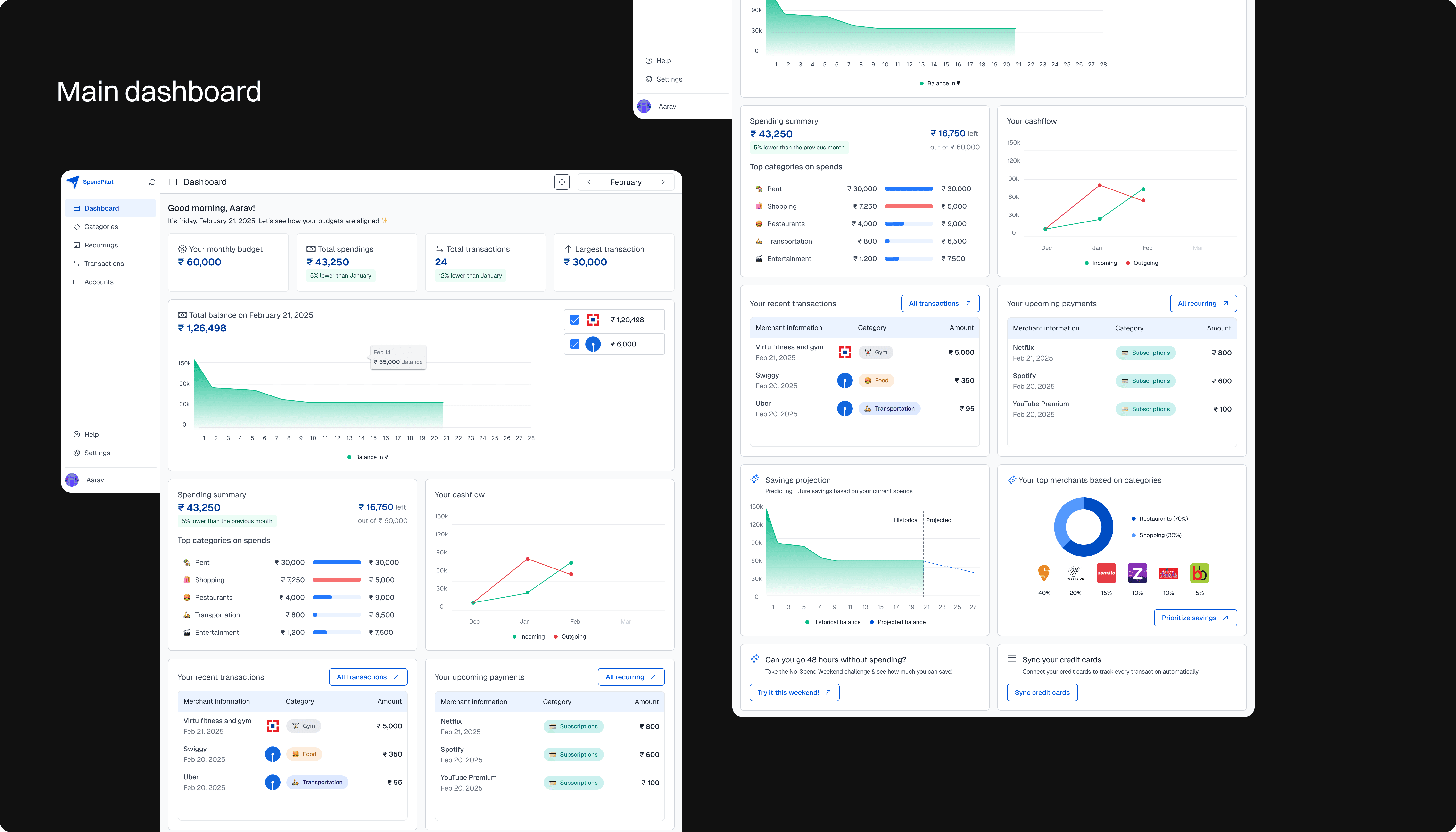

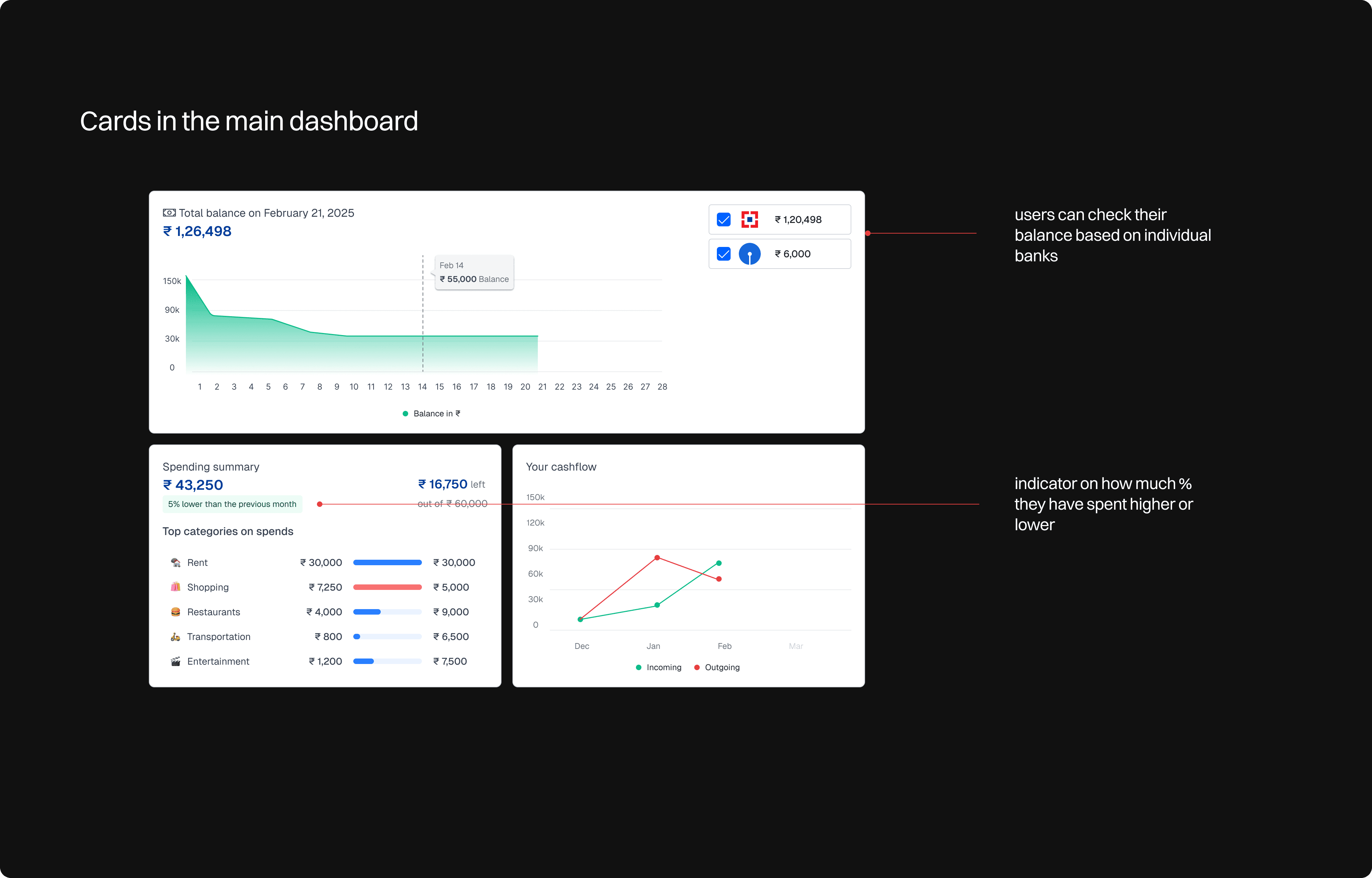

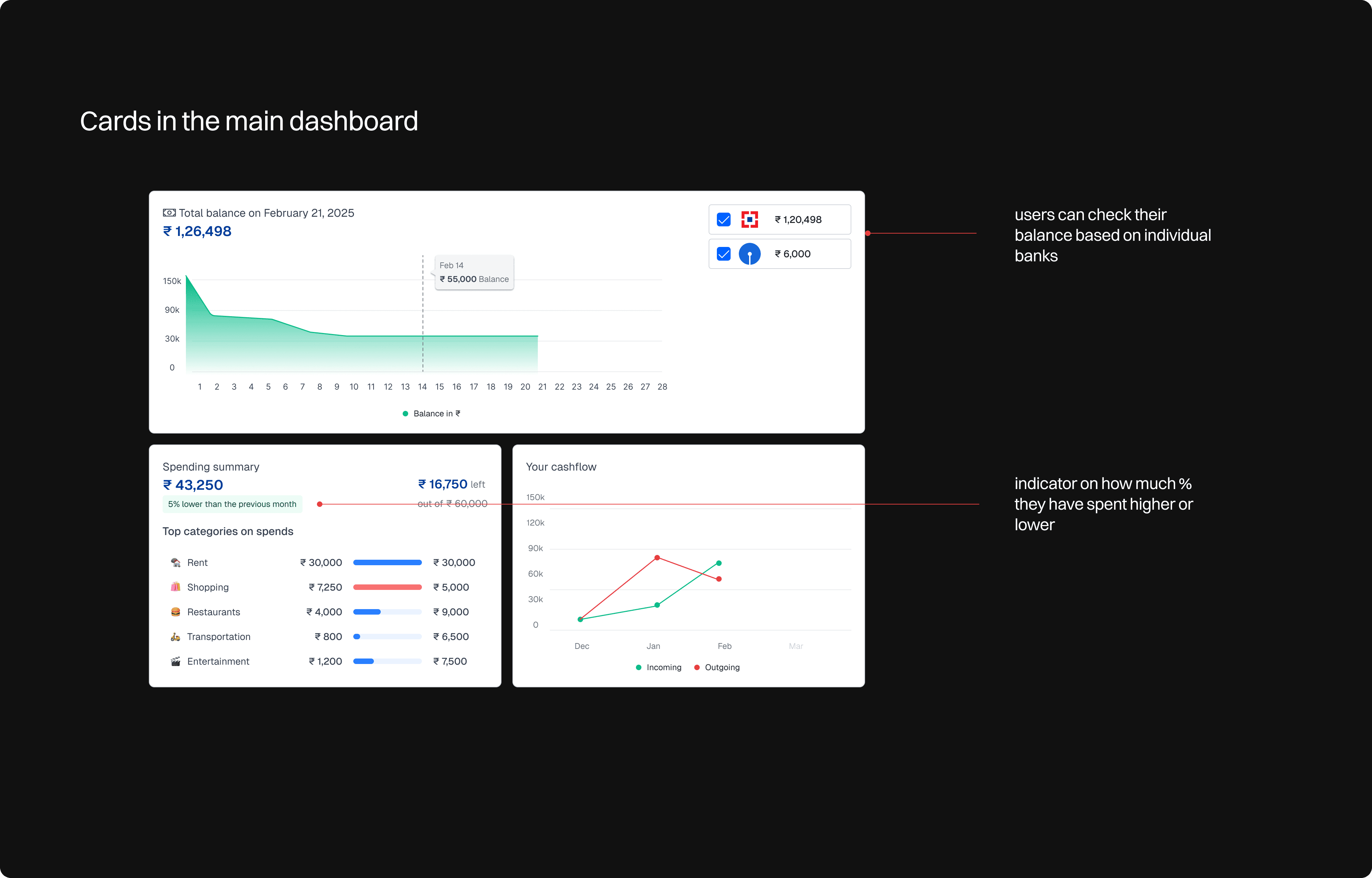

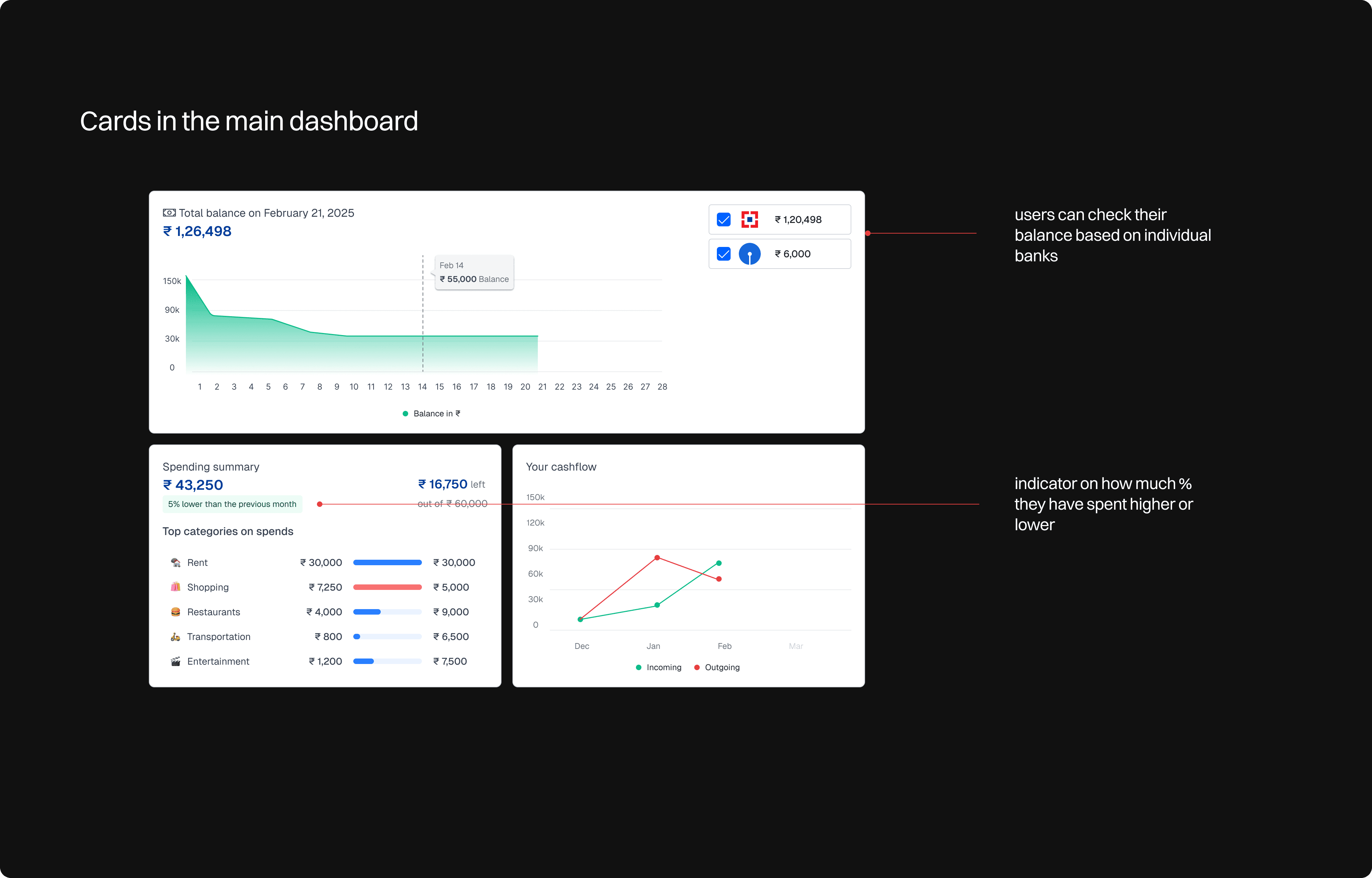

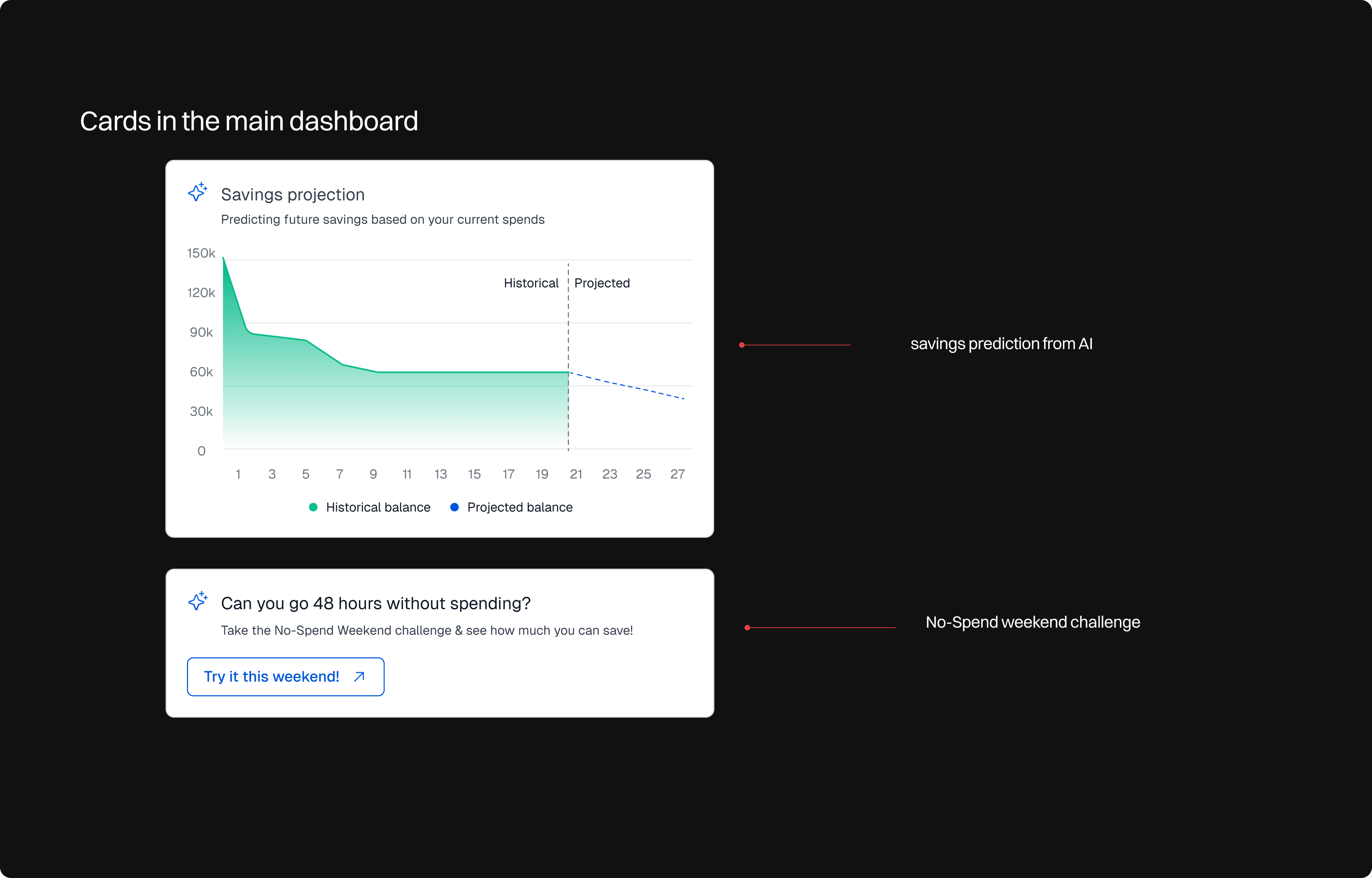

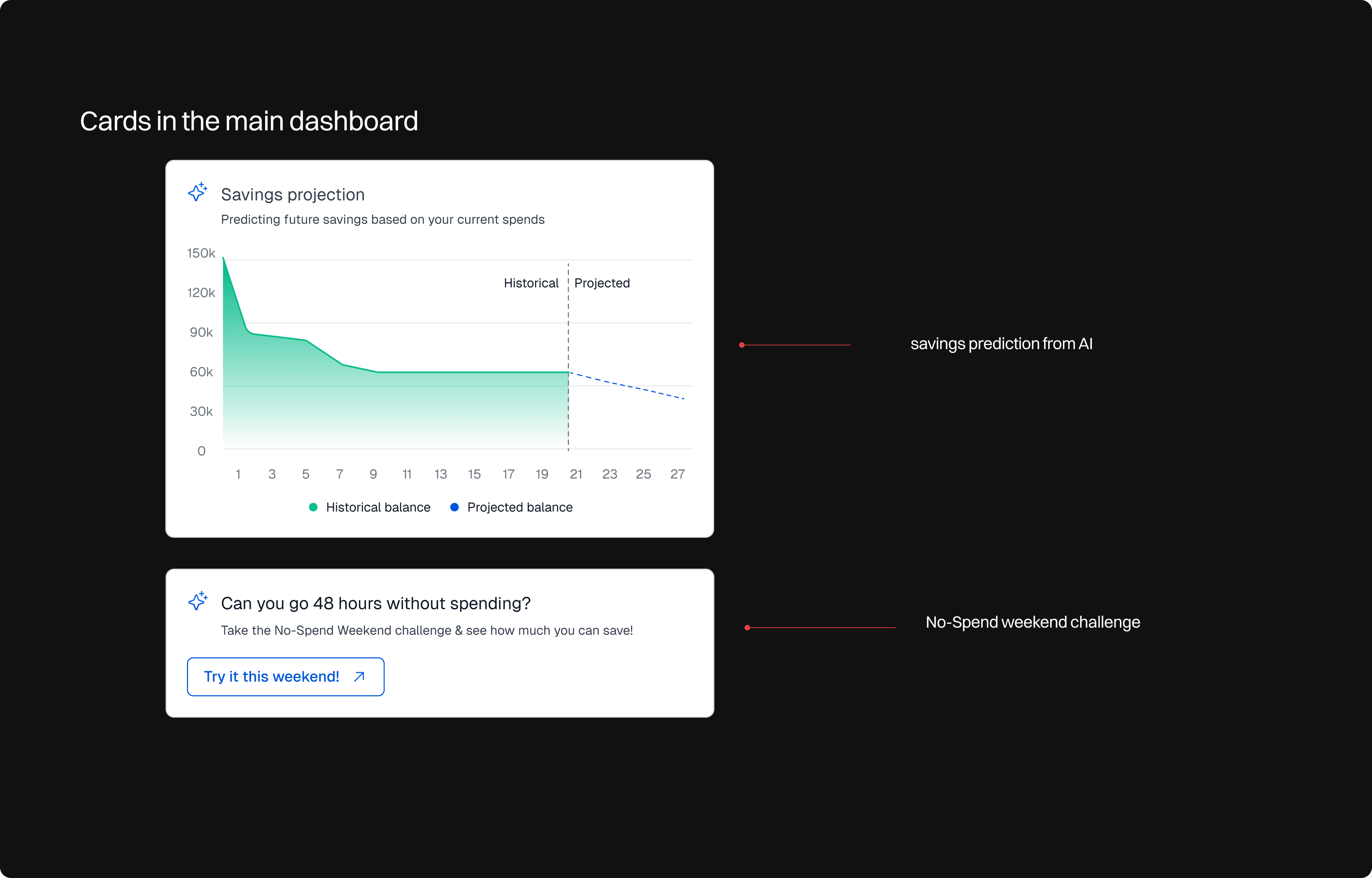

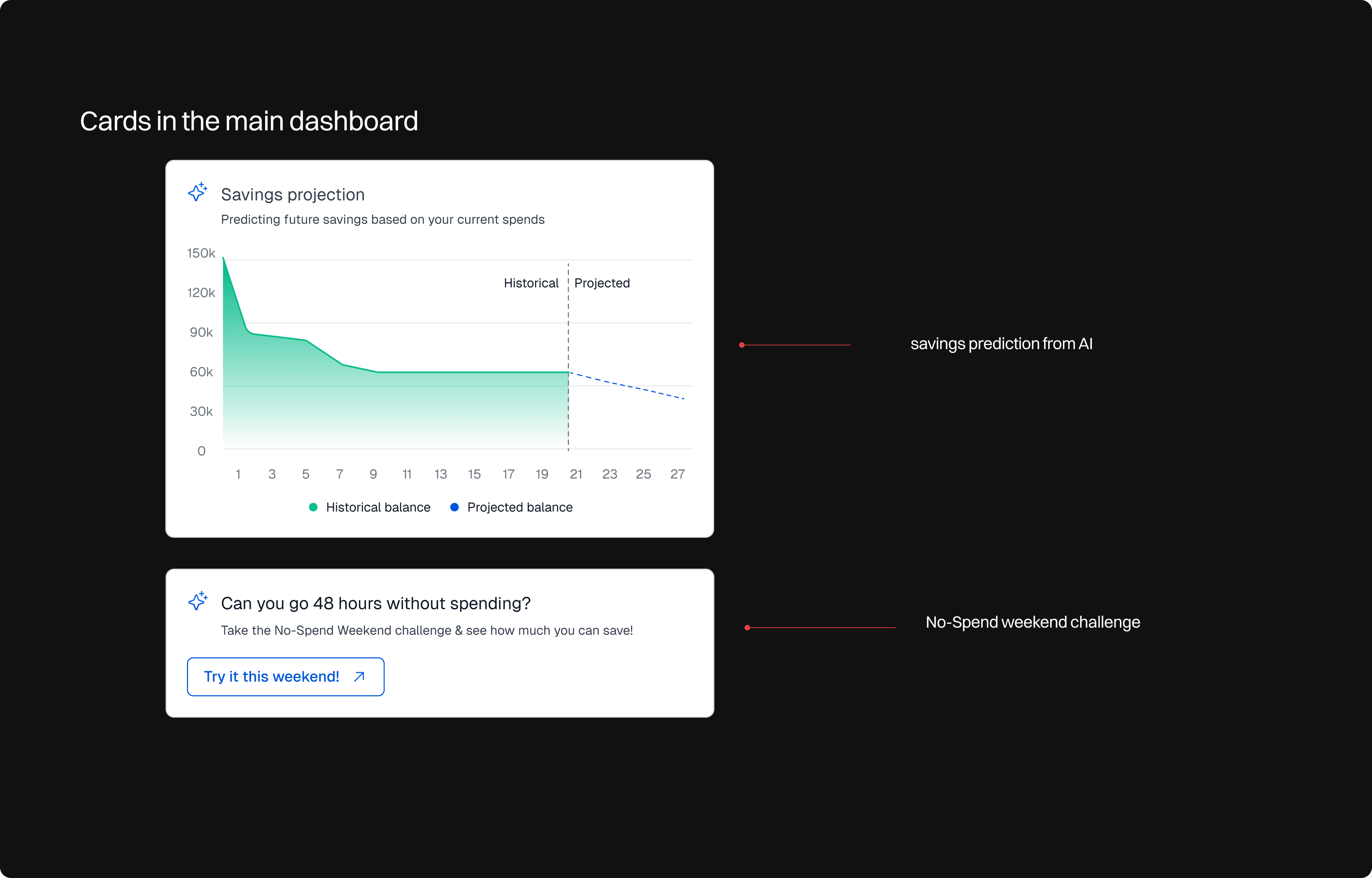

Final Visual Design - Dashboard

Final Visual Design - Dashboard

The dashboard offers instant financial insights through intuitive charts and visualizations. Users get a clear snapshot of their spending patterns and cash flow trends immediately after logging in.

The dashboard offers instant financial insights through intuitive charts and visualizations. Users get a clear snapshot of their spending patterns and cash flow trends immediately after logging in.

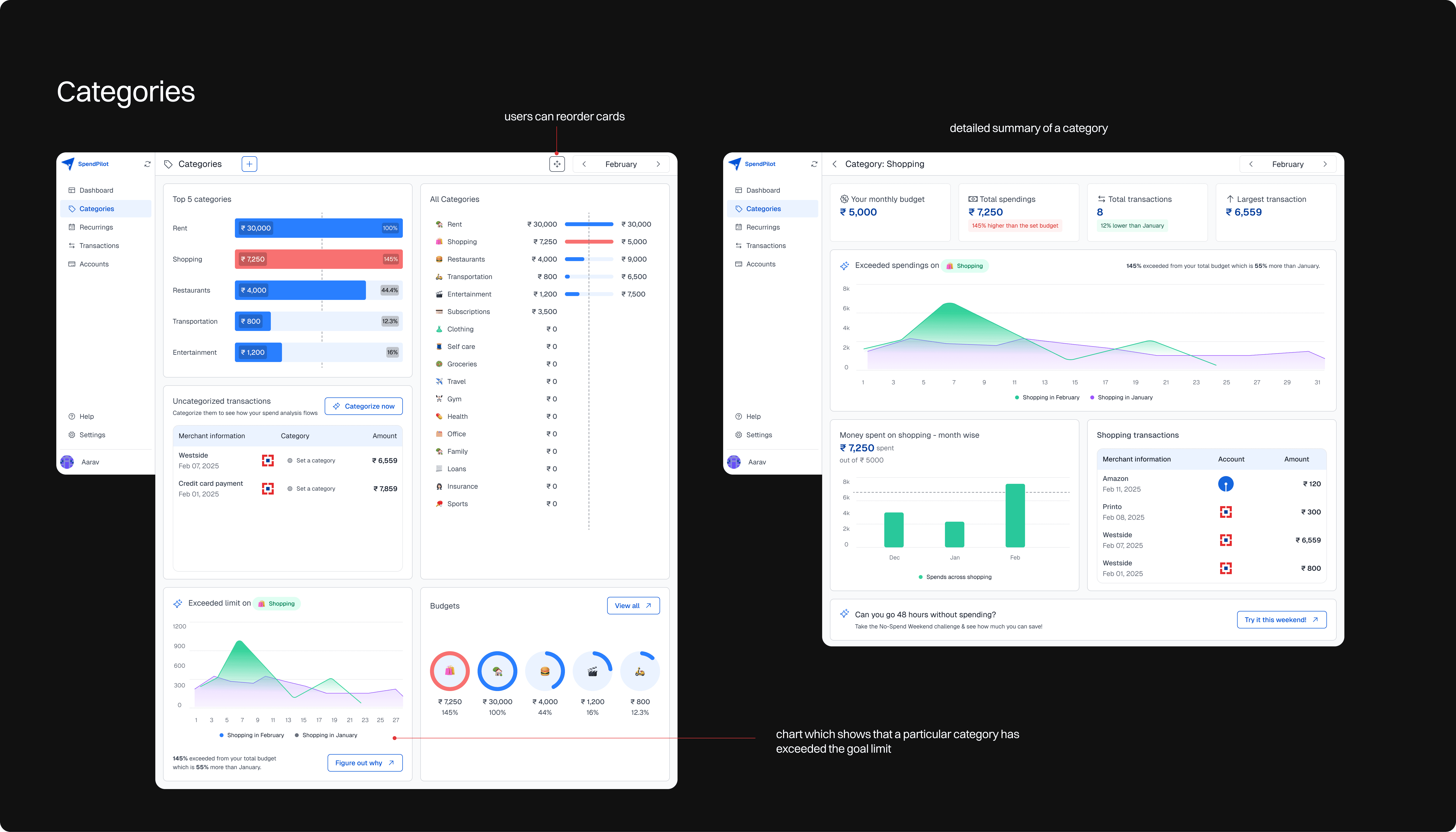

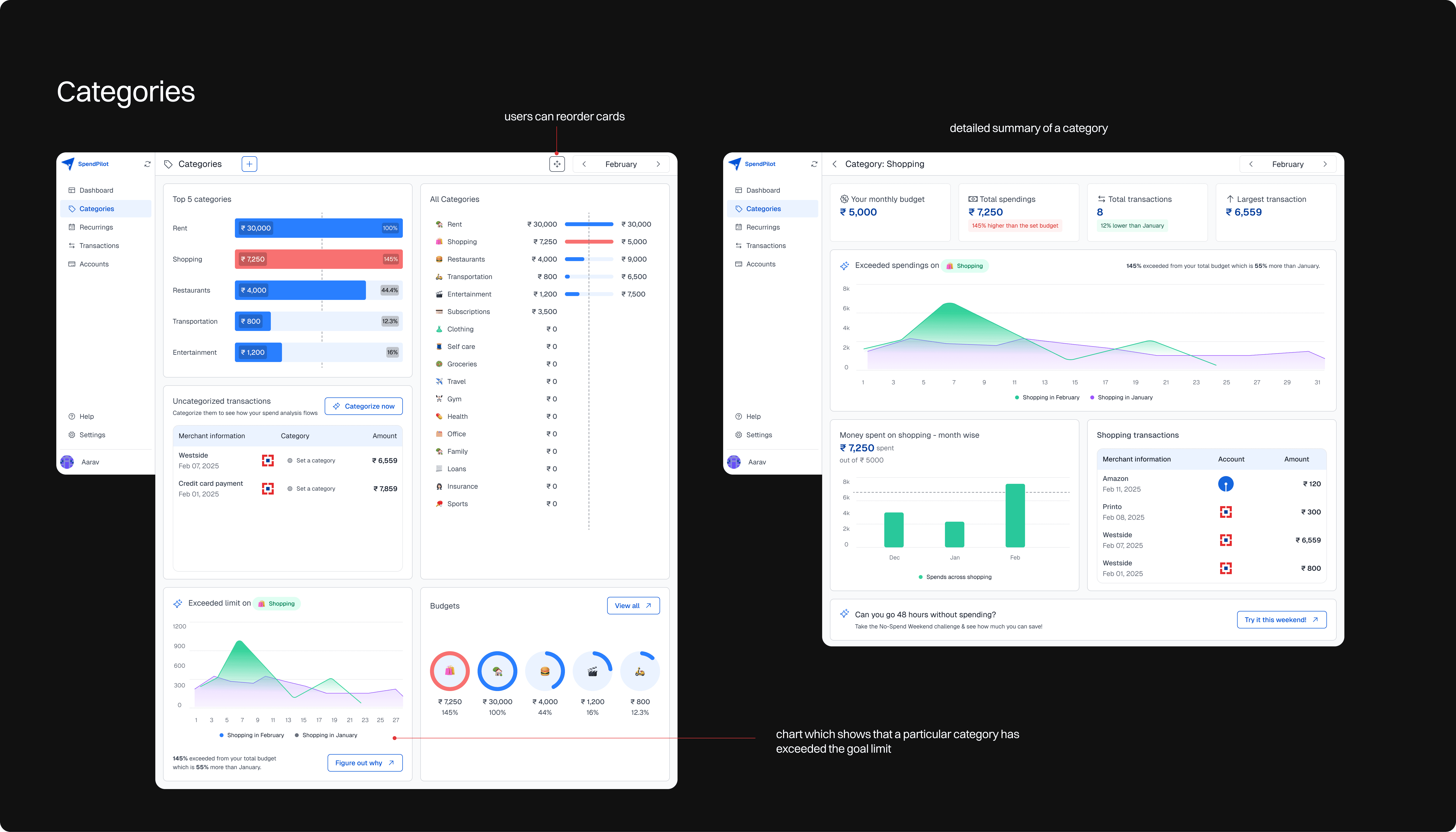

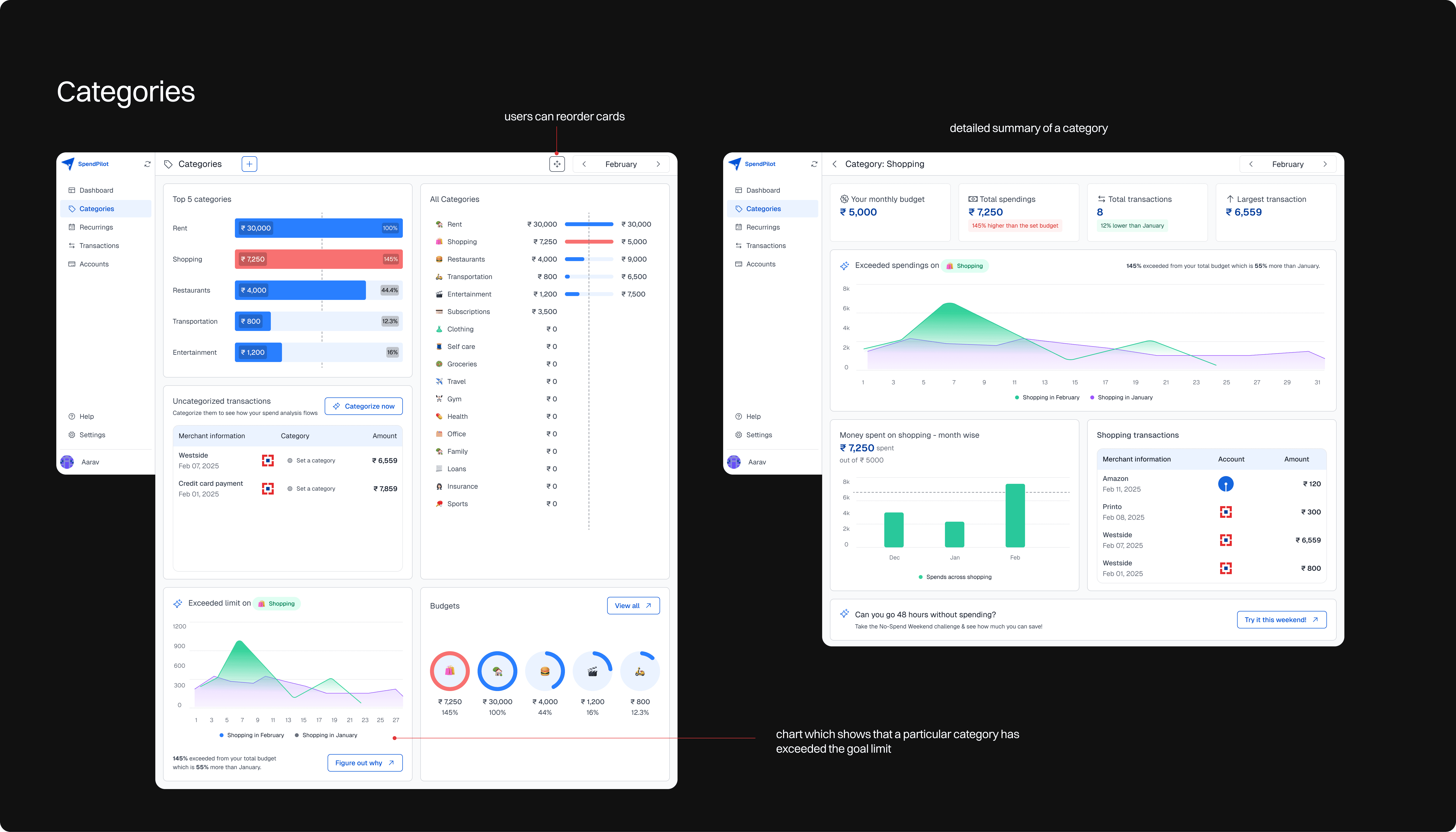

Final Visual Design - Categories

Final Visual Design - Categories

A dynamic budget tracking hub where users can monitor their spending across categories. I've included an innovative "No-Spend Weekend" challenge feature, letting users test their spending discipline while making budgeting more engaging. Users can quickly identify overspending and adjust their budgets in real-time.

A dynamic budget tracking hub where users can monitor their spending across categories. I've included an innovative "No-Spend Weekend" challenge feature, letting users test their spending discipline while making budgeting more engaging. Users can quickly identify overspending and adjust their budgets in real-time.

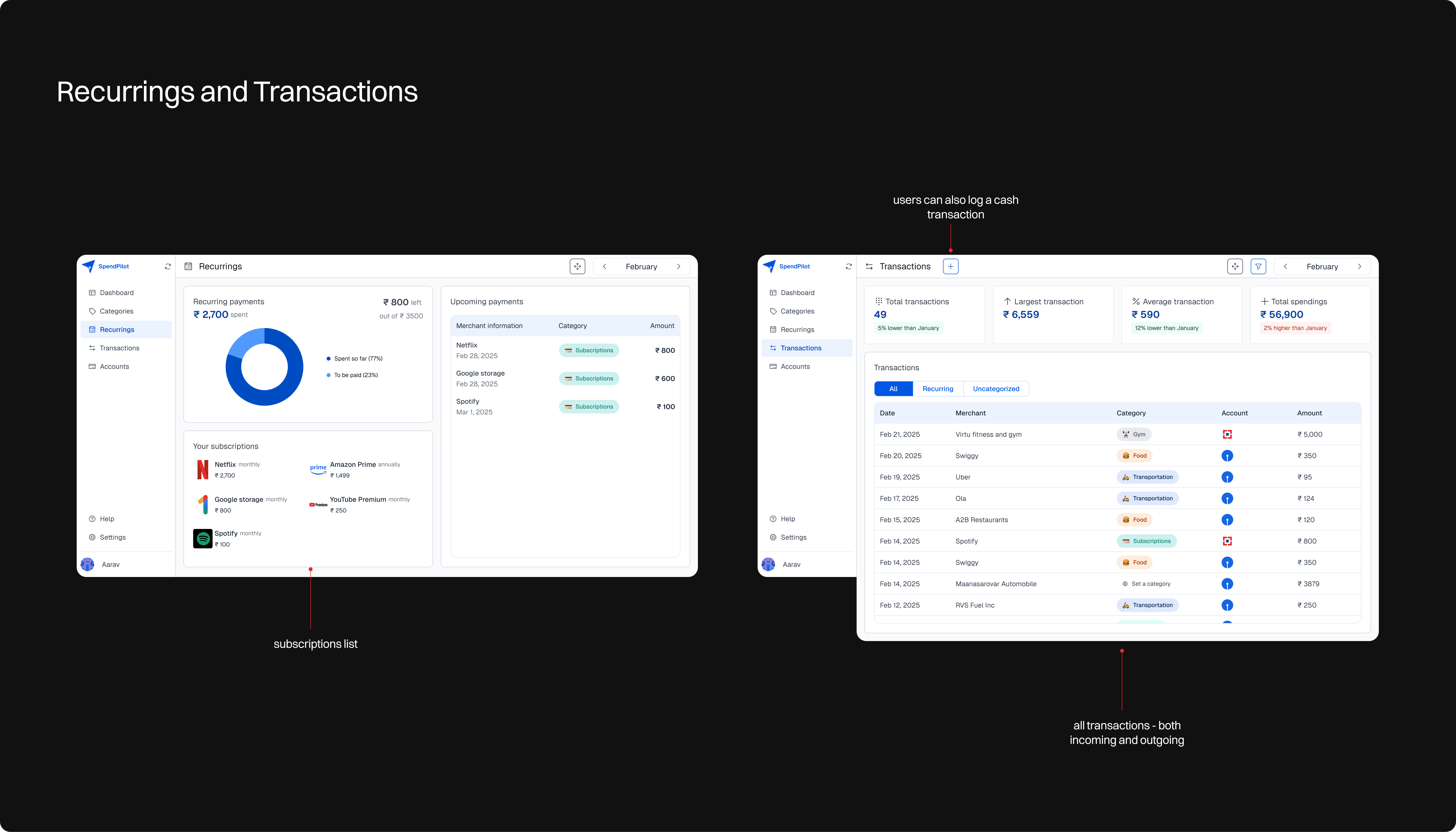

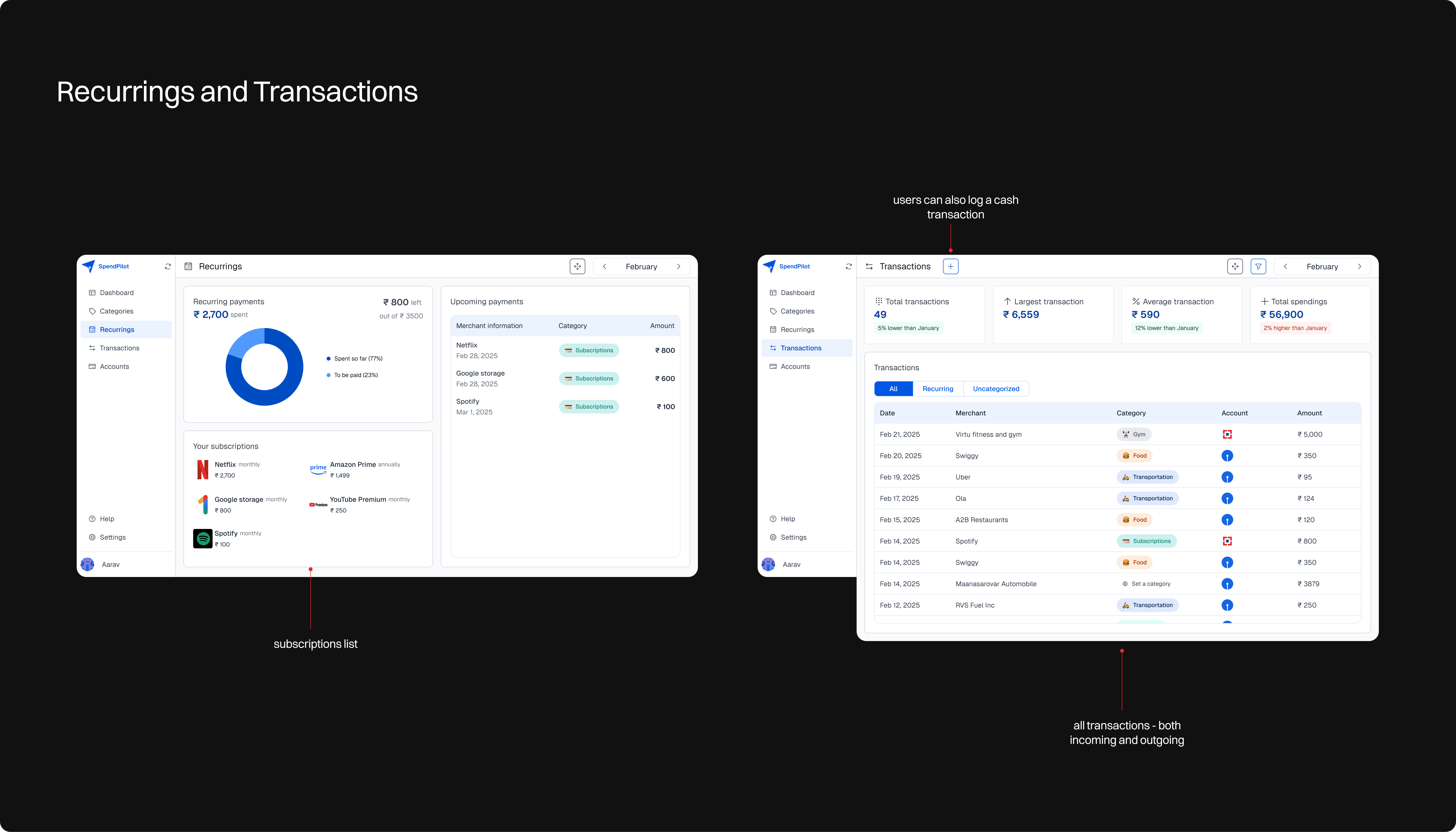

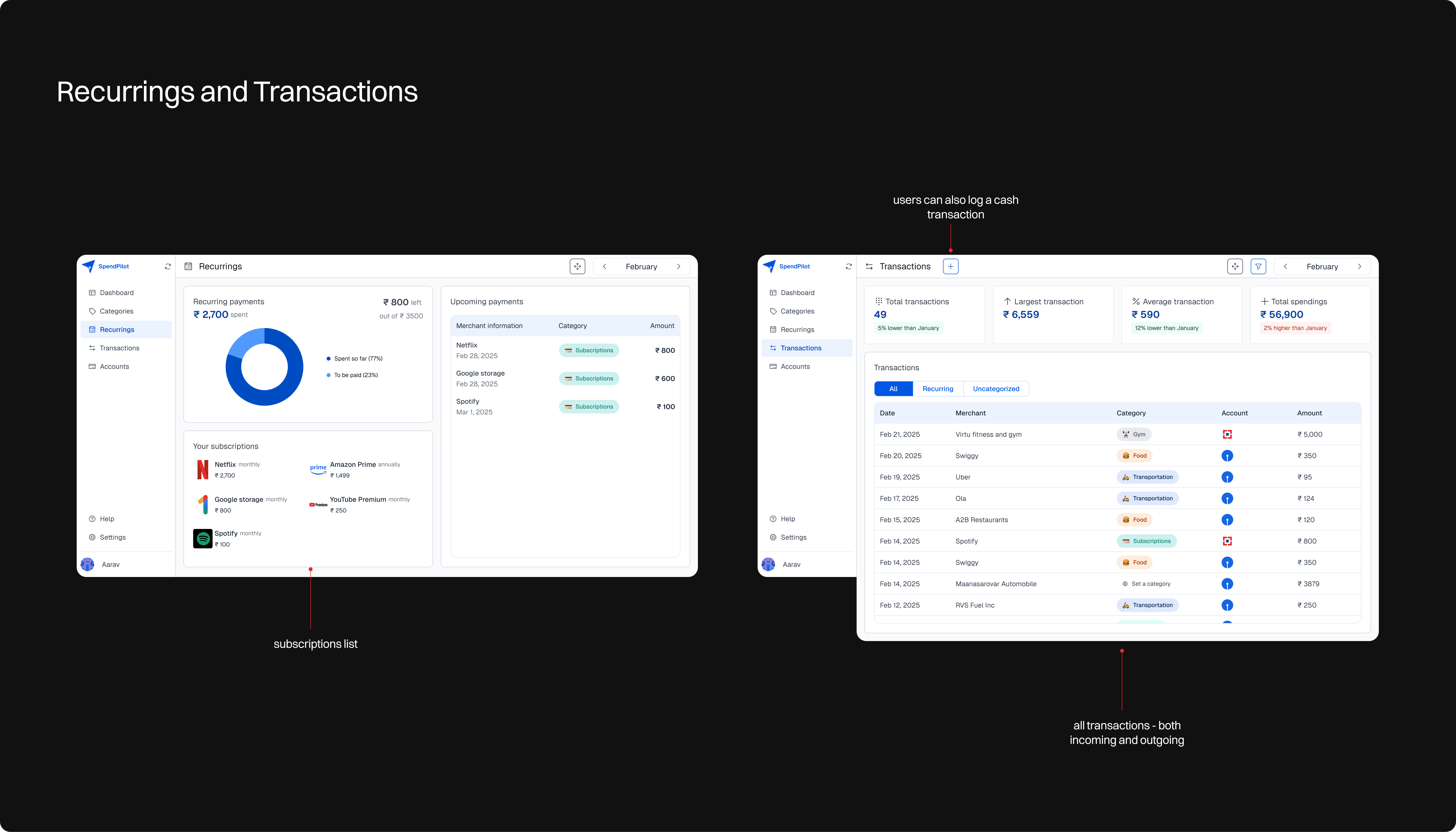

Final Visual Design - Recurrings and Transactions

Final Visual Design - Recurrings and Transactions

Recurrings - A centralized view of all active subscriptions, helping users track and manage their recurring expenses efficiently. This visibility helps prevent subscription overlap and identifies potential savings opportunities.

Recurrings - A centralized view of all active subscriptions, helping users track and manage their recurring expenses efficiently. This visibility helps prevent subscription overlap and identifies potential savings opportunities.

Transactions - A unified transaction feed aggregating data across all linked bank accounts. I've eliminated the need to juggle multiple bank apps by providing a single, comprehensive view of all financial activities.

Transactions - A unified transaction feed aggregating data across all linked bank accounts. I've eliminated the need to juggle multiple bank apps by providing a single, comprehensive view of all financial activities.

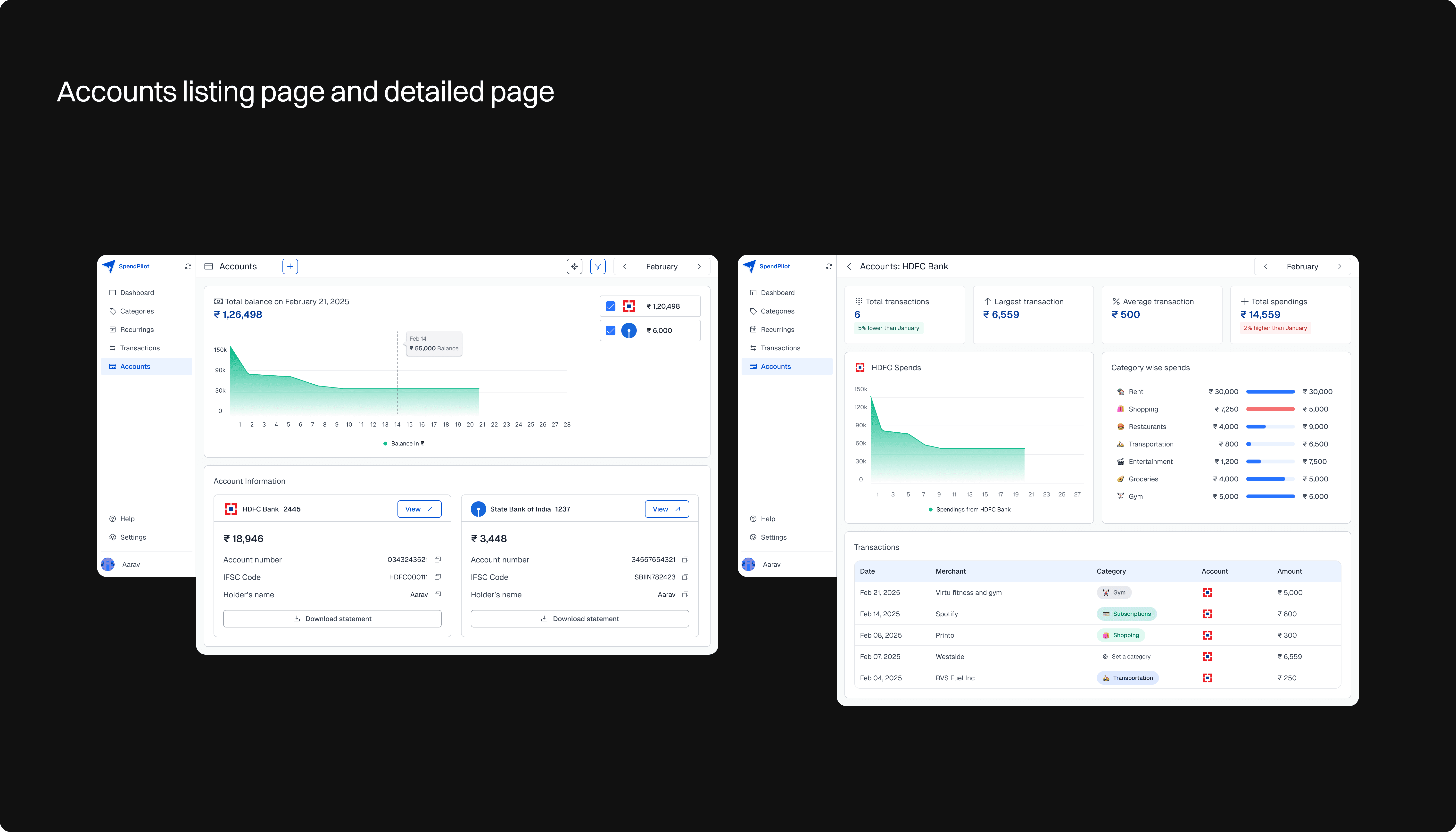

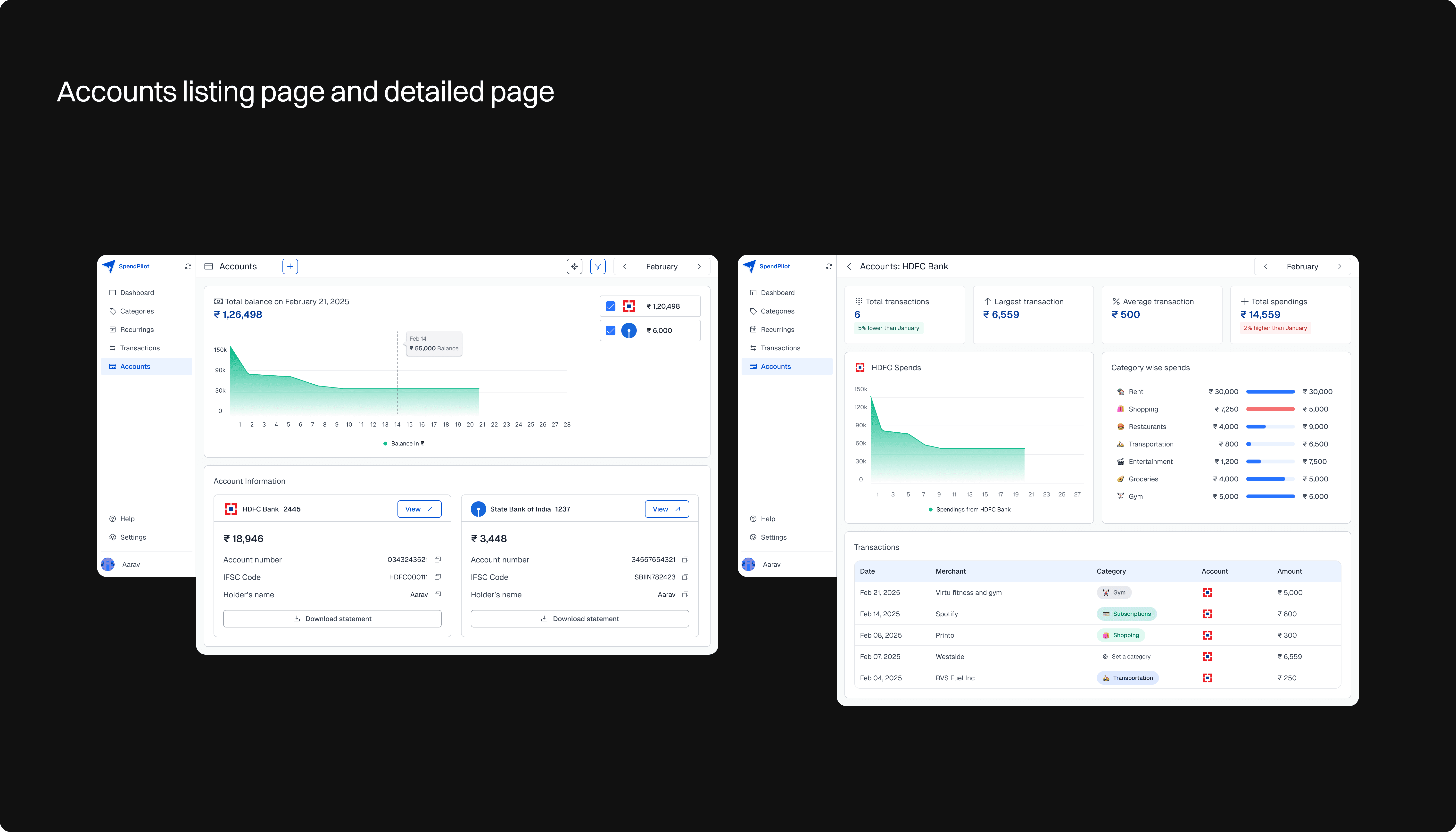

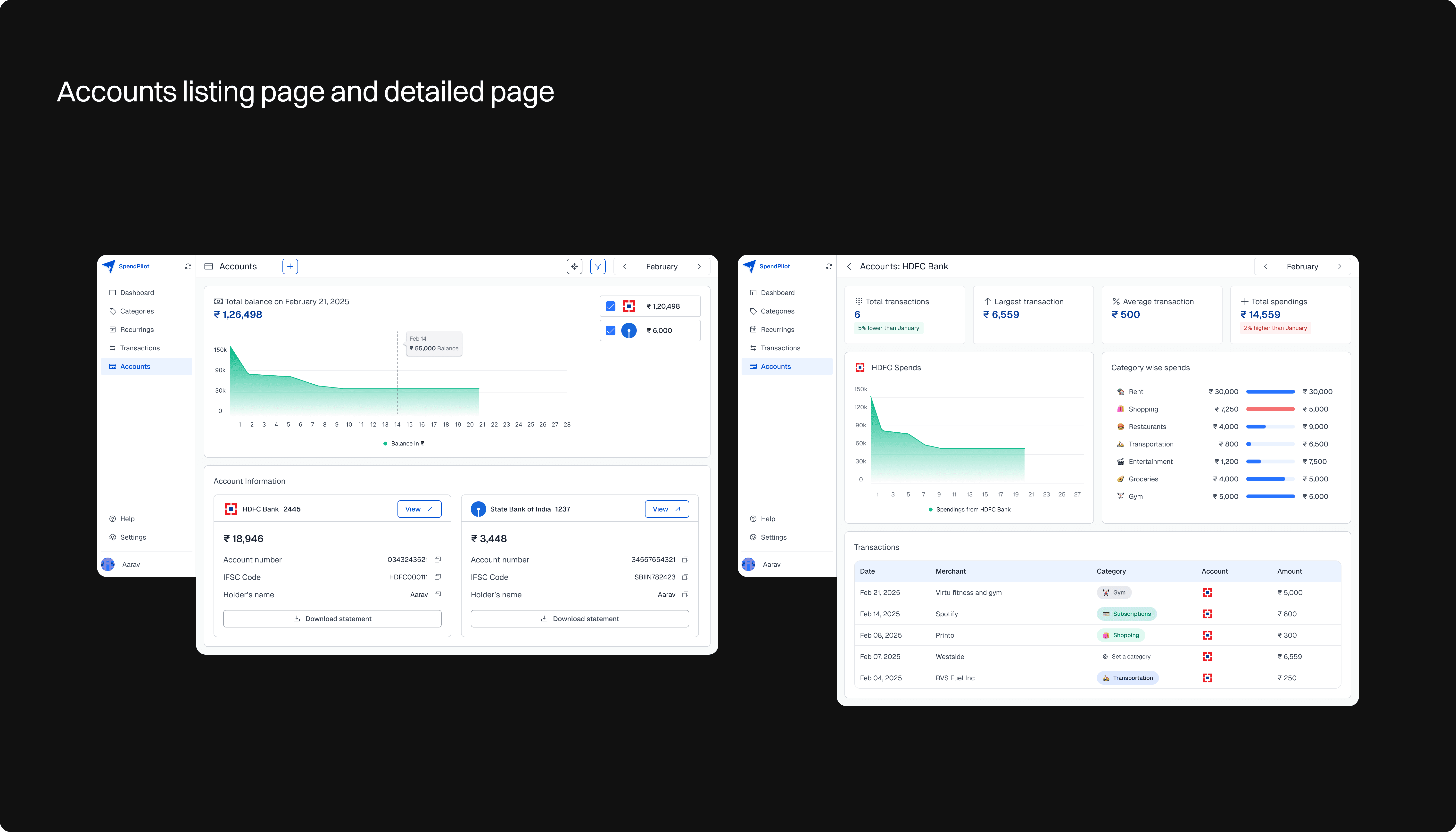

Final Visual Design - Accounts

Final Visual Design - Accounts

The command center for managing linked accounts. Users can view their connected bank accounts and optionally add credit cards to get a complete financial picture. I've kept the interface clean and focused on essential account management functions

The command center for managing linked accounts. Users can view their connected bank accounts and optionally add credit cards to get a complete financial picture. I've kept the interface clean and focused on essential account management functions

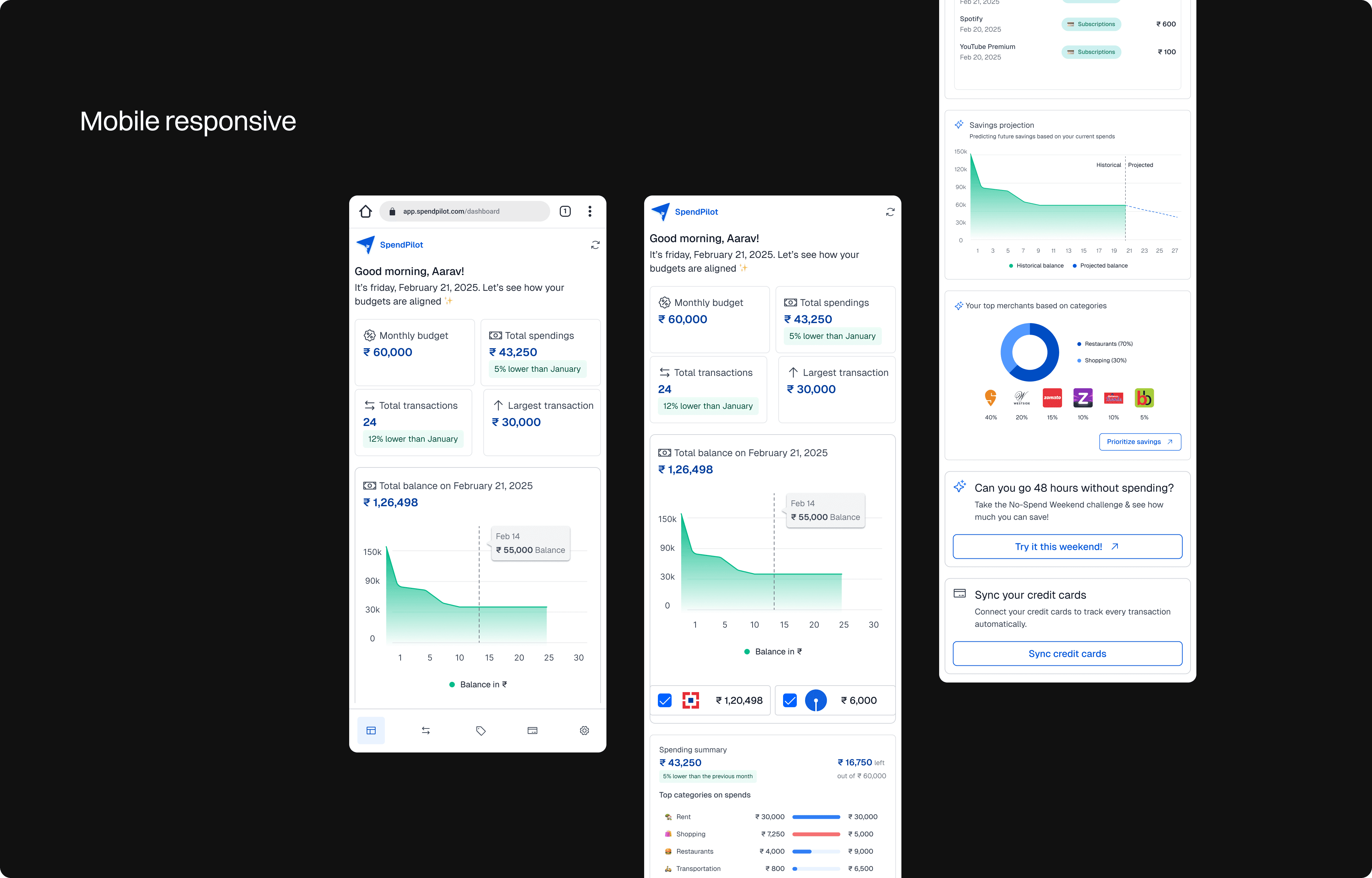

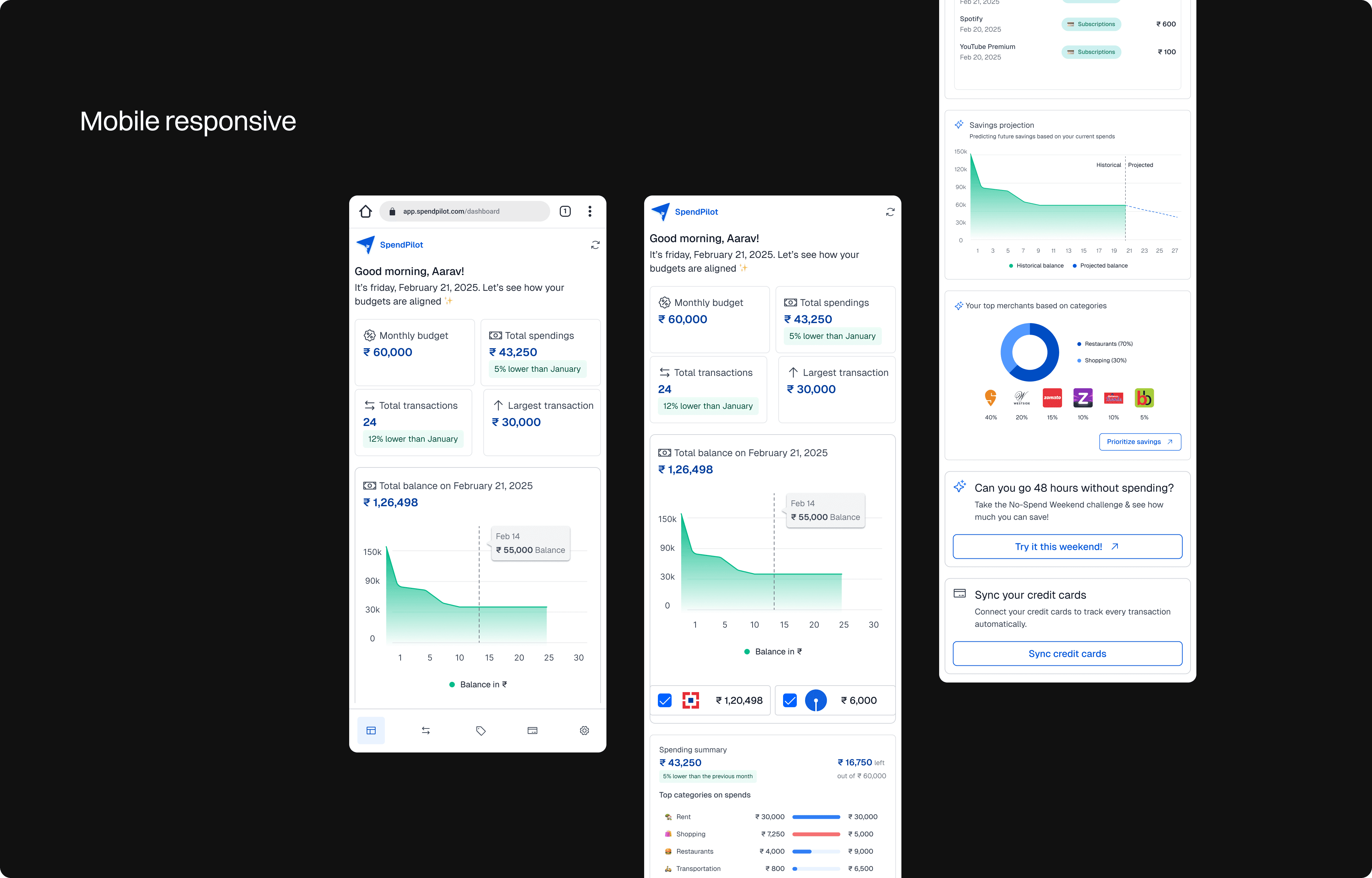

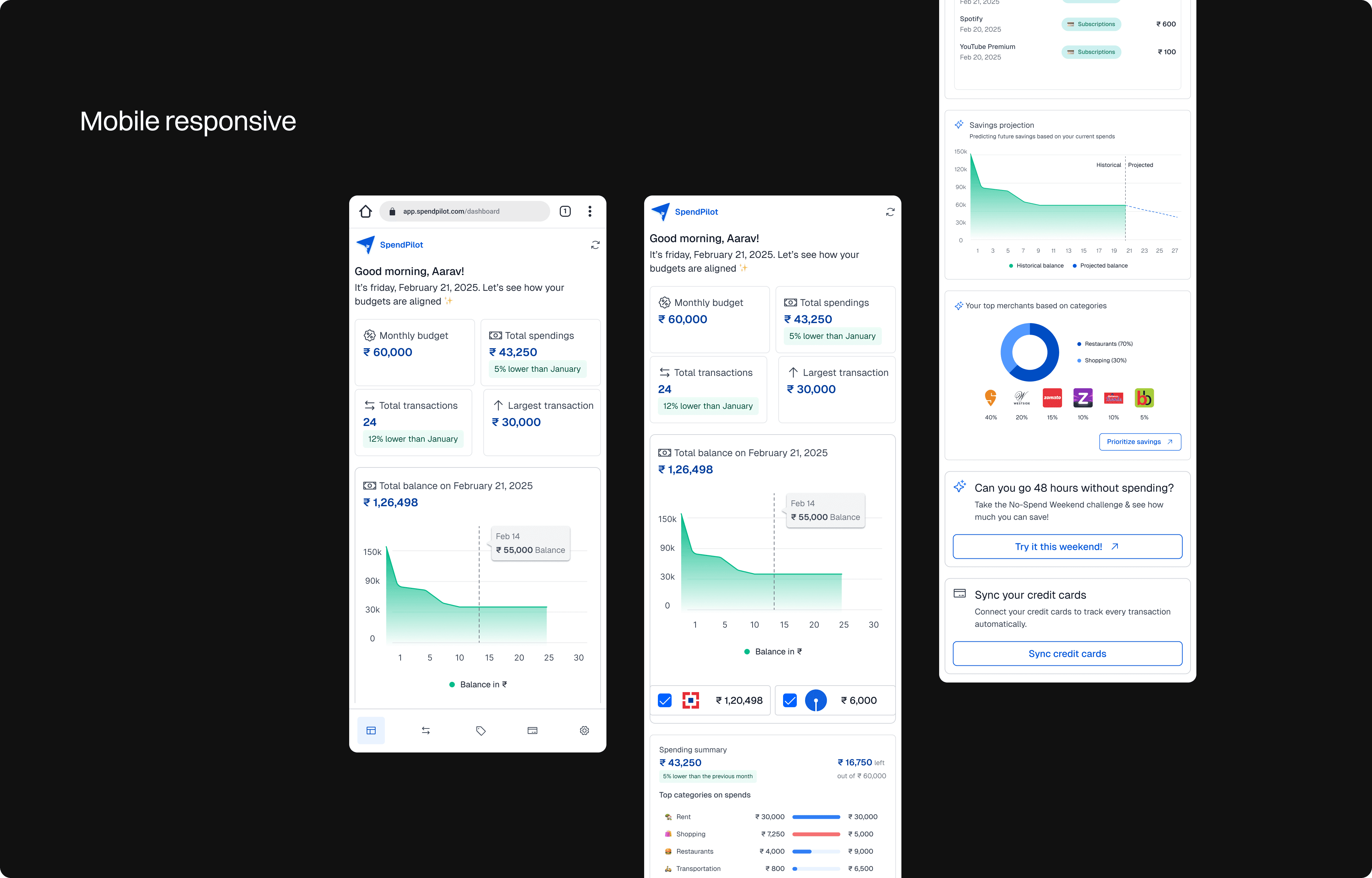

Final Visual Design - Mobile web responsive

Final Visual Design - Mobile web responsive

For users signing up via a mobile browser, this is how the dashboard will appear. I designed a responsive mobile web flow for the dashboard.

For users signing up via a mobile browser, this is how the dashboard will appear. I designed a responsive mobile web flow for the dashboard.

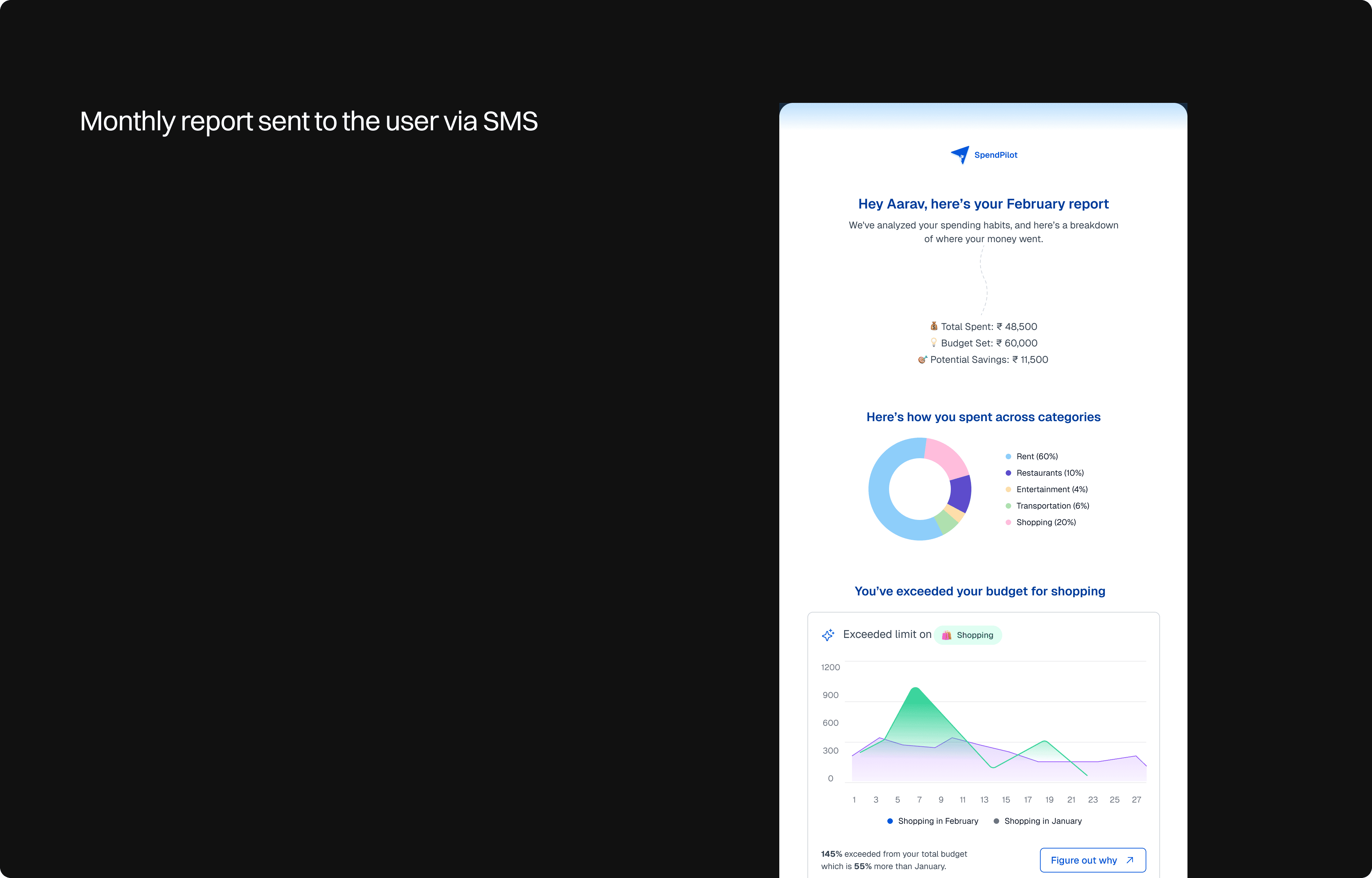

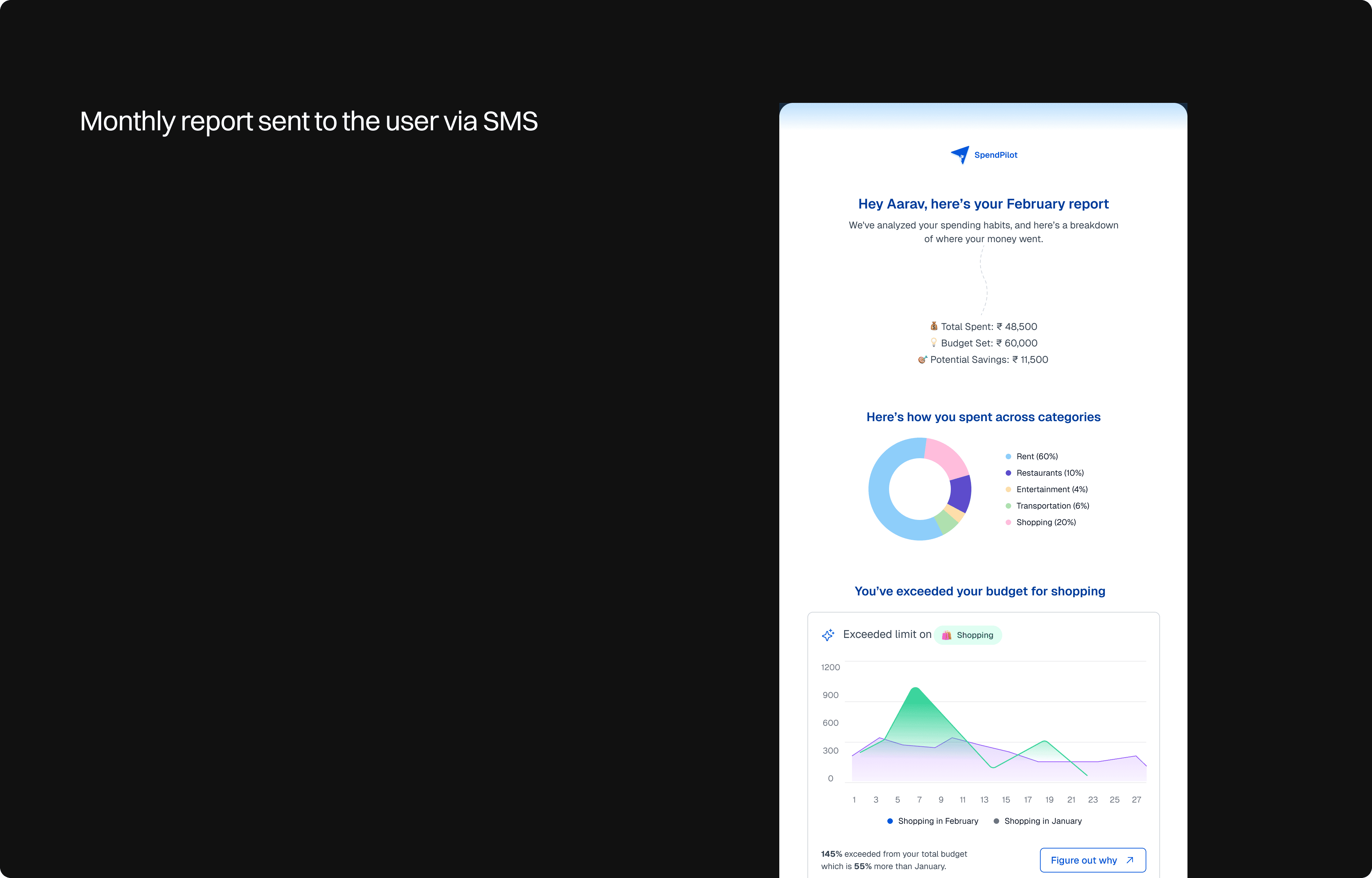

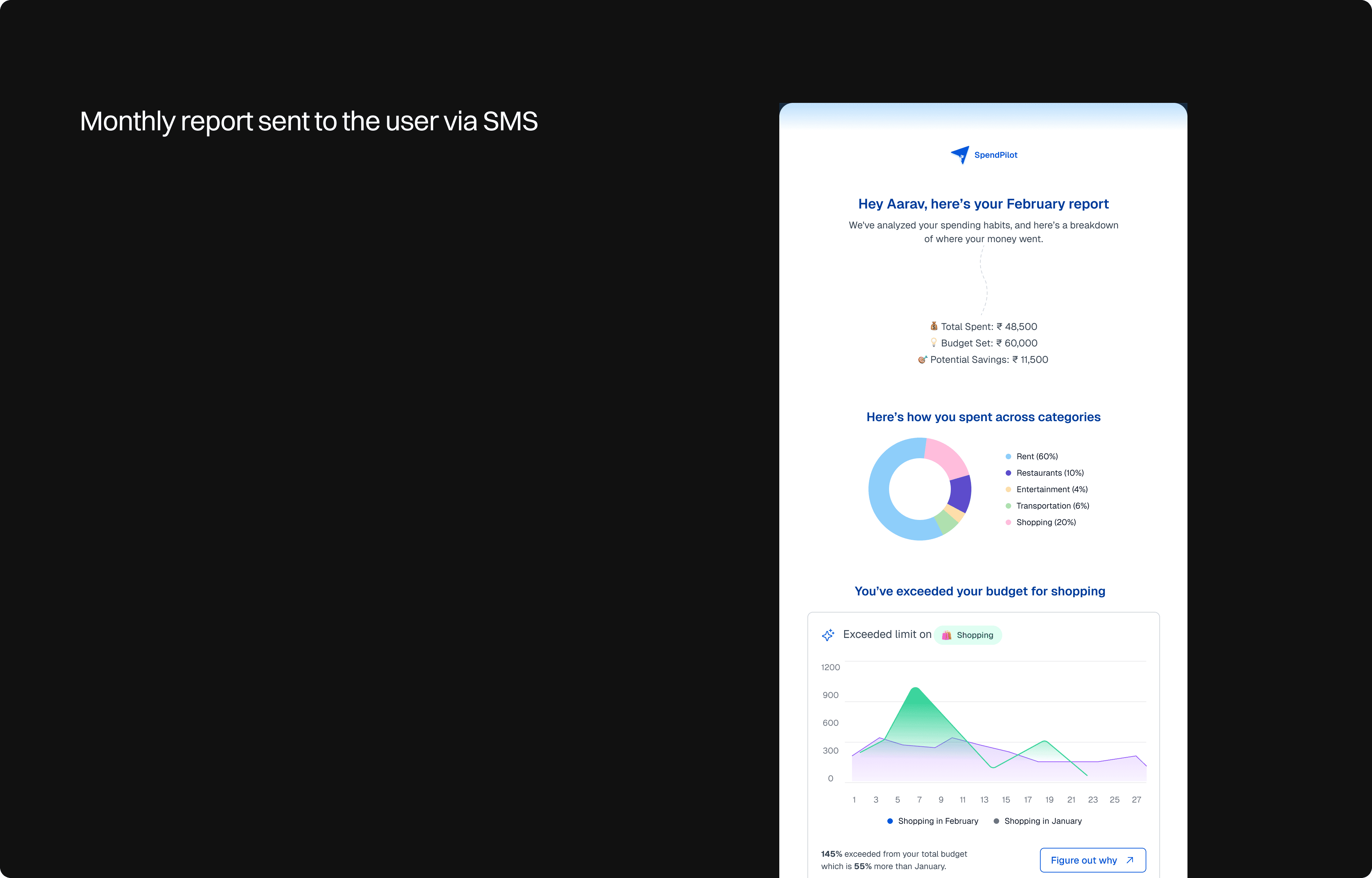

Report Generation

Report Generation

I've designed an automated report delivery system that sends users a comprehensive monthly financial summary via SMS. At month-end, users receive a secure, personalized link to download their performance report as a PDF.

I've designed an automated report delivery system that sends users a comprehensive monthly financial summary via SMS. At month-end, users receive a secure, personalized link to download their performance report as a PDF.

My learnings on AA framework

My learnings on AA framework

I found Account Aggregator framework to be more insightful. Its mobile-number-based architecture and built-in security measures allowed me to simplify the onboarding flow significantly while maintaining robust data.

I found Account Aggregator framework to be more insightful. Its mobile-number-based architecture and built-in security measures allowed me to simplify the onboarding flow significantly while maintaining robust data.

My learnings on UX copies

My learnings on UX copies

At first, the copies felt standard, so I introduced an engaging aviation-themed narrative to enhance the onboarding experience.

At first, the copies felt standard, so I introduced an engaging aviation-themed narrative to enhance the onboarding experience.

My learnings on product decisions

My learnings on product decisions

Prioritized mobile number over email authentication to reduce friction

Prioritized mobile number over email authentication to reduce friction

Focused on debit cards first to ensure reliable core functionality

Focused on debit cards first to ensure reliable core functionality

Automated monthly reports via SMS to maintain user engagement passively

Automated monthly reports via SMS to maintain user engagement passively

Added the "No-Spend Weekend" challenge to make budgeting more engaging

Added the "No-Spend Weekend" challenge to make budgeting more engaging

Consolidated bank data in one view to eliminate app-switching fatigue

Consolidated bank data in one view to eliminate app-switching fatigue

Built automated insights to help users make informed financial decisions without overwhelming them with data

Built automated insights to help users make informed financial decisions without overwhelming them with data

Other case studies

Other case studies

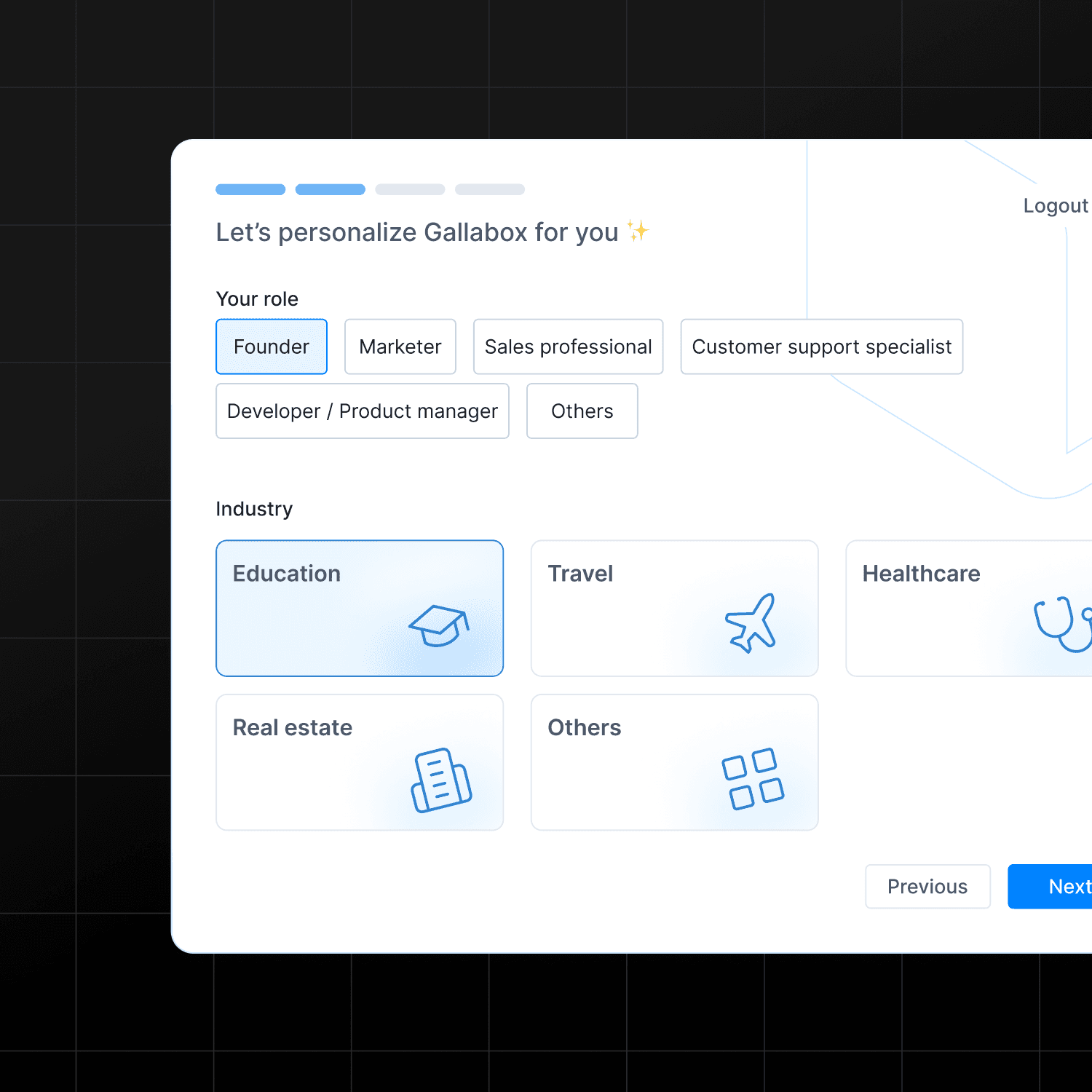

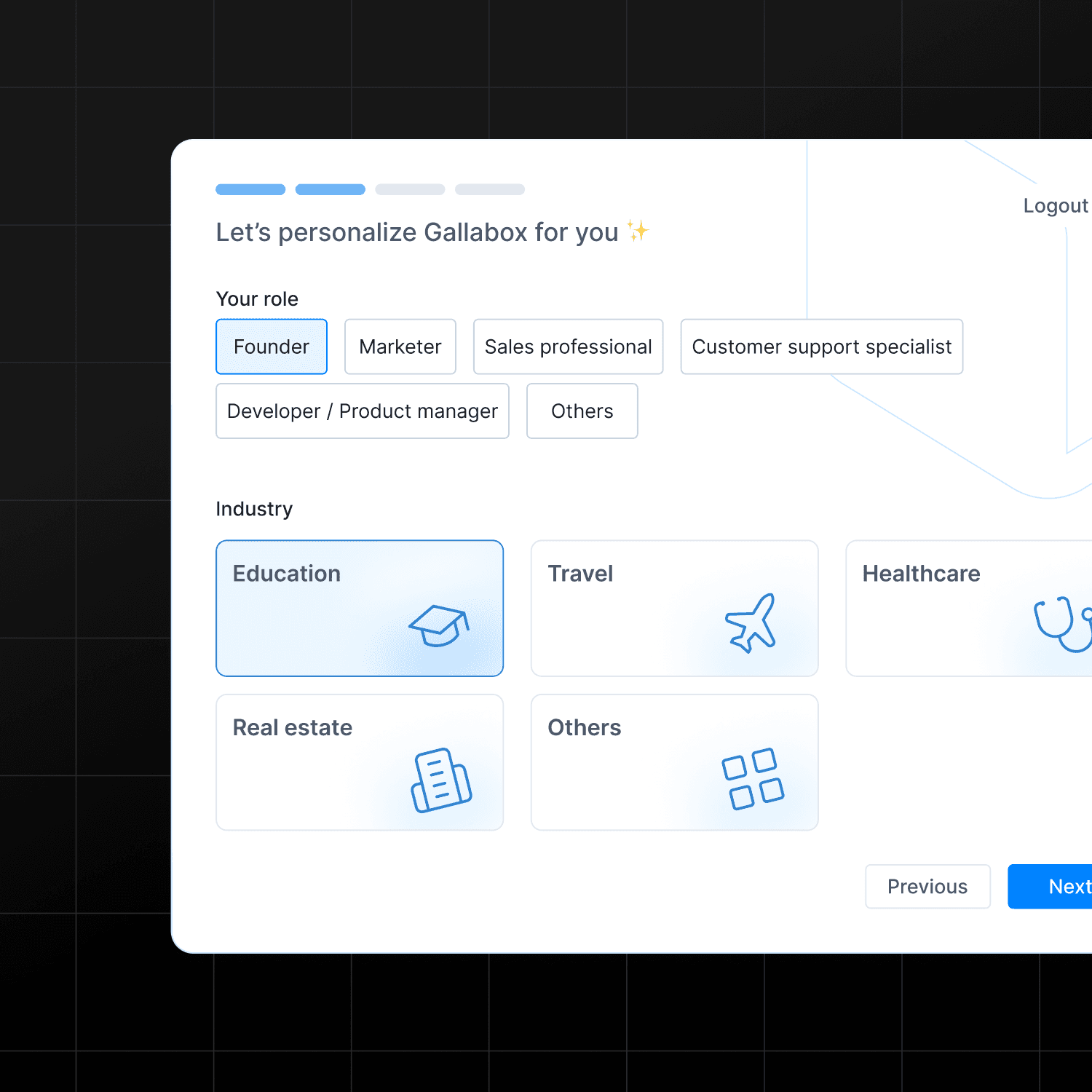

Onboarding flow

Revamped onboarding flow to boost trial conversions by 20% and sandbox activation by 3%

B2B SaaS

CRM

Onboarding flow

Revamped onboarding flow to boost trial conversions by 20% and sandbox activation by 3%

B2B SaaS

CRM

Onboarding flow

Revamped onboarding flow to boost trial conversions by 20% and sandbox activation by 3%

B2B SaaS

CRM

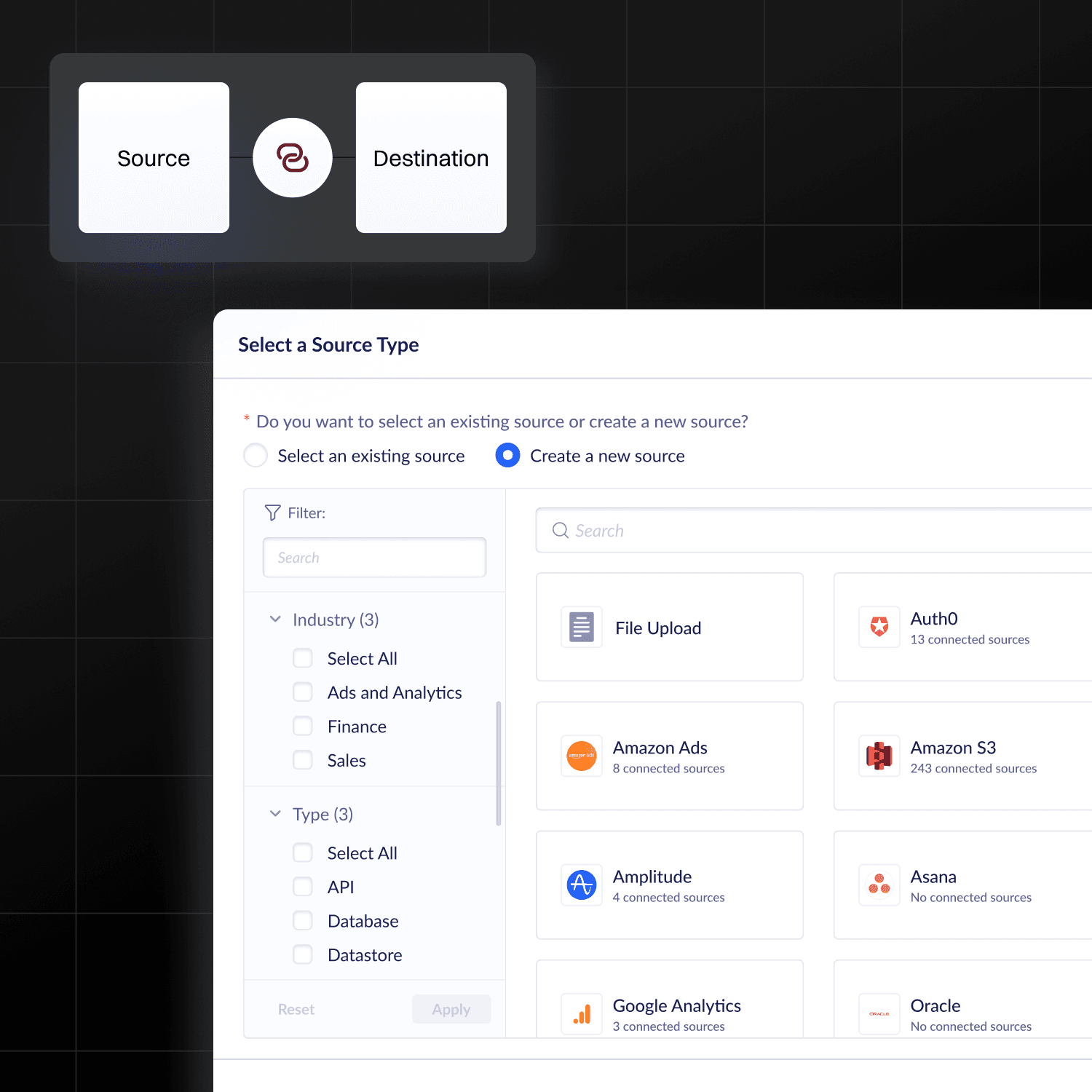

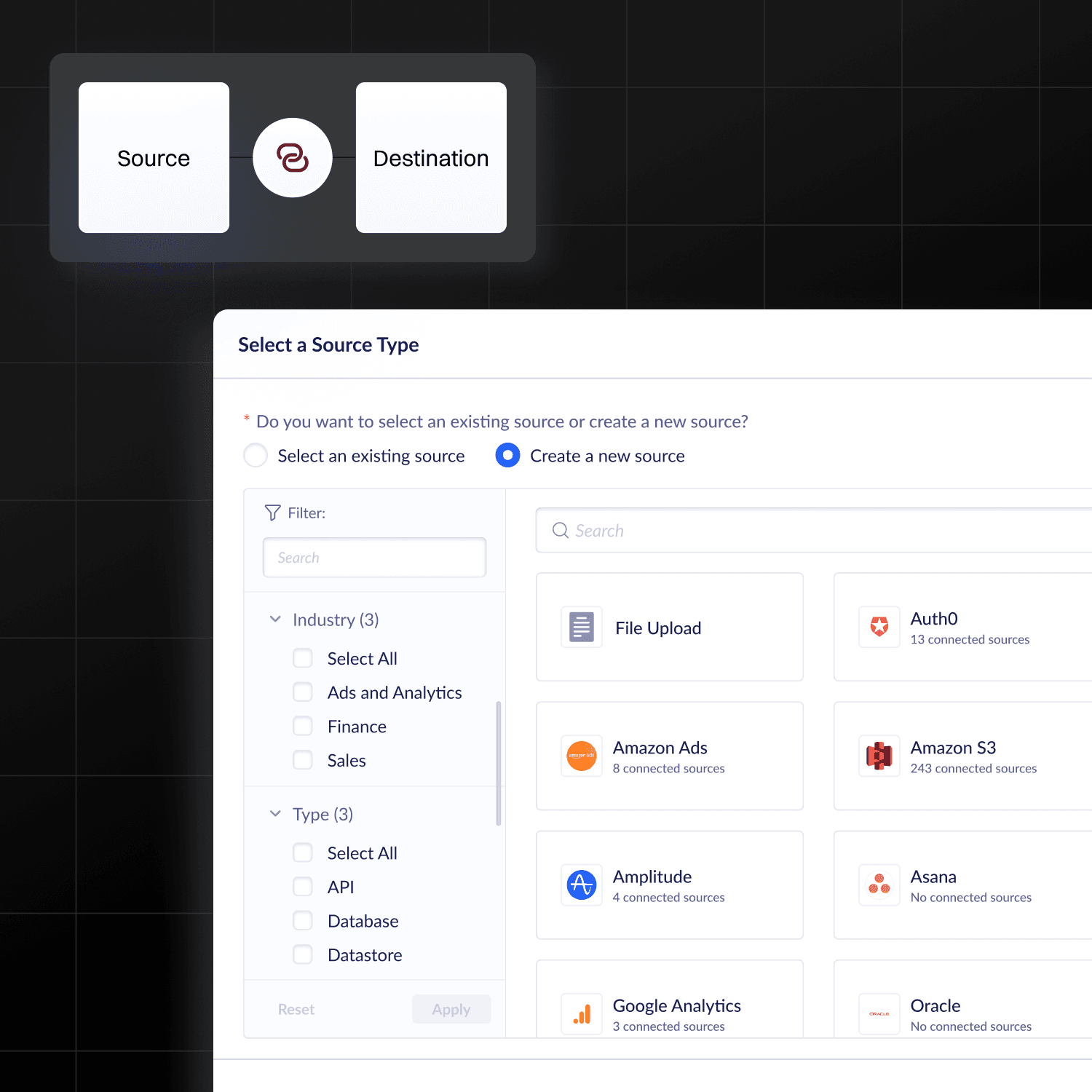

Connectors Hub

A hub that automates data connections for seamless analytical reporting.

B2B SaaS

Data connectors

Connectors Hub

A hub that automates data connections for seamless analytical reporting.

B2B SaaS

Data connectors

Connectors Hub

A hub that automates data connections for seamless analytical reporting.

B2B SaaS

Data connectors